FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![Required Information

[The following Information applies to the questions displayed below.]

Chavez Company most recently reconciled Its bank statement and book balances of cash on August 31 and it reported

two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its

September 30 reconciliation.

From the September 30 Bank Statement

PREVIOUS BALANCE

TOTAL CHECKS AND DEBITS

TOTAL DEPOSITS AND CREDITS

CURRENT BALANCE

16,8ee.45

9,620.es

18,453.25

11,272.85

CHECKS AND DEBITS

DEPOSITS AND CREDITS

Date

Аmount

Date

No.

Amount

e9/03

5888

1,028.e5

719.90

09/05

1,103.75

2,226.90

4,e93.ee

09/04

5902

e9/12

09/07

5901

e9/21

1,824.25

09/17

6ee.25 NSF

e9/25

2,351.70

e9/20

5905

937.80

e9/30

12.50 IN

e9/22

5903

399.10

09/30

1,485.e0 CM

09/22

5984

2,e90.ee

e9/28

5907

213.85

09/29

5909

1,807.65

From Chavez Company's Accounting Records

Cash Receipts Deposited

Cash

Debit

Date

Sep. 5

1,103.7

2,226.90

4,e93.ee

2,351.70

1,682.75

12

21

25

30

11,458.10

Cash Disbursements

Check

Cash

Credit

No.

5901

1,824.25

59e2

719.90

5903

399.10

5984

2,860.ee

59e5

937.80

5986

982.30

59e7

213.85

388.00

5988

5909

1,807.65

9,332.05

Cash

Acct. No. 101

Explanation

Aug. 31 Balance

Date

Debit

Credit

Balance

PR

15,278.15

Total nocoin+r

R11

11 469 10

Son

16 736 16](https://content.bartleby.com/qna-images/question/4b868480-07f0-4513-b0e4-403d75e281f6/0a995550-8582-492d-b0e4-76d4ce41e721/j8c2dx6.png)

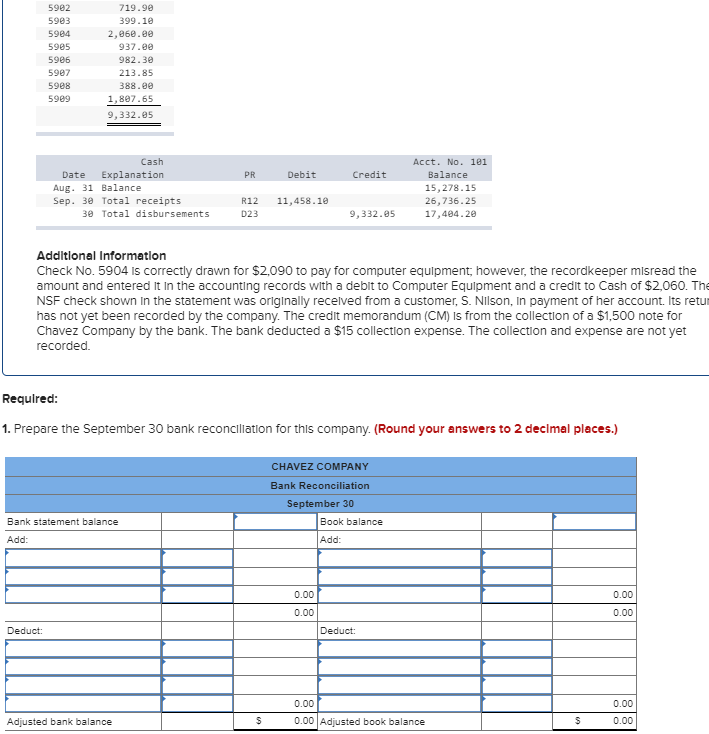

Transcribed Image Text:Required Information

[The following Information applies to the questions displayed below.]

Chavez Company most recently reconciled Its bank statement and book balances of cash on August 31 and it reported

two checks outstanding, No. 5888 for $1,028.05 and No. 5893 for $494.25. The following Information Is avallable for Its

September 30 reconciliation.

From the September 30 Bank Statement

PREVIOUS BALANCE

TOTAL CHECKS AND DEBITS

TOTAL DEPOSITS AND CREDITS

CURRENT BALANCE

16,8ee.45

9,620.es

18,453.25

11,272.85

CHECKS AND DEBITS

DEPOSITS AND CREDITS

Date

Аmount

Date

No.

Amount

e9/03

5888

1,028.e5

719.90

09/05

1,103.75

2,226.90

4,e93.ee

09/04

5902

e9/12

09/07

5901

e9/21

1,824.25

09/17

6ee.25 NSF

e9/25

2,351.70

e9/20

5905

937.80

e9/30

12.50 IN

e9/22

5903

399.10

09/30

1,485.e0 CM

09/22

5984

2,e90.ee

e9/28

5907

213.85

09/29

5909

1,807.65

From Chavez Company's Accounting Records

Cash Receipts Deposited

Cash

Debit

Date

Sep. 5

1,103.7

2,226.90

4,e93.ee

2,351.70

1,682.75

12

21

25

30

11,458.10

Cash Disbursements

Check

Cash

Credit

No.

5901

1,824.25

59e2

719.90

5903

399.10

5984

2,860.ee

59e5

937.80

5986

982.30

59e7

213.85

388.00

5988

5909

1,807.65

9,332.05

Cash

Acct. No. 101

Explanation

Aug. 31 Balance

Date

Debit

Credit

Balance

PR

15,278.15

Total nocoin+r

R11

11 469 10

Son

16 736 16

Transcribed Image Text:5902

719.90

5903

399.10

5904

2,060.ee

5905

937.00

982.30

5906

5907

213.85

59e8

388.ee

59e9

1,807.65

9,332.05

Cash

Acct. No. 101

Explanation

Aug. 31 Balance

Sep. 30 Total receipts

Date

PR

Debit

Credit

Balance

15,278.15

26,736.25

17,404.20

R12

11,458.10

30 Total disbursements

D23

9,332.05

Addltional Information

Check No. 5904 Is correctly drawn for $2,090 to pay for computer equlpment; however, the recordkeeper misread the

amount and entered It In the accounting records with a debit to Computer Equipment and a credit to Cash of $2,060. The

NSF check shown in the statement was originally recelved from a customer, S. Nilson, In payment of her account. Its retur

has not yet been recorded by the company. The credit memorandum (CM) Is from the collection of a $1,500 note for

Chavez Company by the bank. The bank deducted a $15 collection expense. The collection and expense are not yet

recorded

Required:

1. Prepare the September 30 bank reconcliation for this company. (Round your answers to 2 decimal places.)

CHAVEZ COMPANY

Bank Reconciliation

September 30

Bank statement balance

Book balance

Add:

Add:

0.00

0.00

0.00

0.00

Deduct

Deduct:

0.00

0.00

0.00 Adjusted book balance

0.00

Adjusted bank balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 22. Snickers Co. has the following information relating to its month-end reconciliation. Month-end bank statement balance $ 54,000 $ 18,000 $ 600 Check erroneously charged by the bank against the account $ 75 $ 25 Outstanding checks Deposit-in-transit Bank Service Charge The adjusted bank balance at month end is: a. $36,675. b. $71,325. c. $36,525. d. $35,475.arrow_forwardChavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, No. 5888 for $1,037 and No. 5893 for $502. Check No. 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation. From the September 30 Bank Statement PREVIOUS BALANCE TOTAL CHECKS AND DEBITS TOTAL DEPOSITS AND CREDITS CURRENT BALANCE 18,000 9,915 11,479 19,564 CHECKS AND DEBITS DEPOSITS AND CREDITS Date No. Amount Date Amount 09/03 09/04 09/07 09/17 09/20 09/22 09/22 09/28 09/29 1,037 781 09/05 09/12 09/21 09/25 09/30 09/30 1,163 2,228 4,012 2,368 18 IN 5888 5902 1,900 670 NSF 936 378 2,097 264 1,852 5901 5905 5903 5904 1,690 CM 5907 5909 From Chavez Company's Accounting Records Cash Receipts Deposited Cash Debit Date Sept. 5 12 1,163 2,228 4,012 2,368 1,660 21 25 30 11,431 Cash Payments Cash Check No. 5901 Credit 1,900 781 5902 5903 5904 378 2,054 936 1,034 264 391 1,852 5905 5906 5907…arrow_forwardonly 1d question photo thanks!arrow_forward

- Problem 8-12 (IAA) 31: Accounts receivable-unassigned Accounts receivable-assigned Allowance for doubtful accounts-January 1 Receivable from factor Note payable-bank 1,000,000 300,000 30,000 40,000 240,000 During the current year, the entity found itself in financial distress and decided to resort to receivable financing. On June 30, the entity factored P200,000 of accounts receivable to a finance entity. The finance entity charged a factoring fee of 5% of the accounts factored and withheld 20% of the amount factored. On December 31, the entity assigned P300,000 of accounts receivable to a bank under a nonnotification basis. The bank advanced 80% less a service fee of 5% of the accounts assigned. The entity signed a promissory note for the loan. On December 31, it is estimated that 5% of the outstanding accounts receivable may prove uncollectible. Required: 1. Prepare journal entry to record the factoring. 2. Prepare journal entry to record the assignment. 3. Prepare journal entry to…arrow_forwardbuisness k210 Google Docs canvas 0 work i ! Outlook Calendar A ALEKS Accounts Receivable $ 840,000 336,000 67,200 33,600 13,440 Required information Problem 7-3A (Algo) Aging accounts receivable and accounting for bad debts LO P2, P3 [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $16,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Affects Jarden's net income Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Saved Expected Percent New Tab ab Quickbooks Uncollectible 1.30% 2.05 6.55 33.00 69.00 Problem 7-3A (Algo) Part 3 3. On June 30 of the next year, Jarden concludes that a customer's $4,650 receivable is uncollectible and the account is written off. Does this write-off directly affect Jarden's net income?arrow_forwardOn May 2, 20X1, HPF Vacations received its April bank statement from First City Bank and Trust. Enclosed with the bank statement, which appears below, was a debit memorandum for $160 that covered an NSF check issued by Doris Fisher, a credit customer. The firm's checkbook contained the following information about deposits made and checks issued during April. The balance of the Cash account and the checkbook on April 30, 20X1, was $3,972. DATE TRANSACTIONS April 1 Balance 1 Check 1207 3 Check 1208 5 Deposit 5 Check 1209 $6,089 100 300 350 275 10 Check 1210 17 Check 1211 19 Deposit 2,000 50 150 22 Check 1212 23 Deposit 150 26 Check 1213 200 28 Check 1214 18 30 Check 1215 15 30 Deposit 200arrow_forward

- Rr.6.1arrow_forwardAfter Vaughn Company had completed all posting for the month of December, the sum of the balances in the following accounts payable subsidiary ledger did not agree with the balance of the control account in the general ledger. Name Ryker's Address 286 Buck Avenue Date Item Dec. 2 Name Geordie Company Address 818 Western Avenue Date Item Dec. 1 Balance 10 20 29 Name La Forge Company Address 90210 Baker Boulevard Date Item Dec. 1 Balance 18 29 Name Deanna Troi Address 2720 Sommers Avenue Date Item 27 Ref. Debit Credit Balance 3,400 3,400 P25 Ref. Debit Credit Balance 8,600 CP23 8,600 P32 G15 CP28 10,900 P34 900 Ref. Debit Credit Balance 10,900 P27 4,300 R33 4,300 11,600 5,200 Ref. Debit Credit Balance 7.000 7,000 9.000 700 14000arrow_forwardNext Question Find the credit-card sales less refunds for the Sales/Refund record for 09/24/10. 24/10 Sales Refunds ..... $71.86 $451.59 The credit-card sales less refunds for 09/24/10 is $ $76.53 $85.04 $149.72 $115.02 $81.45 $88.49 $30.75 $111.02 $229.23 $254.84 $162.81arrow_forward

- Practice Help Carrow_forwardBramble Stores accepts both its own and national credit cards. During the year, the following selected summary transactions occurred. Made Bramble credit card sales totaling $25,800. (There were no balances prior to January 15.) Made Visa credit card sales (service charge fee 2%) totaling $5,800. Collected $12,000 on Bramble credit card sales. Added finance charges of 1.5% to Bramble credit card account balances. Jan. 15 20 Feb. 10 15 Journalize the transactions for Bramble Stores. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date Jan 15 Jan. 20 Cash Debit Credit M Ç T 9 M Q Me Mu VI 65 Ac Q 59 Acearrow_forwardPlease Helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education