FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

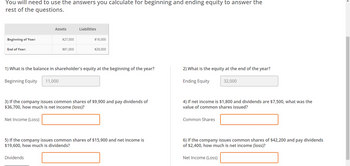

Transcribed Image Text:You will need to use the answers you calculate for beginning and ending equity to answer the

rest of the questions.

Beginning of Year:

End of Year:

Assets

Net Income (Loss)

$27,000

$61,000

Dividends

Liabilities

$16,000

1) What is the balance in shareholder's equity at the beginning of the year?

Beginning Equity 11,000

$29,000

3) If the company issues common shares of $9,900 and pay dividends of

$36,700, how much is net income (loss)?

5) If the company issues common shares of $15,900 and net income is

$19,600, how much is dividends?

2) What is the equity at the end of the year?

Ending Equity

4) If net income is $1,800 and dividends are $7,500, what was the

value of common shares issued?

Common Shares

32,000

6) If the company issues common shares of $42,200 and pay dividends

of $2,400, how much is net income (loss)?

Net Income (Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- How to find the outstanding comon shares? This statement is correct. The per-share book value is calculated by dividing the company’s total common equity by the number of outstanding shares of common stock. The book value per share of Blue Hamster Manufacturing Inc.’s stock is the accounting value of assets that the company’s common shareholders would receive if the company was liquidated. It is listed as total common equity on the balance sheet (total assets minus total debt) and is calculated by dividing the value of total common equity by the outstanding shares. In this case, $32,813 million / 50 million shares = $656.26 per share.arrow_forwardPlease help mearrow_forwardWhat is the earnings per share if the net income is $1,019.20 and the shares outstanding are 1,032,271.arrow_forward

- Required: Calculate the 11 missing amounts. (Loss should be indicated by a minus sign.)Except for the earnings per share statistics, the 2022, 2023, and 2024 income statements for Ace Group Inc. were originally presented as follows: Required: 1. Calculate the 11 missing amounts. (Loss should be indicated by a minus sign.) Calculate the weighted-average number of common shares outstanding during the following years: (Do not round intermediate calculations. Round your answers to nearest whole number.) 3. Prepare the earnings per share income statement presentation during the following years: (Round your answers to 2 decimal places. Negative amounts should be indicated by a minus sign.)arrow_forwardThe balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share×total shares outstanding) of $1,332,000. Furthermore, the firm's income statement for the year just ended has a net income of $523,000, which is $0.251 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 21.18. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares?arrow_forwardBelow is the financial data for Arla Inc. for the year ended December 31, 2020: Market price per share... Net Income...... $150.00 $1,750,000 Preferred Dividends declared... $75,000 Average # of common shares....... Dividends per share...... Average common shareholders' equity..... Total assets..... Total Liabilities... Accumulated Other Comprehensive Income..... 100,000 $2.50 10,000,000 $22,500,000 $11,675,000 $185,000 Instructions Calculate the Return on shareholders' equity (use up to 2 decimal places and do not include a % sign)arrow_forward

- What is the equity multiplier if the total assets are $9,878.20 and total shareholder equity is $6,230.20?arrow_forwardThe following table shows your stock positions at the beginning of the year, the dividends that each stock paid during the year, and the stock prices at the end of the year. Company US Bank PepsiCo JDS Uniphase Duke Energy Shares 200 100 300 100 Beginning of Year Price $ 43.60 59.18 18.98 27.50 Dividend Per End of Year Price Share $ 2.07 1.18 1.27 $ 43.53 62.65 16.76 33.26 What is your portfolio dollar return and percentage return? Note: Do not round intermediate calculations and round your final answer to 2 decimal places.arrow_forwardE2.8 (LO 2) (Calculate ratios and evaluate profitability.) The following informat Saputo Inc. for the year ended March 31 (in millions, except share price): Income available for common shareholders Weighted average number of common shares Share price 2021 $625.6 409.8 $37.79 2020 $582.8 400.3 $33.84 Instructions a. Calculate the basic earnings per share and price-earnings ratio for each year. b. Based on your calculations above, how did the company's profitability change from 2020 to 2021? c. When income rose, did the share price increase? How does this affect the price-earnings ratio? d. Do you think investors are more or less optimistic about the company's profitability in the future? OC €arrow_forward

- I need help with this question to understand the topicarrow_forwardcompanys current balance sheet shows total common equity of $5,295,000. The company has 350,000 shares of stock outstanding, and they sell at a price of $27.50 per share. By how much do the firm's market and book values per share differ? (Round your intermediate and final answers to two decimal places.)arrow_forwardgiven the following data for the cheyenne company: current liabilities 602; long-term debt 630; common stock 858; retained earnings 1210; total liabilities & stockholders' equity 3300. how would common stock apprear on a common size balance sheet?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education