Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

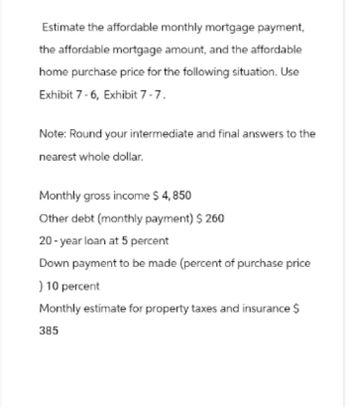

Transcribed Image Text:Estimate the affordable monthly mortgage payment,

the affordable mortgage amount, and the affordable

home purchase price for the following situation. Use

Exhibit 7-6, Exhibit 7-7.

Note: Round your intermediate and final answers to the

nearest whole dollar.

Monthly gross income $ 4,850

Other debt (monthly payment) $260

20-year loan at 5 percent

Down payment to be made (percent of purchase price

) 10 percent

Monthly estimate for property taxes and insurance $

385

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Calculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase(Cash)Price DownPayment AmountFinanced Add-onInterest Number ofPayments FinanceCharge MonthlyPayment $6,000 15% $ 12 1 2 % 30 $ $arrow_forwardShow the first two lines of the amortization table for your new home mortgage, assuming a sellingprice of $118,500, a down payment of 6%, annual interest rate 5.3% compounded monthly, andmonthly payments on a 30-year mortgage. (Please help by solving through calculator)arrow_forwardPLEASE DO NOT ROUND THE ANSWERS Selling Price of Home Down Payment Rate of Interest Years $ 160,000.00 $ 20,000.00 3.50% 30 Required: Please use the above information to answer the below questions: (Use Table 15-1) How many total payments on this mortgage? What is the principal (loan)? What is the payment per $1,000? What is the monthly mortgage payment? TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Term in Years INTEREST 3½% 5% 5½% 6% 6½% 7% 7½% 8% 8½% 9% 9½% 10% 10½% 11% 10 9.89 10.61 10.86 11.11 11.36 11.62 11.88 12.14 12.40 12.67 12.94 13.22 13.50 13.78 12 8.52 9.25 9.51 9.76 10.02 10.29 10.56 10.83 11.11 11.39 11.67 11.96 12.25 12.54 15 7.15 7.91 8.18 8.44 8.72 8.99 9.28 9.56 9.85 10.15 10.45 10.75 11.06 11.37 17 6.52 7.29 7.56 7.84 8.12 8.40 8.69 8.99 9.29 9.59 9.90 10.22 10.54 10.86 20 5.80 6.60 6.88 7.17 7.46 7.76 8.06 8.37 8.68 9.00 9.33 9.66 9.99 10.33 22 5.44 6.20 6.51 6.82 7.13 7.44 7.75 8.07 8.39 8.72 9.05 9.39…arrow_forward

- Complete the following amortization chart by using Table 15.1. Note: Round your "Payment per $1,000" answer to 5 decimal places and other answers to the nearest cent. Selling price of home Down payment Principal (loan) Rate of interest Years Payment per $1,000 Monthly mortgage payment 69 $ 82,000 $ 6,000 5.0 % 30 30arrow_forwardUsing this table as needed, calculate the required information for the mortgage. Amount Interest Financed Rate $88,500 8.00% Need Help? Read It Submit Answer Term of Loan (years) 30 Number of $1,000s Financed 88.5 Table Factor (in $) 7.34 Monthly Payment (in $) X LA Total Interest (in $) Xarrow_forwardVijayarrow_forward

- Let’s assume that you plan to purchase a house which is selling for $350,000 today. You will make a monthly payment for the next 30 years, with an annual interest rate of 3%. What will be the amount of your monthly mortgage (i.e., home loan) payment? answer choices $1,890.37 $1,400.01 $1,475.61 $1,228.14arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forwardPls show steps detailed thanksarrow_forward

- please show calculation for both clearly show mortgage schedule clearly answer in text without copy paste need complete and correct answer with full explanationarrow_forwardCalculate the amount financed, the finance charge, and the monthly payments (in $) for the add-on interest loan. (Round your answers to the nearest cent.) Purchase (Cash) Price Monthly Payment Down Amount Add-on Number of Finance Payment Financed Interest Payments Charge $50,900 $ | $ 25% 11.6% 60arrow_forwardProblem: Please answer the following questions regarding a $300,000 Mortgage Loan with monthly amortization over 30 years and an annual interest rate of 6%. What is the loan payment for a (30 year loan (360 monthly payments) of $300,000 at 6%? Question Answer What is the monthly payment amount? Loan Monthly Payment: How much interest and how much is principle on the first payment? Interest: Principle: How much interest and how much is principle on the second payment? Interest: Principle: If after the second payment an addition $10,000 was paid on principle. How much would the interest be on the third payment? Interest:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education