FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

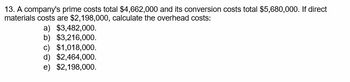

Transcribed Image Text:13. A company's prime costs total $4,662,000 and its conversion costs total $5,680,000. If direct

materials costs are $2,198,000, calculate the overhead costs:

a) $3,482,000.

b) $3,216,000.

c) $1,018,000.

d) $2,464,000.

e) $2,198,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data relates to the operations of company A; direct material cost per unit- ghc5, direct labour cost/unit- ghc20 @ ghc2/hour, indirect production expense is made up of- depreciation- 50000, indirect material- ghc30000, and indirect labour- ghc20000. The company plans to produce 5000units and absorb overhead based on direct labour hours. What is the cost per unit? A. Ghc45 B. Ghc40 C. Ghc35 D. Ghc30 Reset Selectionarrow_forwardThe following costs were incurred in March: Direct materials = PhP1,050,000 Direct Labor = PhP850,000 Manufacturing overhead = PhP3,350,000 Selling expenses = PhP800,000 Administrative expenses = PhP750,000 What is the conversion costs during the month? Show the solution.arrow_forward1)Based on the above, when the company produces 24,000 units, total variable costs will be calculated as follows: A)600,000 + 768,000 + 384,000 B)600,000 + 768,000 + (553,200 – 1,200) + 384,000 + (288,950 – 950) B)600,000 + 768,000 + (553,200 – 1,200) + (288,950 – 950) D)None of the above 2)Based on the above, total fixed costs was: * A)$67,150 B)$65,000 C)$66,200 D)None of the above 3)Based on the above, total direct costs per unit was: * A)$108 B)$32 C)$57 D)None of the abovearrow_forward

- Sheridan Company had the following operating data for the year for its computer division: sales, $700000; contribution margin, $171000; total fixed costs (controllable), $119000; and average total operating assets, $300000. What is the controllable margin for the year? O $171000. O 57%. O $52000. O 17.3%.arrow_forwardAt the end of the first year, the XYZ Team had incurred $550,000 of cost, with the total estimated cost of $1,050,000. Their total estimated revenue is $1,200,000. If the percentage of completion by labor hours expended is 60.8%, calculate the revenue to date for the labor hours expended method, using Alternative A.arrow_forwardA department has total conversion costs of $153,300 and total materials costs of $250,025. If the department has 36,500 equivalent units of production for materials and 73,000 equivalent units of production for conversion costs, what is the total manufacturing cost per unit? O $11.05 O $8.95 $9.50 O $2.65arrow_forward

- At the beginning of the year, you estimated the following - Production - 75,000 units Raw Material - 270,000 pounds at a cost of $1,026,000 Direct Labor - 187,500 hours at a cost of $4,125,000 Variable Overhead - 135,000 machine hours at a cost of $567,000 Fixed Overhead - $900,000 At the end of year, the actual results were as follows - Production - 73,000 units Raw Material - 265,720 pounds purchased and used at a cost of $1,036,308 Direct Labor - 179,580 hours at a cost of $3,968,718 Variable Overhead - 133,590 machine hours at a cost of $558,406.20 Fixed Overhead - $891,000arrow_forwardAt the beginning of the year, you estimated the following - Production - 75,000 units Raw Material - 270,000 pounds at a cost of $1,026,000 Direct Labor - 187,500 hours at a cost of $4,125,000 Variable Overhead - 135,000 machine hours at a cost of $567,000 Fixed Overhead - $900,000 At the end of year, the actual results were as follows - Production - 73,000 units Raw Material - 265,720 pounds purchased and used at a cost of $1,036,308 Direct Labor - 179,580 hours at a cost of $3,968,718 Variable Overhead - 133,590 machine hours at a cost of $558,406.20 Fixed Overhead - $891,000 16) The Total Variance for Direct Labor is Favorable. 17) What is the Variable Overhead standard for machine hours per unit ? 18) What is the standard rate per machine hour for Variable Overhead ? 19) What is the Efficiency Variance for Variable Overhead ? please answer completearrow_forwardJoy Inc. has started manufacturing 15,000 units of a product. Direct materials cost incurred was $235,000, direct labor cost incurred was $202,000, and applied factory overhead was $78,000. What is the amount of total conversion cost? Group of answer choices $515,000 $280,000 $437,000 $313,000arrow_forward

- The cost of direct materials transferred into the Rolling Department of Kraus Company is $3,000,000. The conversion cost for the period in the Rolling Department is $462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardConversion cost per unit equals $11.00. Total materials costs are $80500. Equivalent units of production for materials are 40250. How much is the total manufacturing cost per unit? $2.00. $13.00. $9.00. $11.00.arrow_forward16. In its production of shirts, a company incurs the following costs: $15,000 for production workers, $8,000 for fabric, $3,500 for electricity in production facilities, and $300 for buttons. Calculate the following: a. Prime costs b. Conversion costsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education