FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

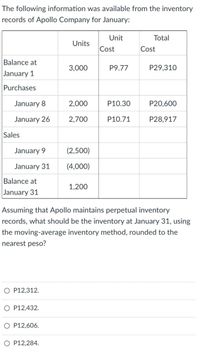

Transcribed Image Text:The following information was available from the inventory

records of Apollo Company for January:

Unit

Total

Units

Cost

Cost

Balance at

3,000

P9.77

P29,310

January 1

Purchases

January 8

2,000

P10.30

P20,600

January 26

2,700

P10.71

P28,917

Sales

January 9

(2,500)

January 31

(4,000)

Balance at

1,200

January 31

Assuming that Apollo maintains perpetual inventory

records, what should be the inventory at January 31, using

the moving-average inventory method, rounded to the

nearest peso?

O P12,312.

O P12,432.

O P12,606.

P12,284.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose that Target Corporation uses the periodic inventory system to account for inventories and has the following information at October 31. October 1 Beginning inventory 400 units $12.00 = $4,800 8 Purchase 800 units @ $12.40 = 9,920 16 Purchase 600 units @ $12.80 = 7,680 24 Purchase 200 units @ $13.60 = 2,720 Total units and cost 2,000 units $25,120 (a) Determine the ending inventory using the FIFO cost assumption if 500 units remain on hand at October 31. Ending inventory $arrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Specific Identification Purchase Date January 1 January 20 January 30 Complete this question by entering your answers in the tabs below. FIFO Activity Units Acquired at Cost 180 units @ $10.50 = LIFO Available for Sale Beginning inventory Purchase Purchase 110 units 270 units @ 560 units # of units 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory…arrow_forwardCompute the correct December 31 Inventory The accounting records of Larkspur Electronics show the following data Beginning inventory3,120 units at $3 Purchases7,280 units at $5 Sales 8,760 units at $8 Determine cost of goods sold during the period under a periodic inventory system using (a) the FIFO method, (b) the LIFO method, and () the average cost methodarrow_forward

- sarrow_forward3arrow_forwardThe beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. Date Transaction Number of units Per unit ($) Total ($) April 3 Inventory 25 1.200 30.000 8 Purchase 75 1.240 93.000 11 Sale 40 2.000 80.000 30 Sale 30 2.000 60.000 May 8 Purchase 60 1.260 76.500 10 Sale 50 2.000 100.000 19 Sale 20 2.000 40.000 28 Purchase 80 1.260 100.800 June 5 Sale 40 2.250 90.000 16 Sale 25 2.250 56.250 21 Purchase 35 1.264 44.240 28 Sale 44 2.250 99.000 Instructions1. Determine the inventory on June 30, 2014, and the cost of goods sold for the threemonth period, using the first-in, first-out method and the periodic inventory system.2. Determine the inventory on June 30, 2014, and the cost of goods sold for the threemonth period, using the last-in, first-out method and the periodic inventory system.3. Determine the inventory on June 30, 2014, and the cost of goods sold for the threemonth period,…arrow_forward

- Some of the information found on a detail inventory card for Blossom Inc. for the first month of operations is as follows. Date January 2 (a1) 7 10 13 18 20 23 26 28 31 Received No. of Units 1,500 900 1,300 1,600 1,900 Unit Cost $5.01 5.34 5.51 5.68 5.85 Issued, No. of Units 1,000 800 600 1,100 1,100 1,600 Balance, No. of Units 1,500 500 1,400 600 1,300 200 1,800 700 2,600 1,000arrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 10 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Req 1 Req 2 to 4 Sales Cost of goods sold Gross profit Complete this question by entering your answers in the tabs below. Specific Identification $ LAKER COMPANY For Month Ended January 31 Weighted Average $ Units Acquired at Cost 185 units @ $11.00 = 5,600 100 units @ 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education