Concept explainers

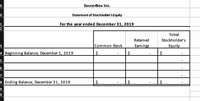

Using the data provided, produce the statemtn of

On December 1, 2019, SoccerBox Inc. started operations. The following transactions occurred during December 2019.

NOTE: There are no beginning balances-this is a new company.

| Dec 1 |

Randol Espy invested $80,000 cash in the company for common stock. |

| 2 |

SoccerBox purchased soccer equipment for $20,000 cash. |

| 2 |

SoccerBox rented an old warehouse for $30,000 cash for the first year's (December 2019-November 2020) rent. |

| 3 |

SoccerBox purchased $500 of office supplies with cash. |

| 10 |

SoccerBox paid $12,000 cash for an annual insurance policy. |

| 14 |

SoccerBox paid $4,000 cash for the first payroll earned by its employees. |

| 24 |

SoccerBox received $85,000 cash from soccer fees paid by parents for a private youth soccer lesson. |

| 28 |

SoccerBox paid $4,000 cash for 2 weeks' salaries earned by its employees. |

| 29 |

SoccerBox paid $200 cash for minor repairs to its soccer equipment. |

| 30 |

SoccerBox paid $150 cash for this month's telephone bill. |

| 30 |

Dividends of $1,000 cash were paid by SoccerBox to its current shareholders. |

what would the statement of stockholders equity be in the following chart attached?

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- dont uplode any imagesarrow_forwardPlease show the solution in good accounting form. 8. How much is the total shareholders' equity at year-end?arrow_forwardCypress Corp. went into business on October 1, 2020. Cypress had the following transactions during 2020: Oct. 1 - Issued a total of 20 shares of stock to two stockholders for a total of $6,00O. • Oct. 1 - Borrowed $20,000 from the bank. No payments will be made on this loan until October 1, 2022, when $24,000 will be due. Oct. 12 - Purchased land for $8,000 in cash. • Nov. 1 - Purchased equipment for $12,000 in cash. The equipment is expected to last for four years with no salvage value. • Nov. 15 - Purchased $5,000 inventory, half in cash and half on account. • Dec. 1 - Purchased six months of insurance for $1,200. Dec. 10 - Sold $2,000 of inventory for $4,500 in cash. • Dec. 12 - Sold one-half of land for $5,000 in cash. Dec. 13 - Paid balance owed on accounts payable. Dec. 18 - Sold $1,500 of inventory for $2,500 on account. • Dec. 31 - Paid $1,000 in dividends. What were the net operating cash flows for Cypress during 2020? O $3,300 $800 O ($600) O ($1,700) None of the abovearrow_forward

- answer in text form please (without image)arrow_forwardPlease help me with this homework question in the screenshot.arrow_forwardSilowing is selected financial information for Osmond Dental Laboratories for 2021 and 2022: 2021 2022 Retained earnings, January 1 $57,000 35,000 42,000 10,000 20,000 75,000 Net income Dividends Common stock ? Osmond issued 4,000 shares of additional common stock in 2022 for $27,000. There were no other stock transactions. Prepare a statement of stockholders' equity for the year ended December 31, 2022. (Amounts to be deducted should be indicated with minus sign.) OSMOND DENTAL LABORATORIES Statement of Stockholders' Equity For the Year Ended December 31, 2022 Total Stockholders' Common Retained Stock Earnings Equity Balance, January 1, 2022 Balance, December 31, 2022arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education