Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

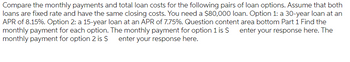

Transcribed Image Text:Compare the monthly payments and total loan costs for the following pairs of loan options. Assume that both

loans are fixed rate and have the same closing costs. You need a $80,000 loan. Option 1: a 30-year loan at an

APR of 8.15%. Option 2: a 15-year loan at an APR of 7.75%. Question content area bottom Part 1 Find the

monthly payment for each option. The monthly payment for option 1 is $ enter your response here. The

monthly payment for option 2 is $ enter your response here.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please show calculation for both clearly show mortgage schedule clearly answer in text without copy paste need complete and correct answer with full explanationarrow_forwardCalculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase (Cash) Price Monthly Payment Down Amount Add-on Number of Finance Payment Financed Interest Payments Charge $50,900 $ | $ 25% 11.6% 60arrow_forwardUse the following amortization chart: Selling price of home Down payment Principal (loan) Rate of interest Years Payment per $1,000 Monthly mortgage payment $ 79,000 $ 6,000 $ 73,000 6% 30 $ 5.9955 $ 437.67 Assume the interest rate rises to 7.5%. What is the total cost of interest with the new interest rate? (Use Table 15.1). Note: Round your intermediate calculations and final answer to the nearest cent. Total cost of interest: ????? The answer is NOT $110,753.57 TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625 0.21875 9.48394 6.72689 5.36014 4.54938…arrow_forward

- The bank offers you the following three options to pay back the loan from the previous question: I: To pay the interest of 6.00% annually II: To pay an interest of 0.49% monthly III: To pay an interest of 1.46% quarterly Which of these three options would be most beneficial for you? O All three options would be equally beneficial Option II ○ Option III Option I O Option II and Option III would be equally beneficialarrow_forwardCalculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table, Table 13-1. (Round your answers to the nearest cent.) Monthly Payment Amount Number of Table Finance APR Financed Payments Factor Charge $800 18 16% $ 15.91 $ 50.29 $ 105.22arrow_forwardTASK: 2 are mu pare Apply your understanding about the present value and future value of annuities and prepare TWO Loan EMI (EMI = Equated Monthly Installments) payment schedules based on the following instructions: 1. Loan Summary and schedule of Short term loan (20 marks) 2. Loan Summary and schedule of Long term loan (20 marks) Guidelines: 1. Suggested Short term Loan period is 1 year to 3 years 2. Suggested Long term Loan period is 7 years and above 3. Each loan summary should contains following points: a. What type of loan is chosen? b. Why it is chosen? C. Interest rate, number of years (loan period) and loan amount to be assumed and clearly stated d. Starting date and ending date of the loan period is to be mentioned 4. The payment schedule should cover the following: a. Serial No. b. Date (period) c. EMI amount (EMI = Equated Monthly Installments) d. Principal component of the EMI e. Interest component of the EMI f. Interest paid to date g. Principal paid- to date h. Principal…arrow_forward

- If you could solve Option 2 with formulas that would be great! Option 2: Borrow $5,000,000 from a bank quoted an annual interest rate of 3.8%, do monthly payments during the payback period of 6 years. Find periodic and annual payments, also cumulative interest and cumulative principal.arrow_forwardIntro You take out a 360-month fixed-rate mortgage for $100,000 with a monthly interest rate of 0.4%. Part 1 What is the monthly payment? 0+ decimals Submitarrow_forwardYou want to purchase an automobile for $22,800. The dealer offers you two options. Option 1 is 0% financing for 48 months. Option 2 offers 2.9% financing for 72 months. A) Compute the monthly payments for each option. Show work to justify your answer. N 1% PV PMT FV P/Y C/Y Option 1: Monthly Payment is: Option 2: Monthly Payment is: N 1% PV PMT FV P/Y C/Y B) Compute the total cost for each option. Show work to justify your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education