FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

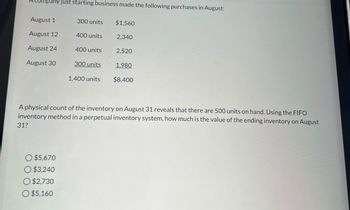

Transcribed Image Text:Company just starting business made the following purchases in August:

August 1

300 units

$1,560

August 12

400 units

2,340

August 24

400 units

2,520

August 30

300 units

1,980

1,400 units

$8,400

A physical count of the inventory on August 31 reveals that there are 500 units on hand. Using the FIFO

inventory method in a perpetual inventory system, how much is the value of the ending inventory on August

31?

$5,670

$3,240

O $2,730

$5,160

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Plz explain in detailarrow_forwardA company's inventory records report the following in November of the current year: Beginning November 1 Purchase November 2 Purchase November 12 On November 8, it sold 12 units for $49 each. Using the LIFO perpetual inventory method, what was the amount recorded in the cost of goods sold account for the 12 units sold? Multiple Choice O O O $342 $248 $264 $378 5 units @ $19 10 units @ $21 6 units @ $23 $443arrow_forwardSheffield Corp. uses a periodic inventory system. Details for the inventory account for the month of January 2022 are as follows: Units Per unit price Total Balance, 1/1/2022 320 $5 $1600 Purchase, 1/15/2022 160 ..6 960 Purchase, 1/28/2022 160 ..6 960 An end of the month (1/31/2022) inventory showed that 250 units were on hand. How many units did the company sell in January 2022? 390 320 250 90arrow_forward

- The following units of a particular item were available for sale during the calendar year: Jan. 1 Apr. 19 Inventory Sale 4,000 units at $50 2,500 units June 30 Purchase 4,500 units at $54 Sept. 2 Sale 5,000 units Purchase 2,000 units at $56 Nov. 15 The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5. Date Purchases Quantity Purchases Unit Cost Purchases Total Cost Quantity Weighted Average Cost Flow Method Cost of Goods Sold Cost of Goods Sold Unit Cost Cost of Goods Sold Total Cost Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 ☐ ☐ ☐ ☐ ☐ ☐ Dec. 31 Balancesarrow_forwardcompany's inventory records show the following data for the month of July. Date July 1 July 5 July 10 July 20 July 25 July 1 Date Activities Beginning inventory Purchase Sale Purchase Sale July 5 Average cost July 5 July 10 July 20 200 units @ $50 If the company uses the weighted average method and the perpetual inventory system, what would be the cost of its ending inventory? Average cost July 20 July 25 Total July 25 Goods purchased Number of Cost per units unit 50 at $ 75.00 Units Acquired at Cost Units Sold at Retail 100 units @ $72 = $7,200 50 units @ $75 = $3,750 225 at $ 77.00 225 units @ $77 = $17,325 Number of units sold Cost of Goods Sold Cost per Cost of Goods Sold unit 75 at $ 50.00 = 200 at $ 50.00 $ 75 units @ $50 $ $ 3,750.00 10,000.00 10,000.00 Number of units 100 at Inventory Balance 100 at 50 at 150 at Cost per unit Inventory Balance 7,200.00 7,200.00 3,750.00 10,950.00 $ 175 at $ $ $ 75 at 150 at 225 at $ 375 at $ 50.00 = $ +73.00 = 77.00 = 75.40 75.00 = 55 72.00 = $…arrow_forwardSuppose that Pharoah has the following inventory data: July 1 Beginning inventory 25 units at $5.00 5 Purchases 101 units at $5.50 14 Sale 67 units 21 Purchases 50 units at $6.00 30 Sale 47 units Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? O $650.50 ○ $980.50 O $330.00 O $485.00arrow_forward

- Crane Company uses a perpetual inventory system and reports the following for the month of June. Date June 1 (a1) 12 23 30 June 1 June 12 June 15 June 23 Explanation Units Unit Cost Inventory Purchase June 27 Purchase Inventory $ $ $ eTextbook and Media 120 Save for Later 360 Calculate the weighted-average cost per unit, using a perpetual inventory system. Assume a sale of 400 units occurred on June 15 for a selling price of $9 and a sale of 50 units on June 27 for $10. (Round intermediate calculations to O decimal places, e.g. 152 and final answers to 3 decimal places, e.g. 5.125.) 170 200 $5 6 7 Total Cost $600 2,160 1,190 Attempts: 0 of 6 used Submit Answerarrow_forwardSunland has the following inventory data: Nov. 1 Inventory 29 units @ $5.80 each 8 Purchase 115 units @ $6.20 each 17 Purchase 58 units @ $6.05 each 25 Purchase 86 units @ $6.30 each A physical count of merchandise inventory on November 30 reveals that there are 96 units on hand. Ending inventory under FIFO isarrow_forwardRequired information [The following information applies to the questions displayed below.] A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 310 units. Ending inventory at January 31 totals 130 units. Units Unit Cost $ 2.60 Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 280 60 2.80 100 2.94 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. Perpetual FIFO: Cost of Goods Sold Goods purchased Inventory Balance # of units Date Cost per unit Cost per Cost of Goods unit Cost per Inventory Balance # of units # of units Sold unit sold January 1 January 9 Total January 9 Ianuani 2Earrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education