Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

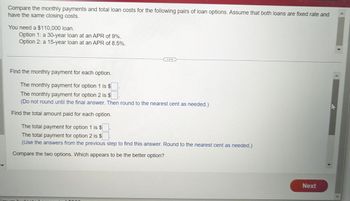

Transcribed Image Text:Compare the monthly payments and total loan costs for the following pairs of loan options. Assume that both loans are fixed rate and

have the same closing costs.

You need a $110,000 loan.

Option 1: a 30-year loan at an APR of 9%.

Option 2: a 15-year loan at an APR of 8.5%.

...

Find the monthly payment for each option.

The monthly payment for option 1 is $

The monthly payment for option 2 is $

(Do not round until the final answer. Then round to the nearest cent as needed.)

Find the total amount paid for each option.

The total payment for option 1 is $

The total payment for option 2 is $

(Use the answers from the previous step to find this answer. Round to the nearest cent as needed.)

Compare the two options. Which appears to be the better option?

imum budgeted

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- fixed rate and have the same closing costs. You need a $140,000 loan. Option 1: a 30-year loan at an APR of 7.5%. Option 2: a 15-year loan at an APR of 7%. Find the monthly payment for each option. The monthly payment for option 1 is $ The monthly payment for option 2 is $ (Do not round until the final answer. Then round to the nearest cent as needed.) Find the total amount paid for each option. The total payment for option 1 is $ The total payment for option 2 is $ (Use the answers from the previous step to find this answer. Round to the nearest cent as needed.) Compare the two options. Which appears to be the better option? OA. Option 2 will always be the better option OB. Option 1 is the better option, but only if the borrower plans to stay in the same home for the entire term of the loan. OC. Option 1 will always be the better option. D. Option 2 is the better option, but only if the borrower can afford the higher monthly payments over the entire term of the loan.arrow_forwardConsider the following options for a $153,000 mortgage. Calculate the monthly payment and total closing costs for each option. Which option would Clearly explain why you chose the option that you chose. you choose? Option 1: a 30-year fixed-rate loan at 4.3% with $1500 closing cost and no points • Option 2: a 30-year fixed-rate loan at 3.8% with $1200 closing cost and 2 pointsarrow_forwardYou are trying to purchase a condo and are looking at various options to finance the purchase.Your two best options are Option I a loan at 13.25 % (APR) interest compounded semi-annually. Or a 11.75 % (APR) interest loan compunded daily. Evaluate each loan structure and determine the Effecte Annual Rate (EAR) of each loan to determine what is the better deal.arrow_forward

- Give typing answer with explanation and conclusion Assume you want to borrow $300,000 and have been presented with two options. The first option is a fully amortizing loan with an interest rate of 3% and $4000 of origination fees and points. The second option is an interest only loan with an interest rate of 4% and $5000 of origination fees and points. Both loans are for 30 years and have monthly payments. Further assume that if the borrower chooses the interest only loan, any money saved on the monthly payment can be invested with a projected return of 7%. Also assume that the proceeds from the investment will first be used to pay off any remaining balance on the loan. How much money will the investor have left at the end of 30 years after repaying the loan? Group of answer choices None, the investor will owe $12,373.42 $323,060.72 $22,063.08 $30,750.78arrow_forward← You need a loan of $150,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices. Choice 1: 20-year fixed rate at 6% with closing costs of $2900 and no points. Choice 2: 20-year fixed rate at 5.5% with closing costs of $2900 and 4 points. What is the monthly payment for choice 1? A (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardCompare the monthly payments and total loan costs for the following pairs of loan options. Assume that both loans are fixed rate and have the same closing costs. You need a $80,000 loan. Option 1: a 30-year loan at an APR of 8.15%. Option 2: a 15-year loan at an APR of 7.75%. Question content area bottom Part 1 Find the monthly payment for each option. The monthly payment for option 1 is $ enter your response here. The monthly payment for option 2 is $ enter your response here.arrow_forward

- Assume you need a $87,000.00 loan for a home. Compute the monthly payment for each option. Assume that the loans are fixed rate and that closing costs are the same in both cases. Round to the nearest penny.Option 1: a 30 year-loan at an APR of 7.25%The monthly payment for Option 1 would be $.Option 2: a 15 year-loan at an APR of 6.5%The monthly payment for Option 2 would be $arrow_forwardG. Find the interest rate (APR) on a 27-year mortgage with a initial loan amount of $358,000, if the monthly payment is $2229.45 Let's use references for input values; and be sure to annualize the rate! INPUTS: OUTPUT: Period Rate is APR Payment Loan amountarrow_forwardYou are offered an add-on loan for $4,500 at 18% for 5 years. What is the monthly payment? What is the amount of interest? What is the true interest rate cost of this loan? If you could pay the same loan above at a compound rate: What would the monthly payment be? What would the amount of interest be? Prepare a monthly payment schedule for each loan above using Excel, and submit it. Suppose that you are only allowed to make a balloon payment to the principal of the compound interest loan. You have $1,000 to put down at the beginning of year three. How many payments will you save?arrow_forward

- Problem: You are interested in a fixed-rate mortgage for $399,000 and need to choose the between options: a 15-year mortgage or a 30- year mortgage. The current mortgage rate is 3.75% for the 15-year mortgage, and 3.25% for the 30-year mortgage. Both require a 15% down payment. (Hint: make use of the amortization formula from Chapter 12). (a) What are the monthly principal and interest payments for EACH loan? Show your work. (b) What is the total amount of interest paid on EACH loan? Show your work. (c) Overall, how much more interest is paid by choosing the 30-year mortgage? Show your work.arrow_forwardBorrower Joe has an existing loan that requires 15 more years of monthly payments of $1,040. He is considering refinancing the loan balance of $117.095.08 with a new loan at the current market rate of 5.675% for 15-year loans. Both the old loan and the new loan require 2 points plus $500 in origination fees. What is the NPV of the refinancing decision at an opportunity rate of 5.675%?arrow_forwardA borrower is purchasing a property for $180,000 and can choose between two possible loan alternatives. The first is a 90% loan for 25 years at 9% interest and the second is a 95% loan for 25 years at 9.25% interest. Assuming the loan will be held to maturity, what is the incremental cost of borrowing the extra money? 18.75% OO 14.34% 13.50% 12.01%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education