Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

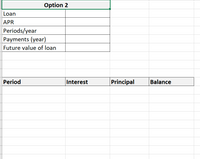

If you could solve Option 2 with formulas that would be great!

Option 2: Borrow $5,000,000 from a bank quoted an annual interest rate of 3.8%, do monthly payments during the payback period of 6 years. Find periodic and annual payments, also cumulative interest and cumulative principal.

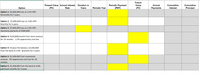

Transcribed Image Text:Future

Present Value Annual Interest

Duration in

Periodic Payment

Value

Annual

Cumulative

Cumulative

Option

(PV)

Rate

Years

Periods/ Year

(PMT)

(FV)

Payments

Interest

Principal

Option 1: $4,600,000 loan at 3.5% APR.

Bimonthly for 5 years.

Option 2: $5,000,000 loan at 3.8% APR.

Monthly for 6 years.

Option 3: $5,000,000 loan at 3.4% APR.

Quarterly payments of $400,000

Option 4: $150,000/month from store revenue

for 10 months. 2.5% opportunity cost lost.

Option 4: Finance the balance, $3,500,000

from the bank at 3.4% quarterly for 5 years.

Option 5: $2,500,000 from investment

account. 3% opportunity cost lost for 10

months.

Option 5: $2,500,000 from the bank at 4.0%

paid back monthly for 3 years

Transcribed Image Text:Option 2

Loan

APR

Periods/year

Payments (year)

Future value of loan

Period

Interest

Principal

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Use the formula for computing future value using compound interest to determine the value of an account at the end of 8 years if a principal amount of $13,000 is deposited in an account at an annual interest rate of 5% and the interest is compounded quarterly. The amount after 8 years will be $ (Round to the nearest cent as needed.) Enter your answer in the answer box and then click Check Answer. All narts showing javascript:doExercise(9); Clear All Check Answer sy Po a 99+arrow_forwardPlease provide the steps to solving this problem using a financial calculator: You just opened a brokerage account, depositing $3,500. You expect the account to earn an interest rate of 9.652%. You also plan on depositing $4,500 at the end of years 5 through 10. What will be the value of the account at the end of 20 years, assuming you earn your expected rate of return?arrow_forwardGive typed solution only If you put $200,000 into your investment account now for 10 year at 5% annual interest, what is the difference in interest income between simple interest calculation and compound interest calculation?arrow_forward

- You deposit $2000 in an account that pays 7% interest compounded semiannually. After 2 years, the interest rate is increased to 7.52% compounded quarterly. What will be the value of the account after a total of 4 years? i Click the icon to view some finance formulas. The value of the account will be $ (Round to the nearest dollar as needed.)arrow_forwardYou would like to contribute to a savings account over the next three years in order to accumulate enough money to take a trip to Europe. Assume an interest rate of 20%, compounded quarterly. How much will accumulate in three years by depositing $560 at the beginning of each of the next 12 quarters? Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (EV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Table, Excel, or calculator function Payment: Future Value: n= FVAD of $1 $ 560 12 5.0%arrow_forwardA borrower can obtain an 80% loan with an 8% interest rate and monthly payments. The loan is to be fully amortized over 25 years. Alternatively, he could obtain a 90% loan at an 8.5% rate with the same loan term. The borrower plans to own the property for the entire loan term. solve with finanical calucltor What is the incremental cost of borrowing the additional funds? How would your answer change if 2 points were charged on the 90% loan? Would your answer to part (b) change if the borrower planned to own the property for only 5 years?arrow_forward

- You just opened a brokerage account, depositing $4,500. You expect the account to earn an interest rate of 8.57 % . You also plan on depositing $3,000 at thenend of years 5 through 10. What will be the value of the account at the end of 20 years, assuming you earn your expected rate of return?arrow_forwardSuppose you want to save $220,000 for retirement. You will do so by putting monthly deposits into an account that gets 5% interest compounded monthly for 30 years. What should your monthly deposits be? Round your answer to the nearest cent and include units. Make sure you show the formula you used and the values you filled in.arrow_forwardAnswer the following question using a spreadsheet and the material in the appendix. You would like to buy a house. Assume that given your income, you can afford to pay $12,000 a year to a lender for the next 30 years. If the interest rate is 7% how much can you borrow today based on your ability to pay? What about if the interest rate is 3%? Maximum mortgage at 7%: $ Maximum mortgage at 3%: $arrow_forward

- Assume you graduate from university with a $20,000 student loan. If your interest rate is fixed at 4.55% APR with monthly compounding and you will repay the loan over a 20-year period, what will be your monthly payment? The monthly payment will be $ (Round to two decimal places.)arrow_forwardIf you could pay for your mortgage forever, how much would you have to pay per month for a $1,000,000 mortgage, at a 6.5% annual interest rate? Work out the answer (a) if the 6.5% is a bank APR quote and (b) if the 6.5% is a true effective annual rate of return.arrow_forwardGive typing answer with explanation and conclusion Assume you want to borrow $300,000 and have been presented with two options. The first option is a fully amortizing loan with an interest rate of 3% and $4000 of origination fees and points. The second option is an interest only loan with an interest rate of 4% and $5000 of origination fees and points. Both loans are for 30 years and have monthly payments. Further assume that if the borrower chooses the interest only loan, any money saved on the monthly payment can be invested with a projected return of 7%. Also assume that the proceeds from the investment will first be used to pay off any remaining balance on the loan. How much money will the investor have left at the end of 30 years after repaying the loan? Group of answer choices None, the investor will owe $12,373.42 $323,060.72 $22,063.08 $30,750.78arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education