FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

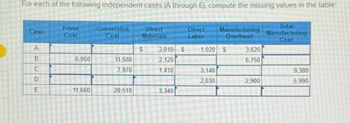

Transcribed Image Text:For each of the following independent cases (A through E), compute the missing values in the table:

Total

Manufacturing

Cost

Case

A

B

C

DE

E

Prime

Cost

6,950

11,660

Conversion

Cost

11,580

7,970

20,510

Direct

Materials

$

2,010 $

2,120

1,410

3,340

Direct

Labor

Manufacturing

Overhead

1,020 $

3,140

2,030

3,620

6,750

2,900

9,380

5,990

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When Zee Corporation produces 25,000 units, its fixed cost is $21.00 per unit. Zee's fixed cost will if it produces 20,000 units. а. remain at $21.00 per unit b. increase by $5.25 per unit С. increase by $26.25 per unit d. decrease to $16.80 per unit а. С ОБ. В с. D O d. Aarrow_forwardThe following department data are available: Total materials costs OMR 180,000 Equivalent units of materials 60,000 Total conversion costs OMR 105,000 Equivalent units of conversion costs 30,000 What is the total manufacturing cost per unit? Select one: O a. OMR 3.50. O b. OMR 6.90. Oc. OMR 3.00. Od. None of the answers are correct, moodle.asu.edu.om/mod/quiz/attem Oe. OMR 4.75. 直arrow_forwardPrime cost is 86000 OMR, Cost of production 84600 OMR, Opening stock of work in progress is 20000, and closing stock of Work in progress is 13750 OMR, Cost of goods manufactured 290800 OMR, Opening stock of finished goods is 20000, and closing stock of finished goods is 13750 OMR, Calculate unit production cost if total manufacturing units was 5000 a. 13.800 OMR per unit b. 16.920 OMR per unit c. None of These d. 18.50 OMR per unitarrow_forward

- From the following information, prepare an Income Statement under: (a) Marginal Costing; (b) Absorption Costing. Particulars Product (RO) X Y Z Direct Material 5,500 20,000 2,000 Direct Wages 7,000 7,000 1,000 Factory Overheads - Fixed 2,000 1,000 1,500 Factory Overheads - Variable 1,900 8,000 2,500 Selling Overheads - Fixed 1,000 500 400 Selling Overheads - Variable 1,000 4,000 1,000 Sales 22,000 41,000 12,000 Fixed factory overhead and fixed selling overhead apportioned to products X, Y and Z on equitable bases.arrow_forwardShore Company reports the following information regarding its production cost. Units produced 36,500 units $ 27.25 per unit Direct labor $28.25 per unit Direct materials $675,250 in Variable overhead total $ 129,940 in Fixed overhead total Compute production cost per unit under absorption costing. O $74.00 O $77.56 O $55.50 O $27.25 O $18.50arrow_forwardTotal Material cost is 260000 OMR Fixed cost is 0. calculate Total Vairable cost a. 260000 OMR b. 250000 Units c. 256000 Units d. 256000 OMRarrow_forward

- Based on the following information from ASX Corporation, calculate its total contribution margin. Revenue $133,500 Direct Material $26,700 Direct Labor $19,580 Variable Overhead $18.690 Fixed Overhead $17.800 Sales Commission $10,680 $8,010 Fixed Selling Cost O a $32.040 Ob $50.370 Oc $57.850 Od $68.530 РОСОРНONЕ SHOT ON POCOPHONE F1arrow_forwardUse the information in the following table to compute each department's contribution to overhead (both in dollars and as a percent). (Round Contribution percent to 1 decimal place.) Sales Cost of goods sold Gross profit Total direct expenses Contribution to overhead Contribution percent (of sales) O Department A O Department B Department C Dept. A $ 57,000 35,910 21,090 5,820 Dept. B $207,000 107,640 99,360 44,200 Which department contributes the largest dollar amount to total overhead? Department A O Department B O Department C Dept. C $ 77,000 40,810 36,190 9,146 Which department contributes the highest percent (as a percent of sales) to total overhead?arrow_forwardPlease help me to solve this problemarrow_forward

- 3arrow_forwardUnder process 2, what is the equivalent unit of production on materials and conversion, respectively? * 5,700 and 5,700 5,440 and 5,460 6,000 and 5,850 5,600 and 5,600arrow_forwardPart B: Assuming Wildhorse uses the FIFO method of process costing, complete Step 4 to determine its cost per equivalent unit for both DM and conversion costs. (Round cost per equivalent unit answers to 2 decimal places, e.g. 15.25.) DM Conversion Costs Total equivalent units of work done this period (FIFO) 29,000 26,000 STEP 4 Calculate Cost Per Equivalent Unit DM Conversion Cost select an item Correct answer $enter a dollar amount Correct answer $enter a dollar amount Correct answer select an item Correct answer enter a number of unitsCorrect answer enter a number of unitsCorrect answer select a closing name Correct answer $enter a dollar amount rounded to 2 decimal places $enter a dollar amount rounded to 2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education