FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

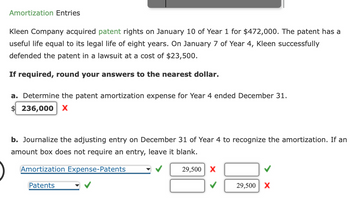

Transcribed Image Text:Amortization Entries

Kleen Company acquired patent rights on January 10 of Year 1 for $472,000. The patent has a

useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully

defended the patent in a lawsuit at a cost of $23,500.

If required, round your answers to the nearest dollar.

a. Determine the patent amortization expense for Year 4 ended December 31.

$236,000 X

b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an

amount box does not require an entry, leave it blank.

Amortization Expense-Patents

Patents

29,500 X

29,500 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- jagdisharrow_forwardOn December 31, Chase Rock Company estimated that a goodwill of $80,000 was impaired. In addition, on June 1, Chase Rock acquired a patent with an estimated useful life of 10 years for $262,000. Required: Journalize the adjusting entry on December 31, for the impaired goodwill. Journalize the adjusting entry on December 31, for the amortization of the patent rights.arrow_forwarddevratarrow_forward

- Amortization Entries Kleen Company acquired patent rights on January 10 of Year 1 for $392,000. The patent has a useful life equal to its legal life of eight years. On January 7 of Year 4, Kleen successfully defended the patent in a lawsuit at a cost of $19,500. If required, round your answers to the nearest dollar. a. Determine the patent amortization expense for Year 4 ended December 31. $ b. Journalize the adjusting entry on December 31 of Year 4 to recognize the amortization. If an amount box does not require an entry, leave it blank.arrow_forwardOn January 2 of the current year, a company purchased a patent for $35,000 with a useful life of 10 years. Prepare the journal entry to amortize the patent at the end of the first year using the general journal.arrow_forward1. A patent was acquired from another company on January 1, 2019, for $25,000.The useful life is 10 years. 2. On April 2, 2019, the company was successful in obtaining a patent. The legal fees paid to an outside law firm were $8,400. The development costs paid to engineers who were employees of Bishop were $75,000. The useful life is 10 years. 3. On July 1, 2019, Bishop acquired all the assets net of the liabilities of Fargo Company. The identifiable net assets' market values at the time of purchase totaled $100,000. Bishop acknowledged the superior earnings and loyal customer following of Fargo Company. Therefore, Bishop and Fargo agreed on a total purchase price of $145,000. Any goodwill arising from the purchase is not to be amortized. 4. On December 31, 2019, Bishop paid a consulting firm $17,000 to develop a trademark. In addition, legal fees paid in connection with the trademark were $3,000. Assume a useful life of 20 years. 5. On August 1, 2019, Bishop acquired intangible asset…arrow_forward

- G Company purchases a patent for $120000 on Jan 1, 2008. It has estimated useful life is 10 years. Prepare journal entry to record patent expense for the first yeararrow_forwardGemini Group has acquired a patent for $22.000. Its useful life is expected to be ten years. What amount would be recorded in a periodic amortization journal entry? Amortization Expense-Patents Patents 2,200 2,200 Amortization Expense-Patents 2,000 Patents 20,000 Amortization Expense-Patents 22,000 Patents 22,000 1,200 Amortization Expense-Patents 1,200 Patents Submit Answerarrow_forwardComputing Subsequent Carrying Amount of Patents In January of Year 1, Ford Co. purchased a patent from a research institution for $325,000. The patent was estimated to have a useful life of 15 years. In December of Year 2, Ford Co. defended the patent in legal proceedings and successfully retained rights of ownership of the patent. The estimated life of the patent did not change from its original estimate Legal expenses on December 31 were $26,000. Determine the (1) amortization for Year 2, and (2) carrying value of the patent on December 31 of Year 2. Note: Round your final answers to the nearest dollar. 1. Amortization for Year 2 1 2. Carrying value on Dec 31, Year 25 25.214 x 302.572 xarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education