FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

This is an example in my textbook for

Transcribed Image Text:Chapter 13

Corporations: Organization, Stock Transactions, and Dividen

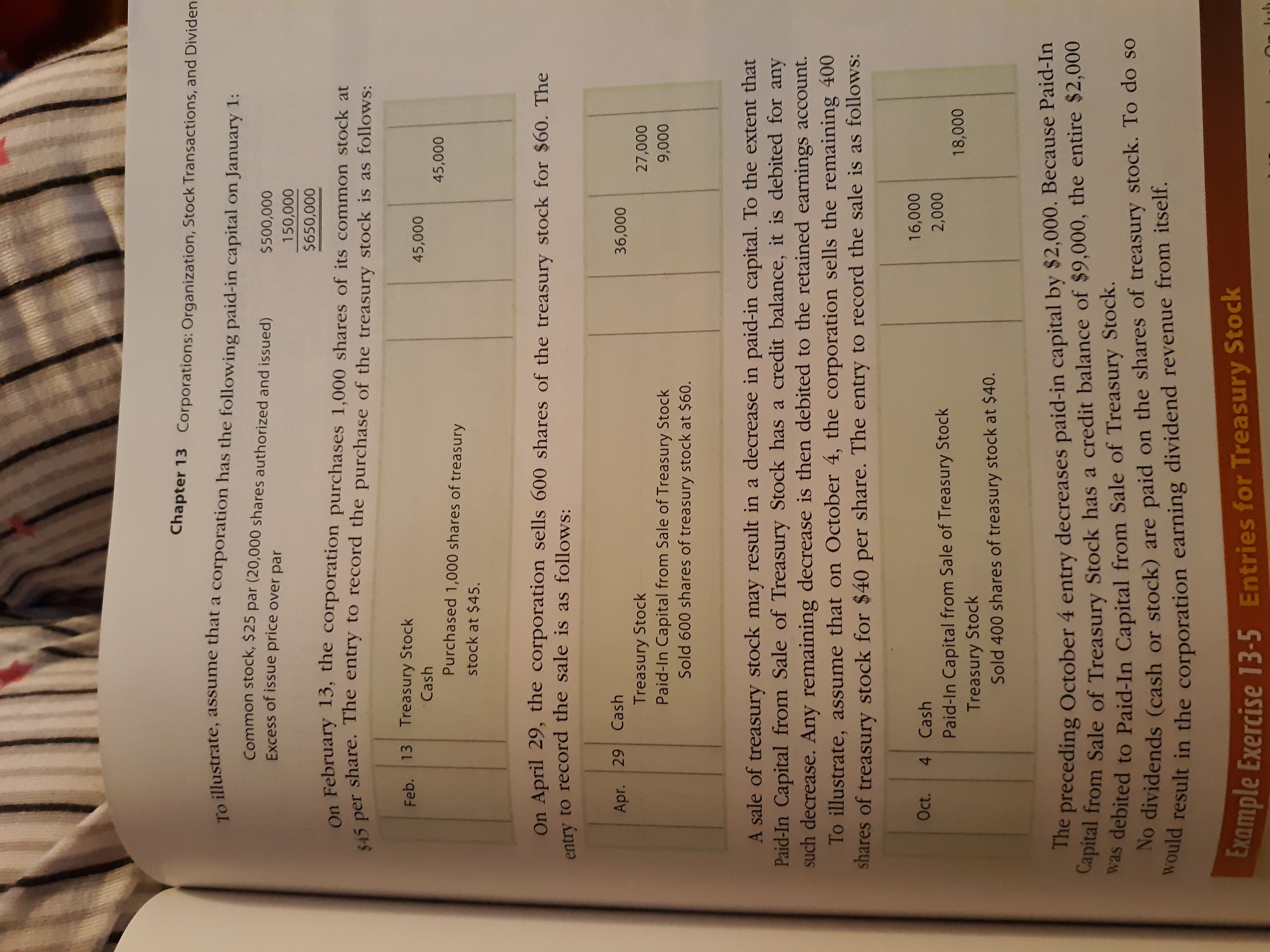

To illustrate, assume that a corporation has the following paid-in capital on January 1:

Common stock, $25 par (20,000 shares authorized and issued)

$500,000

Excess of issue price over par

150,000

$650,000

On February 13, the corporation purchases 1,000 shares of its common stock at

VE per share. The entry to record the purchase of the treasury stock is as follows:

13 Treasury Stock

Feb.

45,000

Cash

45,000

Purchased 1,000 shares of treasury

stock at $45.

On April 29, the corporation sells 600 shares of the treasury stock for $60. The

entry to record the sale is as follows:

Apr. 29 Cash

36,000

Treasury Stock

Paid-In Capital from Sale of Treasury Stock

Sold 600 shares of treasury stock at $60.

27,000

9,000

A sale of treasury stock may result in a decrease in paid-in capital. To the extent that

Paid-In Capital from Sale of Treasury Stock has a credit balance, it is debited for any

such decrease. Any remaining decrease is then debited to the retained earnings account.

To illustrate, assume that on October 4, the corporation sells the remaining 400

shares of treasury stock for $40 per share. The entry to record the sale is as follows:

16,000

Oct.

4 Cash

2,000

Paid-In Capital from Sale of Treasury Stock

Treasury Stock

Sold 400 shares of treasury stock at $40.

18,000

preceding October 4 entry decreases paid-in capital by $2,000. Because Paid-In

Capital from Sale of Treasury Stock has a credit balance of $9,000, the entire $2,000

as debited to Paid-In Capital from Sale of Treasury Stock.

No dividends (cash or stock) are paid on the shares of treasury stock. To do so

would result in the corporation earning dividend revenue from itself.

Example Exercise 13-5

Entries for Treasury Stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Climate Control Systems Co. offers its services to residents in the Spokane area. Selected accounts from the ledger of Climate Control Systems for the fiscal year ended December 31, 20Y2, are as follows: Prepare a statement of stockholders' equity for the year.arrow_forwardI'm having difficulty with this question, by getting the rest of the values from the given prices, as well as understanding where to place some of the prices.arrow_forwardHow do I solve this?arrow_forward

- Scenario: It's 12/31 and I'm doing financial statement accounting adjustments. On October 1st, my company borrowed $25,000 from the a bank involving a 1-year, 12% note payable. Principal ands interest are due after 1 year. On the Balance Sheet, I thought the Liabilities and Stocholders Equity would be $7k and -$7k, respectively, but that's not correct. I figured for the Income Statement, the Expenses and Net Income would be $7k and -$7k, respectively. That also isn't correct. The categories are correct, but my $ figures aren't. Could someone please help.arrow_forwardCan you help me? Prepare an income statement for the year ended December 31, 20Y5. Answer Check Figure: Net income, $137,400 Prepare a statement of stockholders’ equity for the year ended December 31, 20Y5. During the year, common stock of $25,000 was issued. Prepare a balance sheet as of December 31, 20Y5. Based upon the end-of-period spreadsheet, journalize the closing entries. Prepare a post-closing trial balancearrow_forward. 7 Mutual funds and individual stocks sometimes have graphs like the one shown below. AMZN (NASDAQ) February 12, 2012-February 12, 2013 299.81 272.39 24497 21755 10271 $191.59 +2012 OF 2012 Source: Microsoft Finance February 12, 2013. Markel data by Morningstar. $284.72 $257.21 a. How would you describe the pattern of change in the price of one share of Amazon.com stock over the one-year period shown? b. Estimate the equivalent simple annual interest rate earned on a share of Amazon stock purchased on February 12, 2012. c. Suppose you had purchased 100 shares of Amazon stock on February 12, 2012 and sold it at the highest value of the stock during the year that followed. What equivalent simple annual interest rate would you have earned? What would be the profit on your investment? €arrow_forward

- The right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the sum of what the initial stockholders paid when they bought company shares and the earnings that the company has retained over the years. Equity is the difference between the paid-in capital and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $136 million. Last year, the company reported a retained earnings balance of $459 million, whereas this year it increased to $540 million. How much was paid out in dividends this year? $4 million $217 million $55 million $280 millionarrow_forwardA company's financial statements include the following selected data ($ in millions): Sales, $22,600; Net income, $900; Beginning stockholders' equity, $3,540; Ending stockholders' equity, $4,200.Calculate the return on equity. (Round your answer to 1 decimal place.) Return on equity: _________%arrow_forward1 Assume an investor deposits $115,332 in a professionally managed account. One year later, the account has grown in value to $147,367 and the investor withdraws $44,209. At the end of the second year, the account value is $91,455. No other additions or withdrawals were made. Calculate holding period return during year 2. Round the answer to two decimals in percentage form. Please write % sign in the units box. Your Answer: 2 Assume an investor deposits $118,152 in a professionally managed account. One year later, the account has grown in value to $149,976 and the investor withdraws $42,343. At the end of the second year, the account value is $91,322. No other additions or withdrawals were made. Calculate holding period return during year 2. Round the answer to two decimals in percentage form. Please write % sign in the units box. Answer:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education