FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

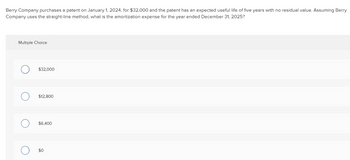

Transcribed Image Text:Berry Company purchases a patent on January 1, 2024, for $32,000 and the patent has an expected useful life of five years with no residual value. Assuming Berry

Company uses the straight-line method, what is the amortization expense for the year ended December 31, 2025?

Multiple Choice

C

$32,000

$12,800

$6,400

$0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 6arrow_forwardProblem 10-60 (LO 10-2, LO 10-3) (Algo) Assume that ACW Corporation has 2021 taxable income of $1,680,000 for purposes of computing the $179 expense. The company acquired the following assets during 2021 (assume no bonus depreciation): (Use MACRS Table 1, Table 2 and Table 5.) Machinery Asset Computer equipment Delivery truck Qualified improvement property Total Placed in Service 12-Sep Basis $ 488,000 10-Feb 21-Aug 02-Apr 88,000 111,000 1,398,000 $ 2,085,000 a. What is the maximum amount of $179 expense ACW may deduct for 2021? b. What is the maximum total depreciation that ACW may deduct in 2021 on the assets it placed in service in 2021? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Answer is complete but not entirely correct. a. Maximum §$179 expense for 2021 $ 1,050,000 b. Maximum total deductible depreciation for 2021 $ 1,166,263 xarrow_forwardAmortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $360,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $18,000. If required, round your answers to the nearest dollar. Question Content Area a. Determine the patent amortization expense for Year 4 ended December 31.$fill in the blank bc4756fc8040fa8_1 Question Content Area b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select -arrow_forward

- acc1arrow_forwardProblem 10-61 (LO 10-2, LO 10-3) (Algo) I Chaz Corporation has taxable income in 2023 of $1,312,100 for purposes of computing the $179 expense and acquired the following assets during the year: Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Placed in Service September 12 February 10 August 21 Basis $ 784,000 934,000 72,000 September 30 1,503,000 $ 3,293,000 What is the maximum total depreciation deduction that Chaz may deduct in 2023? (Use MACRS Table 1, Table 2. Table 3. Table 4, and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation deduction Assessment Tool iFramearrow_forwardQd 52.arrow_forward

- MC Qu. 16-84 Donata Company purchased equipment for... Donata Company purchased equipment for $45,000 in December 20x1. The equipment is expected to generate $12,000 per year of additional revenue and incur $6,000 per year of additional cash expenses, beginning in 20x2. Under MACRS, depreciation in 20x2 will be $7,000. If the firm's income tax rate is 20%, the after-tax cash flow in 20x2 would be: Multiple Choice O O о $1,200. $2,200. $3,600. $6.200. None of the answers is correct.arrow_forwardAmortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $472,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $23,500. If required, round your answers to the nearest dollar. a. Determine the patent amortization expense for Year 4 ended December 31. $236,000 X b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank. Amortization Expense-Patents Patents 29,500 X 29,500 Xarrow_forward10. Al the end of the year, Cosby Universit's held assets of $15.000,000 and 59,000,000 of tiabilites (including deferred revenues of $300,000). What Is Cramer's net assets balance? $5,700,000 B. $6,000,000 C. $6,300,000 D. $15,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education