FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

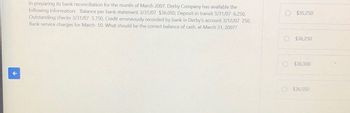

Transcribed Image Text:In preparing its bank reconciliation for the month of March 2007, Derby Company has available the

following information: Balance per bank statement 3/31/07 $36,050, Deposit in transit 3/31/07 6,250,

Outstanding checks 3/31/07 5,750, Credit erroneously recorded by bank in Derby's account 3/12/07 250,

Bank service charges for March 50. What should be the correct balance of cash, at March 31, 2007?

$35,250

O $36,250

$36,300

$36,550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1) On May 31, Money Corporation's Cash account showed a balance of $17,000 before the bank reconciliation was prepared. After examining the May bank statement and items included with it, the company's accountant found the following items : 1,950 Checks outstanding Deposits outstanding NSF check from a customer 3,700 170 Service fees 105 Error: Money Corporation wrote a check for $70 but recorded it incorrectly for $700. What is the amount of cash that should be reported in the company's balance sheet as of May 31?arrow_forwardNeed help with this Questionarrow_forwardThe following information was available to the accountant of Boots Company when preparing the monthly bank reconciliation: Outstanding cheques: #643 for $502 #651 for $43 Bank service charges $25 Deposits in transit $190 Interest received from bank $5 Customer cheque returned by bank as NSF $20 Cash balance per bank statement $975 Cash balance per books (prior to $660 reconciliation) The amount of cash that should appear on the Balance Sheet following completion of the reconciliation and adjustment of the accounting records is: Multiple Choice $660arrow_forwardMazaya company developed the following reconciling information in preparing it's June bank reconciliation: cash balance per bank, 6/30 $8,000; note receivable collected by bank 3,200; outstanding check 4,800; deposits in transit 2,400; Bank service charge 40; NSF check 640. Determine the cash balance per book (before adjustments) for mazaya company.arrow_forwardXYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on October 31 was $1,900. Some adjustments to this cash ledger balance were recorded on the Bank Reconciliation Report, as follows: • Bank service charge $55 NSF cheque: $375 • Cheque # 40 was correctly written and processed for $3,030 however the XYZ bookkeeper recorded the cheque amount for $3,300. What is the adjusted cash balance for October 31, for the Bank Reconciliation Report? Show your basic math.arrow_forwardShown below is the information needed to prepare a bank reconciliation for Alpha Communications at December 31, 2018: At December 31, cash per bank statement was $16,200; cash per the company’s records was $17,225. Two debit memoranda accompanied the bank statement: services charges for December of $25, and a $775 check drawn by Jane Jones marked “NSF”. Cash receipts of $9,000 on December 31 were deposited at the bank by end of day but were not shown in the bank statement until January 4. The following checks had been issued (written) in December but were not included among the paid checks returned by the bank: check no. 410 for $8,000 and check no. 425 for $2,500. Included in the bank statement was a check withdrawn (written) for an amount of $5,300 (rent expense) that was erroneously recorded for $3,500 in Alpha's records. The bank statement shows a credit (memorandum) interest of $75. Instructions Prepare a bank reconciliation at December 31, 2018. Prepare the…arrow_forwardprovide full solutionarrow_forwardQUESTION: ON OCTOBER 31, 2015, THE BANK STATEMENT FOR THE CHECKING ACCOUNT OF BLOCKWOOD VIDEO SHOWS A BALANCE OF $12,818, WHILE THE COMPANY S RECORDS SHOW A BALANCE OF $12,326. INFORMATION THAT MIGHT BE USEFUL IN PREPARING A BANK RECONCILIATION IS AS FOLLOWS: A. OUTSTANDING CHECKS ARE $1,225. B. THE OCTOBER 31 CASH RECEIPTS OF $780 ARE NOT DEPOSITED IN THE BANK UNTIL NOVEMBER 2. C. ONE CHECK WRITTEN IN PAYMENT OF UTILITIES FOR $136 IS CORRECTLY RECORDED BY THE BANK BUT IS RECORDED BY BLOCKWOOD AS DISBURSEMENT OF $163. D. IN ACCORDANCE WITH PRIOR AUTHORIZATION, THE BANK WITHDRAWS $449 DIRECTLY FROM THE CHECKING ACCOUNT AS PAYMENT ON A NOTE PAYABLE. THE INTEREST PORTION OF THAT PAYMENT IS $49 AND THE PRINCIPAL PORTION IS $400. BLOCKWOOD HAS NOT RECORDED THE DIRECT WITHDRAWAL. E. BANK SERVICE FEES OF $23 ARE LISTED ON THE BANK STATEMENT. F. A DEPOSIT OF $566 IS RECORDED BY THE BANK ON OCTOBER 13, BUT IT DID NOT BELONG TO BLOCKWOOD. THE DEPOSIT SHOULD HAVE BEEN MADE TO THE CHECKING ACCOUNT…arrow_forwardYou are auditing the cash in bank account of XXX Corporation as of December 31, 2021. Your examination revealed the following: From the bank statement: Balance, December 1, 2021 P 876,750 Deposits (20) 9,153,760 Checks (64) plus debit memos (8,524,300) Service charges for new checks 2,250) Balance, December 31, 2021 P 1,503,960 From the company's records: CASH Particulars Debit Particulars Credit Nov. 1 P 652,070 Nov. 30 CD P 6,654,410 Nov. 30 CR 6,824,290 Dec. 1 - bank reconciliation 38,400 Dec. 31 CR 9,198,720 Dec. 31 CD 8,574,610 CD – cash disbursements CR – cash receiptsarrow_forwardWhat is the cash shortage as of Dec 31?arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $6,788 Book balance: $6,228 Deposits in transit: $1,712 Outstanding checks: $569 and $1,623 Bank charges: $50 Bank incorrectly charged the account $50. The bank will correct the error next month. Check number 2456 correctly cleared the bank in the amount of $137 but posted in the accounting records as $317. This check was expensed to Utilities Expense. Bank Reconciliation Bank Statement Balance at (date) Add: Less: Adjusted Bank Balance Book Balance at (date) Add: Less: Adjusted Book Balancearrow_forward22.) The following information was included in the bank reconciliation for Bayside Company for October and November 2013: Checks and charges recorded by bank in November, including a November service charge of P4,000 and NSF check of P20,000 550,000 Service charge made by bank in October and recorded by depositor in November 2,000 Total credits to cash in all journals during November 620,000 Customer's NSF check returned in October and redeposited in November (no entry made by depositor in either October or November) 40,000 Outstanding checks on October 31,2013 that cleared in November 230,000 What is the amount of outstanding checks on November 30,2013? a 282.000 b. 300,000 c. 322,000 d. 302,000 23 Tam Companu providing the hank roconciliation on May31arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education