FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

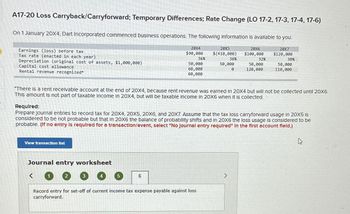

Transcribed Image Text:A17-20 Loss Carryback/Carryforward; Temporary Differences; Rate Change (LO 17-2, 17-3, 17-4, 17-6)

On 1 January 20X4, Dart Incorporated commenced business operations. The following information is available to you:

20X4

$90,000

Earnings (loss) before tax

Tax rate (enacted in each year)

Depreciation (original cost of assets, $1,000,000)

Capital cost allowance

Rental revenue recognized*

View transaction list

Journal entry worksheet

1

2

3

4

5

36%

50,000

60,000

60,000

6

*There is a rent receivable account at the end of 20X4, because rent revenue was earned in 20X4 but will not be collected until 20X6.

This amount is not part of taxable incon In 20X4, but will be taxable income in 20X6 when it is collected.

20X5

$(410,000)

Required:

Prepare Journal entries to record tax for 20X4, 20X5, 20X6, and 20X7. Assume that the tax loss carryforward usage in 20X5 is

considered to be not probable but that in 20X6 the balance of probability shifts and in 20X6 the loss usage is considered to be

probable. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.)

Record entry for set-off of current income tax expense payable against loss

carryforward.

36%

50,000

0

20X6

$100,000

32%

50,000

120,000

20X7

$120,000

30%

50,000

110,000

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stone Company reported pre-tax book income of $700,000 in 20X1, the first year of operation. The tax depreciation exceeded the book depreciation by $90,000. The tax rate for 20X1 and all future years was 21%. What amount of deferred tax liability should Stone report in its December 31, 20X1, balance sheet? Select one: a. $6,300 b. $14,000 c. $18,900 d. $3,500arrow_forwardNeed answer of this Questionarrow_forwardLewes Company appropriately uses the installment sales method for tax purposes and the accrual method for revenue recognition for accounting purposes. Pertinent data at December 31, 2016, the close of the first year of operations, are as follows: Revenue Recognized Revenue Recognized Customer for Accounting Purposes for Tax Purposes Lowe's Builders $200,000 $100,000 Top Down Plumbing 500,000 350,000 Glass Plus Windows 600,000 350,000 Lewes's tax rate is 30%. What amount should be included in the deferred tax account at December 31, 2016 for these installment sales?arrow_forward

- 1. Given the following information, calculate the tax liability for year 1. The Net Operating Income is $97,200. Capital Expenditure is $8,500. Interest is $51,219. Principal is $8,852. Depreciation $21,662. Amortized Financing Costs is 792. Ordinary tax rate is 35%. $26,059 $9,488 $11,209 $27,640arrow_forwardIf the beginning balance in Swan, Inc.’s OAA is $6,700 and the following transactions occur, what is Swan’s ending OAA balance? Depreciation recapture income $ 21,600Payroll tax penalty (4,200) Tax-exempt interest income 4,012Nontaxable life insurance proceeds 100,000 Life insurance premiums paid (nondeductible) (3,007)arrow_forwardTime left 0:43:13 Y Pty. Ltd. has assessable income of $100,000, deductions of $15,000 and tax offsets of $500. What is Y Pty. Ltd.'s tax payable for the year assuming a corporate tax rate of 25%? ut of O a. $21,200 O b. $25,500 O c. $20,750 O d. $25,000arrow_forward

- Provide the Correct answer in text formatarrow_forwardThe CFO has asked you to calculate the taxable income and prepare journal entries for Rudolf Ltd at 30th June 2022. Accounting loss before tax Impairement loss warranty expense Fines expense Doubtful Debts. Depreciation Plant warranty paid** Depreciation for tax - Plant.** Bad debts written off. ** (80,000) 1,000 10,000 5,000 4,000 20,000 8,000 30,000 10,000 Note These items ** are deductible for tax purposesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education