FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:n

1

2

3

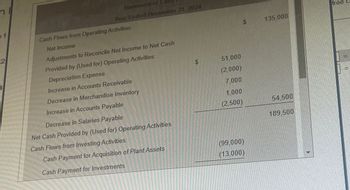

Statement of

Year Ended December 31, 2024

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to Net Cash

Provided by (Used for) Operating Activities:

Depreciation Expense

Increase in Accounts Receivable

Decrease in Merchandise Inventory

Increase in Accounts Payable

Decrease in Salaries Payable

Net Cash Provided by (Used for) Operating Activities

Cash Flows from Investing Activities:

Cash Payment for Acquisition of Plant Assets

Cash Payment for Investments

$

51,000

(2,000)

7,000

1,000

(2,500)

$

(99,000)

(13,000)

135,000

54,500

189.500

free C

PRETTY

Transcribed Image Text:F:14

r

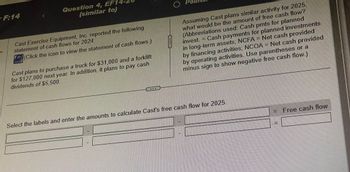

Question 4, EF14

(similar to)

Cast Exercise Equipment, Inc. reported the following

statement of cash flows for 2024:

(Click the icon to view the statement of cash flows.)

Cast plans to purchase a truck for $31,000 and a forklift

for $127,000 next year. In addition, it plans to pay cash

dividends of $5,500.

O Po

lan

Assuming Cast plans similar activity for 2025.

what would be the amount of free cash flow?

(Abbreviations used: Cash pmts for planned

Cash payments for planned investments

invest. =

in long-term assets; NCFA = Net cash provided

by financing activities; NCOA = Net cash provided

by operating activities. Use parentheses or a

minus sign to show negative free cash flow.)

Select the labels and enter the amounts to calculate Cast's free cash flow for 2025.

= Free cash flow

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine External Funds Needed (EFN) and how it may be financed.arrow_forwardPlease help.arrow_forwardSuppose Gulf Shipping Company had the following results related to cash flows for 2019: Net Income of $5,300,000 Adjustments from Operating Activities of -$500,000 Net Cash Flow from Investing Activities of -$700,000 Net Cash Flow from Financing Activities of $3,200,000 Create a statement of cash flows with amounts in thousands. What is the Net Cash Flow? Note: Financial results are provided in dollars but the income statement units are thousands of dollars. Please specify your answer in the same units as the statement of cash flows (i.e., enter the number from your completed statement of cash flows).arrow_forward

- Hampton Industries had $68,000 in cash at year-end 2020 and $16,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$100,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. b. If accruals increased by $35,000, receivables and inventories increased by $195,000, and depreciation and amortization totaled $13,000, what was the firm's net income?arrow_forwardAs a financial analyst, you have been tasked with evaluating Randy Watson Music's free cash flow. Based on the 2022 income statement, EBIT was $41 million, the tax rate was 21 percent, and its depreciation expense was $6 million. NOPAT gross fixed assets increased by $28 million from 2021 and 2022. The company's current assets increased by $18 million and current liabilities increased by $14 million. Calculate the operating cash flow (OCF) for 2022. (Enter your answer in millions of dollars.)arrow_forwardReview the CFLO from operations for Q1 2022 for GE (link below) and answer the following: Make sure you expand the cashflow from continuing operations link to see the details. https://finance.yahoo.com/quote/GE/cash-flow?p=GE (Links to an external site.) 4. Why is depreciation added back in the statement of cashlfow?arrow_forward

- Cash Flow From AssetsIf your corporation's operating cash flow for 2020 is $7,300, net capital spending is $3,500, and your change in net working capital is $1,600, what is your 2020 cash flow from assets? Please show your formula and calculations in the space provided.arrow_forwardHampton Industries had $44,000 in cash at year-end 2020 and $27,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$150,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. b. If accruals increased by $50,000, receivables and inventories increased by $125,000, and depreciation and amortization totaled $73,000, what was the firm's net income?arrow_forwardGiven the following data for Year 1: Earnings before Interest and Tax = $11 million; Interests = $3 million, Taxes = $2 million; Depreciation = $4 million; Investment in fixed assets = 5 million; Investment net working capital = $1 million. Calculate the free cash flow (FCF) for Year 1: Group of answer choices $8 million $9 million $6 million $7 millionarrow_forward

- Company ABC is preparing its 2021 financial statements. At the end of 2021, the company purchased a building for $500,000 making a down payment of $200,000 cash and signing a $300,000 mortgage note. The president of Company ABC, Jackie Brown understand that debt transactions are considered a financing activity from a business perspective and also, that purchases of long-term assets are investing activities. Summarize how this transaction is to be reported on the State of Cash Flows using the related GAAP. Required: - What are the issues of the given case? List them. - Show how the transaction is to be recorded on the statement of cash flows (Journal entries). - Give an example of the disclousure required for the particular items . - Give your reasoning/support based on guidance from the codification.arrow_forwardABC Corporation had the following information for the year 2022: Cash collected from customers: $300,000 Cash paid to suppliers: $150,000 Cash paid for operating expenses: $50,000 Cash paid for interest expense: $10,000 Cash paid for income taxes: $20,000 Calculate the net cash flow from operating activities.arrow_forwardDetermine the cash fixed costs which are used when calculating EBDAT:Administrative expenses = $100, 000; Rent expenses = $70,000;Depreciation expenses = $50,000; and Interest expenses = $20,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education