FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

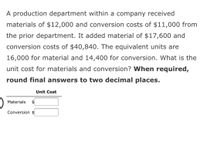

Transcribed Image Text:A production department within a company received

materials of $12,000 and conversion costs of $11,000 from

the prior department. It added material of $17,600 and

conversion costs of $40,840. The equivalent units are

16,000 for material and 14,400 for conversion. What is the

unit cost for materials and conversion? When required,

round final answers to two decimal places.

Unit Cost

Materials

$

Conversion $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- a. Determine the number of units transferred to the next department. b. Determine the costs per equivalent unit of direct materials and conversion. If required, round your answer to two decimal places. Cost per equivalent unit of direct materials Cost per equivalent unit of direct materials c. Determine the cost of units started and completed in November.arrow_forward1. The prime cost for company XYZ was $20,000, while the conversion cost was $25,000. Assume that direct labor cost is three times the direct materials cost and that the manufacturing overhead cost was two times the direct materials cost. Calculate the direct labor cost ($)? a. 30,000 b. 10,000 c. 15,000 d. 5,000 e. 45,000arrow_forwardPlease help me with show all calculation thankuarrow_forward

- Reconcile the number of physical units to find the missing amounts. Determine the number of units started and completed each month. Beginning Work in Process Ending Work in Process Conversion Conversion Complete Complete (percent) (percent) Month February June September December Units 2,000 4,700 3,800 48 66 27 39 Units Started 23,900 26,400 22,900 Units Completed 23 36 59 76 Units Started and Completedarrow_forwardCurrent Attempt in Progress Production costs chargeable to the Sanding Department in July in Monty Company are $41,160 for materials, $14,700 for labor, and $12,740 for manufacturing overhead. Equivalent units of production are 29,400 for materials and 19,600 for conversion costs. Compute the unit costs for materials and conversion costs. (Round answers to 2 decimal places, e.g. 15.25.) Unit costs $ Materials $ Conversion Costsarrow_forwardJeffrey's Bottling Company incurred the following costs during November: Conversion costs $ __________ Prime costs 227,500 Manufacturing overhead 181,000 If direct materials cost was $144,500 in November, what was the conversion cost for November?arrow_forward

- For the month of July, Jacobs Company incurs a direct materials cost of $6,000 for 6,000 gallons of paint produced in its Mixing Department. It also incurs conversion costs of $1,470 with 70% completed. If the conversion cost per equivalent unit was $0.25 per gallon in June, what is the difference in the conversion cost per equivalent unit between the two months? a. $1.00 b. $0.10 c. $0.75 O d. $0.35arrow_forwardMuscat Painting Company has the following production data for March. Beginning work process 400,000 units (60% complete), started into production 370,000 units, completed and transferred out 706,000 units, and ending work in process 40,000 units (40% complete). the equivalent units of production for conversion costs will be: Select one: O a. 810,000. O b. 650,000. O c 770,000. O d. None of the answers are correct O e. 722,000.arrow_forwardThe prime cost for company XYZ was $20,000, while the conversion cost was $25,000. Assume that direct labor cost is three times the direct materials cost and that the manufacturing overhead cost was two times the direct materials cost. Calculate the direct materials cost ($). O a. 45,000 O b. 15,000 Oc. 5,000 O d. 10,000 O e. 30,000 Al-Nahdha company is preparing its cash budget for the first half of the year 2022. The company records shows that it has $20,000 in the cash at the start of the period. Cash collections from customers for the period are budgeted at $56,000. Purchases of inventory as budgeted will cost cash payment during the period of $50,000. The Company intends to keep its cash balance at the end of the period at $10,000. Other operating expenses for this period are budgeted at $30,000, which includes $4,000 depreciation and any cash expenses are paid in the month incurred. How much borrowing will the company need in the Finisarrow_forward

- Work in Process—Assembly Department Bal., 3,000 units, 35% completed 7,395 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $1.8 127,800 Direct labor 100,700 Factory overhead 39,200 Bal., ? units, 40% completed ? Cost per equivalent units of $1.80 for Direct Materials and $2.00 for Conversion Costs. a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. 1. Cost of beginning work in process inventory completed this period $ 2. Cost of units transferred to finished goods during the period $ 3. Cost of ending work in process inventory $ 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) $ b. Did the production costs change from the preceding period?Yes c. Assuming that the direct materials cost per unit did not change from the preceding period, did the conversion costs per equivalent unit…arrow_forwardCost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $525,200. The conversion cost for the period in the Rolling Department is $300,800. The total equivalent units for direct materials and conversion are 2,600 tons and 4,700 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $ per ton Conversion cost per equivalent unit: $ per tonarrow_forwardAssume that Swifty has identified three activity cost pools.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education