FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Can you help me?

-

Prepare an income statement for the year ended December 31, 20Y5.

AnswerCheck Figure: Net income, $137,400

-

Prepare a statement of

stockholders’ equity for the year ended December 31, 20Y5. During the year, common stock of $25,000 was issued. -

Prepare a

balance sheet as of December 31, 20Y5. -

Based upon the end-of-period spreadsheet, journalize the closing entries.

-

Prepare a post-closing

trial balance

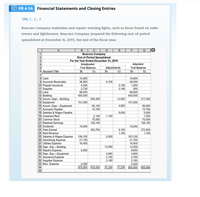

Transcribed Image Text:PR 4-1A Financial Statements and Closing Entries

Obj. 1, 2, 3

Beacons Company maintains and repairs warning lights, such as those found on radio

towers and lighthouses. Beacons Company prepared the following end-of-period

spreadsheet at December 31, 20Y5, the end of the fiscal year:

c | D | E |

B

Beacons Company

End-of-Period Spreadsheet

A

G

1

For the Year Ended December 31, 20Y5

Unadjusted

Trial Balance

Adjusted

Trial Balance

4

Adjustments

6 Account Title

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

7

10,800

38,900

8 Cash

9 Accounts Receivable

10 Prepaid Insurance

11 Supplies

12 Land

13 Building

14 Accum. Depr.Building

15 Equipment

16 Accum. Depr.-Equipment

17 Accounts Payable

18 Salaries & Wages Payable

19 Uneamed Rent

20 Common Stock

21 Retained Earnings

22 Dividends

23 Fees Eamed

24 Rent Revenue

25 Salaries & Wages Expense

26 Advertising Expense

27 Utlities Expense

28 Depr. Exp.-Building

29 Repairs Expense

30 Depr. Exp.-Equipment

31 Insurance Expense

32 Supplies Expense

33 Misc. Expense

10,800

9,100

4,200

2,730

98,000

48,000

1,050

550

98,000

3,150

2,180

400,000

400,000

205,300

12,000

217,300

101,000

101,000

85, 100

15,700

4,800

89,900

15,700

5,000

1,000

75,000

5,000

2,100

1,100

75,000

128,100

128,100

10,000

10,000

9,100

1,100

372,800

1,100

363,700

158, 100

5,000

163,100

21,700

21,700

16,400

16,400

12,000

12,000

8,850

4,800

3,150

2,180

8,850

4,800

3,150

2,180

4,320

875.000 875.000

4,320

37,330 905,900 905.900

34

37,330

35

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would I prepare the statement of stockholder's equity?arrow_forwardYear-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Current Year 1 Year Ago 2 Years Ago $ 26,725 77,457 $ 31,858 95,459 8,436 240,403 30,967 41,290 43,529 52,503 73,671 8,200 220,389 3,372 193,642 $ 312,800 $ 42,115 69,129 162,500 Machinery, net Total assets $ 448,480 $ 386,621 Liabilities and Equity Accounts payable $ 110,555 Long-term notes payable 83,471 $ 65,992 88,034 Common stock 162,500 Retained earnings 91,954 162,500 70,095 39,056 Total liabilities and equity $ 448,480 $ 386,621 $ 312,800 Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago. Current Year 1 Year Ago Times Interest Earned Choose Numerator: / Choose Denominator: I II 11 Times interest earned times timesarrow_forwardClimate Control Systems Co. offers its services to residents in the Spokane area. Selected accounts from the ledger of Climate Control Systems for the fiscal year ended December 31, 20Y2, are as follows: Prepare a statement of stockholders' equity for the year.arrow_forward

- How do I solve this?arrow_forwardA summary of selected transactions in ledger accounts appears below for Alberto’s Plumbing Services for the current calendar year-end. Common Stock 1/1 6,870 Retained Earnings 12/31 7,608 12/31 21,781 Dividends 3/30 2,402 12/31 7,608 9/30 5,206 Net income for the period isarrow_forwardThe right side of the balance sheet shows the firm’s liabilities and stockholders’ equity. Which of the following best describes shareholders’ equity? Equity is the sum of what the initial stockholders paid when they bought company shares and the earnings that the company has retained over the years. Equity is the difference between the paid-in capital and retained earnings. NOW Inc. released its annual results and financial statements. Grace is reading the summary in the business pages of today’s paper. In its annual report this year, NOW Inc. reported a net income of $136 million. Last year, the company reported a retained earnings balance of $459 million, whereas this year it increased to $540 million. How much was paid out in dividends this year? $4 million $217 million $55 million $280 millionarrow_forward

- 1 Assume an investor deposits $115,332 in a professionally managed account. One year later, the account has grown in value to $147,367 and the investor withdraws $44,209. At the end of the second year, the account value is $91,455. No other additions or withdrawals were made. Calculate holding period return during year 2. Round the answer to two decimals in percentage form. Please write % sign in the units box. Your Answer: 2 Assume an investor deposits $118,152 in a professionally managed account. One year later, the account has grown in value to $149,976 and the investor withdraws $42,343. At the end of the second year, the account value is $91,322. No other additions or withdrawals were made. Calculate holding period return during year 2. Round the answer to two decimals in percentage form. Please write % sign in the units box. Answer:arrow_forwardpresented below is an alphabetical list of of account balances take from the looks of an entity at the end of the current period, dec 31: accounts payable 125,000 accrued expenses 47,000 cash surrender value on life insurance 29,000 dividends, ordinary shares 100,000 dividends, preference shares 150,000 mortgage payable (including 200,000 due in six months) 1,200,000 note payable (not due within 12 months)1,500,000 premium on notes payable 25,000 profit and loss summary - credit balance 500,000 retained earning January 1 550,000 share capital- ordinary, 100 par 1,000,000 share capital - preference, 200 par 450,000 share premium - ordinary 250,000 unamortized issue cost on note payable 25,000 unearned rent income 33,000 what is the retained earnings balance on December 31?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education