FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, Number 5888 for $1,045 and Number 5893 for $490. Check Number 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation.

| Date | Description | Withdrawals | Deposits | Balance |

|---|---|---|---|---|

| September 1 | $ 17,500 | |||

| September 3 | Check #5888 | $ 1,045 | $ 16,455 | |

| September 4 | Check #5902 | $ 791 | $ 15,664 | |

| September 5 | Cash deposit | $ 1,130 | $ 16,794 | |

| September 7 | Check #5901 | $ 1,840 | $ 14,954 | |

| September 12 | Cash deposit | $ 2,258 | $ 17,212 | |

| September 17 | NSF check | $ 610 | $ 16,602 | |

| September 20 | Check #5905 | $ 983 | $ 15,619 | |

| September 21 | Cash deposit | $ 4,291 | $ 19,910 | |

| September 22 | Check #5903 | $ 378 | $ 19,532 | |

| September 22 | Check #5904 | $ 2,131 | $ 17,401 | |

| September 25 | Cash deposit | $ 2,328 | $ 19,729 | |

| September 28 | Check #5907 | $ 212 | $ 19,517 | |

| September 29 | Check #5909 | $ 1,851 | $ 17,666 | |

| September 30 | Collected note | $ 1,510 | $ 19,176 | |

| September 30 | Interest earned | $ 17 | $ 19,193 |

From Chavez Company’s Accounting Records

| Cash Receipts Deposited | |

| Date | Cash Debit |

|---|---|

| September 5 | 1,130 |

| September 12 | 2,258 |

| September 21 | 4,291 |

| September 25 | 2,328 |

| September 30 | 1,707 |

| 11,714 |

| Cash Payments | |

| Check Number | Cash Credit |

|---|---|

| 5901 | 1,840 |

| 5902 | 791 |

| 5903 | 378 |

| 5904 | 2,088 |

| 5905 | 983 |

| 5906 | 1,022 |

| 5907 | 212 |

| 5908 | 352 |

| 5909 | 1,851 |

| 9,517 |

| Cash | Account Number 101 | ||||

| Date | Explanation | PR | Debit | Credit | Balance |

|---|---|---|---|---|---|

| August 31 | Balance | 15,965 | |||

| September 30 | Total receipts | R12 | 11,714 | 27,679 | |

| September 30 | Total payments | D23 | 9,517 | 18,162 |

Additional Information

- (a) Check Number 5904 is correctly drawn for $2,131 to pay for computer equipment; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Computer Equipment and a credit to Cash of $2,088.

- (b) The NSF check shown in the statement was originally received from a customer, S. Nilson, in payment of her account. Its return has not yet been recorded by the company.

- (c) The collection of the note on September 30 is not yet recorded by the company.

2. Prepare journal entries to adjust the book balance of cash to the reconciled balance. (If no entry is required for a transaction/event, select "No

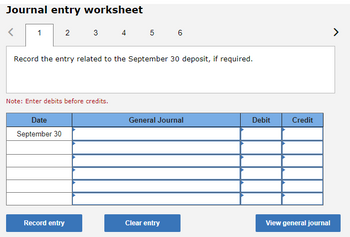

Transcribed Image Text:Journal entry worksheet

2

1

Record the entry related to the September 30 deposit, if required.

3 4 5 6

Note: Enter debits before credits.

Date

September 30

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need helparrow_forwardI want Solution please provide itarrow_forwardRexrode Company's bank statement at January 31 showed an ending balance of $24,712.80. The unadjusted cash account balance for Rexrode is $21,245.75. The following data were gathered by Rexrode's accountant: Outstanding checks as of January 31: $4,895.44 ● NSF check from customer: $183.62 • Debit memo related to the returned deposit: $20.00 Credit memo for interest earned: $12.00 • Deposits in transit: $1,236.77 Required: a. Prepare a bank reconciliation for Rexrode Company at January 31. b. Indicate how each of the required adjusting entries impact the financial statements. . • Complete this question by entering your answers in the tabs below. Required A Required B Indicate how each of the required adjusting entries impact the financial statements. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Round your answers to 2 decimal places. Item Outstanding checks NSF check from a customer Debit memo related to the…arrow_forward

- Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, Number 5888 for $1,040 and Number 5893 for $493. Check Number 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. Date Description Withdrawals Deposits Balance September 1 $ 17,000 September 3 Check #5888 $ 1,040 $ 15,960 September 4 Check #5902 $ 742 $ 15,218 September 5 Cash deposit $ 1,112 $ 16,330 September 7 Check #5901 $ 1,849 $ 14,481 September 12 Cash deposit $ 2,250 $ 16,731 September 17 NSF check $ 627 $ 16,104 September 20 Check #5905 $ 993 $ 15,111 September 21 Cash deposit $ 4,067 $ 19,178 September 22 Check #5903 $ 399 $ 18,779 September 22 Check #5904 $ 2,093 $ 16,686 September 25 Cash deposit $ 2,398 $ 19,084 September 28 Check #5907 $ 256 $ 18,828 September 29 Check #5909 $ 1,858 $ 16,970…arrow_forwardOn April 30, the bank reconciliation of Sunland Company shows three outstanding checks: no. 254, $730; no. 255, $910; and no. 257, $310. The May bank statement and the May cash payments journal show the following. Bank Statement Checks Paid Date Check No. Amount 5/4 254 $730 5/2 257 310 5/17 258 249 5/12 259 200 5/20 261 500 5/29 263 430 5/30 262 690 Cash Payments Journal Checks Issued Date Check No. Amount 5/2 258 $249 5/5 259 200 5/10 260 840 5/15 261 500 5/22 262 690 5/24 263 430 5/29 264 580 List the outstanding checks at May 31. No. Amount Select a check number $Enter a dollar amount Select a check number Enter a dollar…arrow_forwardcash account for Norwegian Medical Co. at April 30 indicated a balance of $403,784. The bank statement indicated a balance of $468,460 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $73,870. b. A deposit of $51,230, representing receipts of April 30, had been made too late to appear on the bank statement. c. The bank collected $50,630 on a $48,220 note, including interest of $2,410. d. A check for $9,160 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as $916. The check was for the payment of an obligation to Universal Supply Co. for a purchase on account. e. A check drawn for $680 had been erroneously charged by the bank as $860. f. Bank service charges for April amounted to $170. Required: 1. Prepare a bank reconciliation. Be sure to complete the statement heading. Refer to the Labels and…arrow_forward

- Please provide correct solutionarrow_forwardAlvin Electronics is in the process of reconciling its bank account for the month of November. The following information is available: Balance per bank statement $ 8,325 Outstanding checks 2,400 Deposits outstanding 1,215 Bank service charges for November 35 Check written by Alvin for $300 but recorded incorrectly by Alvin as a $30 disbursement. What should be the corrected cash balance at the end of November?arrow_forwardIn preparing its bank reconciliation for the month of March 2007, Derby Company has available the following information: Balance per bank statement 3/31/07 $36,050, Deposit in transit 3/31/07 6,250, Outstanding checks 3/31/07 5,750, Credit erroneously recorded by bank in Derby's account 3/12/07 250, Bank service charges for March 50. What should be the correct balance of cash, at March 31, 2007? $35,250 O $36,250 $36,300 $36,550arrow_forward

- Please Solve this Onearrow_forwardBank reconciliation and entries The following information was available to reconcile Nelson Company's book cash balance with its bank statement as of September 30, 2021: The September 30 cash balance according to the accounting records was $21,870. Oustanding checks from August's bank reconciliation: Check # 356 $1,240 Check # 357 775 Check # 359 3,280 Check # 360 924 Below is a record of the cash receipts and cash payments for September: Cash Deposits Cash Payments Date Amount Check# Amount Sep 2 $8,359 361 $3,268 Sep 4 11,250 362 7,140 Sep 6 4,371 363 4,257 Sep 12 5,260 364 3,525 Sep 15 12,118 365 4,160 Sep 18 7,493 366 1,789 Sep 22 5,395 367 6,285 Sep 27…arrow_forwardThe bookkeeper at Martin Company has asked you to prepare a bank reconciliation as of May 31. The May 31 bank statement and the May T-account for cash (summarized) are below. Martin Company's bank reconciliation at the end of April showed a cash balance of $23,300. No deposits were in transit at the end of April, but a deposit was in transit at the end of May. Balance, May 1 May 2 May 5 May 7 May 8 May 14 May 17 May 22 May 27 May 31 Balance, May 31 May 1 May 1 May 7 May 29 May 31 Debit Balance Balance # 301 #302 #303 # 304 Checks $ 12,000 8,000 600 23,300 9,000 11,000 8,000 Required: 1. Prepare a bank reconciliation for May. Cash (A) 22,800 BANK STATEMENT Deposits $9,000 5,600 11,000 12,000 8,000 600 5,600 2,300 Interest earned. NSF check Service charge Credit # 301 May 2 #302 May 4 Other # 303 May 11 # 304 May 23 # 305 May 29 $ 220 380 110 Balance $ 23 300 32,300 20,300 12,300 23,300 22,700 22,920 22,540 16,940 16,830 16,830arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education