FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

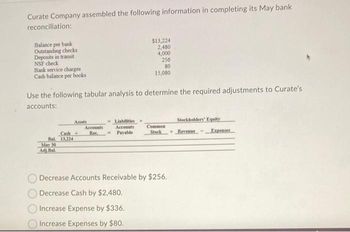

Transcribed Image Text:Curate Company assembled the following information in completing its May bank

reconciliation:

Balance per bank

Outstanding checks

Deposits in transit

NSF check

Bank service charges

Cash balance per books

Use the following tabular analysis to determine the required adjustments to Curate's

accounts:

Cash

Bal 13,224

May 30

Adj.Bal

Assets

Accounts

Rec

$13,224

2,480

4,000

256

80

15,080

Liabilities

Accounts

Payable

Common

Stock

Decrease Accounts Receivable by $256.

Decrease Cash by $2,480.

Increase Expense by $336.

Increase Expenses by $80.

Stockholders' Equity

+Revenue-

Expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please give me correct optionarrow_forwardThompson Corporation gathered the following reconciling information in preparing its October bank reconciliation: Line Item Description Amount Cash balance per bank, October 31 $15,554 Note receivable collected by bank 4,010 Outstanding checks 7,718 Deposits in transit 5,145 Bank service charge 140 NSF check 1,521 Determine the cash balance per the company’s records (before adjustments). a. $17,903 b. $10,632 c. $12,981 d. $15,330arrow_forwardBank Reconciliation The following data were accumulated for use in reconciling the bank account of Kaycee Sisters Inc. for August 20Y9: a. Cash balance according to the company's records at August 31, $28,730. b. Cash balance according to the bank statement at August 31, $30,200. c. Checks outstanding, $5,830. d. Deposit in transit, not recorded by bank, $4,680. e. A check for $590 in payment of an account was eroneously recorded by Kaycee Sisters Inc. as $950. f. Bank debit memo for service charges, $40. Prepare a bank reconciliation, using the format shown in Exhibit 12. Kaycee Sisters Inc. Bank Reconciliation August 31, 20Y9 Cash balance according to bank statement Adjusted balance Cash balance according to Kaycee Sisters Inc. $ Adjusted balancearrow_forward

- The following data were gathered to use in reconciling the bank account of Reddan Company: Line Item Description Amount Balance per bank $ 18,050 Balance per company records 10,220 Bank service charges 40 Deposit in transit 4,000 Note collected by bank with $150 interest 5,500 Outstanding checks 6,370 Question Content Area a. What is the adjusted balance on the bank reconciliation?fill in the blank 1 of 1$ Feedback Area Feedback Question Content Area b. Journalize any necessary entries for Photo Op. Company based on the bank reconciliation. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardJamison Company gathered the following reconciling information in preparing its June bank reconciliation. Cash balance per bank, June 30 $10,580 Note receivable collected by bank 5,781 8,771 3,495 127 1,779 Outstanding checks Deposits in transit Bank service charge NSF check Determine the cash balance per company records (before adjustment) on June 30. a. $9,179 b. $22,846 OC. $5,304 d. $1,429arrow_forwardGunnar Company gathered the following reconciling information in preparing its September bank reconciliation: Cash balance per books, 9/30 $3,120 Deposits in transit 369 Notes receivable and interest collected by bank 721 Bank charge for check printing 28 Outstanding checks 1,595 NSF check 106 Calculate the adjusted cash balance per books on September 30. a.$2,481. b.$2,587. c.$3,707. d.$1,894.arrow_forward

- From the give Problem 2, What is the adjusted cash in bank on December 31?arrow_forwardGunnar Company gathered the following reconciling information in preparing its September bank reconciliation: Line Item Description Amount Cash balance per company’s records, September 30 $3,019 Deposits in transit 450 Note receivable and interest collected by bank 895 Bank charge for check printing 31 Outstanding checks 1,286 NSF check 169 Determine the adjusted balance that would appear in the company section of the bank reconciliation on September 30. a. $3,047. b. $2,183. c. $2,878. d. $3,714.arrow_forwardBank Reconciliation Components ldentify the requested amount in each of the following situations: a. Howell Company's August 31 bank reconciliation shows deposits in transit of $3.400 The general ledger Cash in Bank account shows total cash receipts during September of $92.200. The September bank statement shows total cash deposits (and no credit memos) of $89.000. What amount of deposits in transit should appear in the September 30 bank reconciliation? b Wright Corporation's March 31 bank reconciliation shows deposits in transit of $2.600. The general ledger Cash in Bank account shows total cash receipts during April of S64 100. The April bank statement shows total cash deposits of S67200 (including $3,000. from the collection of a note: the note collection has not yet been recorded by Wright what amount of deposits in transit should appear in the April 30 bank reconciliation? Braddock Company's october 31 bank reconciliation shows outstanding checks of $3600.…arrow_forward

- The bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR [ Select ] ["Bank Service Charges", "Interest Expense", "Interest Income", "Bank Errors", "Cash"] [ Select ] ["$569", "$30", "$300", "$1,020", "$852"] CR [ Select ] ["Interest Expense", "Cash", "Bank Service Charges", "Interest Income", "Bank Errors"] [ Select ] ["$852", "$300", "$569", "$1,030", "$30"] and DR…arrow_forwardHelp with questionarrow_forwardPlease solve thearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education