FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

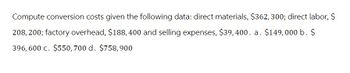

Transcribed Image Text:Compute conversion costs given the following data: direct materials, $362, 300; direct labor, $

208, 200; factory overhead, $188,400 and selling expenses, $39,400. a. $149,000 b. $

396, 600 c. $550, 700 d. $758,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question Content Area Compute conversion costs given the following data: direct materials, $376,200; direct labor, $200,400; factory overhead, $179,400 and selling expenses, $48,400. a. $555,600 b. $131,000 c. $756,000 d. $379,800arrow_forwardCost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Kraus Company is $459,000. The conversion cost for the period in the Rolling Department is $303,800. The total equivalent units for direct materials and conversion are 2,700 tons and 4,900 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardCost per Equivalent Unit The cost of direct materials transferred into the Filling Department of Ivy Cosmetics Company is $314,430. The conversion cost for the period in the Filling Department is $186,300. The total equivalent units for direct materials and conversion are 66,900 ounces and 69,000 ounces, respectively. Determine the direct materials and conversion costs per equivalent unit. If required, round to the nearest cent. Direct materials cost per equivalent unit: $fill in the blank 1 per ounce Conversion costs per equivalent unit: $fill in the blank 2 per ouncearrow_forward

- Compute conversion costs given the following data: direct materials, $356,600; direct labor, $196,300; factory overhead, $194,500 and selling expenses, $40,900. a.$390,800 b.$153,600 c.$551,100 d.$747,400arrow_forwardTotal product cost per unit under absorption costing = Units produced = 1000Direct Materials = $ 6Direct Labor = $10Fixed overhead =$ 6000Variable overhead = $ 6Fixed Selling & Admin = $ 2000Variable Selling & Admin $ 2arrow_forwardCompute conversion costs given the following data: direct materials, $351,300; direct labor, $207,800; factory overhead, $189,700 and selling expenses, $46,300. a. $748,800 b. $143,400 c. $541,000 d. $397,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education