FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

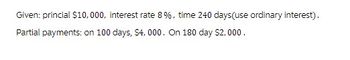

Transcribed Image Text:Given: princial $10,000, interest rate 8%, time 240 days (use ordinary interest).

Partial payments: on 100 days, $4,000. On 180 day $2,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the interest on a 270−day, 11% note for $50,000. (Use a 365−day year. Do not round intermediate calculations, and round the final answer to the nearest dollar.) A. $8,250 B. $458 C. $4,068 D. $5,500arrow_forward1. The interest on a $4,800 note at 5% for 4 months is ________. Please show steps.arrow_forwardSuppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forward

- You have taken a loan of $6,000.00 for 3 years at 2.9% compounded monthly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest Balance 0) $6,000.00 1) $ 2) 3) $ $arrow_forwardCompute for the simple interest earned given the principal P, interest rate r and time t. a) P = 10,000 pesos; r = 5%; t = 3 b) P = 100,000 pesos; r = 20%; t = 7 months c) P = 25,000 pesos; r = 12.5%; t = 165 days (ordinary interest)arrow_forwardCalculate the finance charge (in $), the finance charge per $100 (in $), and the annual percentage rate for the installment loan by using the APR table, Table 13-1. (Round dollar amounts to the nearest cent.) Finance Charge per $100 Number of Monthly Payment Amount Finance APR Financed Payments Charge $14,000 $489.00 $ 36 %arrow_forward

- Using the ordinary interest method, find the amount of interest on a loan of $5,000 at 12 % interest, for 274 days. (Round to the nearest cent.) 2 O $380.56 O$469.18 O $475.69 O $575.00arrow_forwardA $51,000 loan at 9.6% compounded semiannually is to be repaid by semiannual payments of $3,900 (except for a smaller final payment). (Do not round intermediate calculations and round your final answers to 2 decimal places.) a. What will be the principal component of the sixteenth payment? Principal $ b. What will be the interest portion of the fifth payment? Interest $ c. How much will Payments 8 to 14 inclusive reduce the principal balance? Principal reduction $ d. How much interest will be paid in the fifth year? Interest paid $ e. What will be the final payment? Final payment $arrow_forwardA loan carries a simple interest rate of 5.25 % . The loan was fully repaid by two $5000 payments made 8 and 11 months after the original date of the loan. How much was borrowed at the start? Multiple Choice $10,000 $9601.34 $9661.84 $9540.85 $9329.44arrow_forward

- Given Principal $13,500, Interest Rate 9%, Time 240 days (use ordinary interest) Partial payments: On 100th day, $3,800; On 180th day, $2,500 a. Use the U.S. Rule to solve for total interest cost. Note: Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent. Total interest cost c b. Use the U.S. Rule to solve for balances. Note: Use 360 days a year. Do not round intermediate calculations. Round your answers to the nearest cent. Balance after the payment Final payment On 100th day On 180th day c. Use the U.S. Rule to solve for final payment. Note: Use 360 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardThe interest rate on a $15,300 loan is 9.7% compounded semiannually. Semiannual payments will pay off the loan in nine years. (Do not round intermediate calculations. Round the PMT and final answers to 2 decimal places.) a. Calculate the interest component of Payment 12. $ b. Calculate the principal component of Payment 5. Principal c. Calculate the interest paid in Year 8. Interest paid d. How much do Payments 5 to 8 inclusive reduce the principal balance? Principal reduction Interestarrow_forwardJournal Entries (Note Received, Renewed, and Collected) Jan. Received a 30-day, 6% note in payment for merchandise sale of $20,000. 16 Feb. Received $100 (interest) on the old (January 16) note; the old note is renewed for 30 15 days at 7%. Mar. Received principal and interest on the new (February 15) note. 17 19 Received a 60-day, 6% note in payment for accounts receivable balance of $8,000. May Received $80 (interest) plus $1,000 principal on the old (March 19) note; the old note 18 renewed for 60 days (from May 18) at 6%. July Received principal and interest on the new (May 18) note. 17 Prepare general journal entries for the transactions. Assume 360 days in a year. Page: 1 ACCOUNT TITLE DOC. POST. NO. REF. DATE DEBIT CREDIT 20-- 1 Jan. 16 3 4 Feb. 15 4 6 7 8 9 Mar. 17 9 10 10 11 11 12 12 13 Mar. 19 13 14 14 15 15 16 May 18 16 17 17 18 18 19 19 20 20 21 July 17 21 22 22 23 23 24 24 inarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education