FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

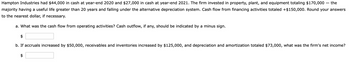

Transcribed Image Text:Hampton Industries had $44,000 in cash at year-end 2020 and $27,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the

majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$150,000. Round your answers

to the nearest dollar, if necessary.

a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign.

b. If accruals increased by $50,000, receivables and inventories increased by $125,000, and depreciation and amortization totaled $73,000, what was the firm's net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Atkins Corporation has provided the following information for the year ended December 31, 2019:• The equipment account balance increased $200,000.• The equipment accumulated depreciation account increased $35,000.• Equipment costing $50,000 was sold during the year resulting in a $10,000 gain.• Depreciation expense on the equipment recorded during the year was $65,000. Which of the following statements is incorrect with respect to preparation of the statement of cash flows? Assume that the equipment purchase and sale resulted in cash flows. A. A $60,000 cash inflow is reported from the equipment sale. B. Using the indirect method, net income is increased by the $65,000 depreciation expense. C. Using the indirect method, net income is decreased by the $10,000 gain on the sale of the equipment. D. A $30,000 cash inflow is reported from the equipment sale.arrow_forwardHampton Industries had $68,000 in cash at year-end 2020 and $16,000 in cash at year-end 2021. The firm invested in property, plant, and equipment totaling $170,000 - the majority having a useful life greater than 20 years and falling under the alternative depreciation system. Cash flow from financing activities totaled +$100,000. Round your answers to the nearest dollar, if necessary. a. What was the cash flow from operating activities? Cash outflow, if any, should be indicated by a minus sign. b. If accruals increased by $35,000, receivables and inventories increased by $195,000, and depreciation and amortization totaled $13,000, what was the firm's net income?arrow_forwardFinance is Fun, Inc recently reported net income of $4.2 million, depreciation of $750,000, and amortization of $100,000. What was its net cash flow?arrow_forward

- Sweeter Enterprises Inc. has net cash flows from operating activities of $378,000. Cash flows used for investments in property, plant, and equipment totaled $76,000, of which 65% of this investment was used to replace existing capacity. a. Determine the free cash flow for Sweeter Enterprises Inc. b. How might a lender use free cash flow to determine whether or not to give Sweeter Enterprises Inc. a loan? Free cash flow is often used to measure the financial strength of a business. The - free cash flow that a business has, the easier it will be for the company to pay the interest on the loan and repay the loan principal. Sweeter's free cash flow is $ which is veryarrow_forwardReview the CFLO from operations for Q1 2022 for GE (link below) and answer the following: Make sure you expand the cashflow from continuing operations link to see the details. https://finance.yahoo.com/quote/GE/cash-flow?p=GE (Links to an external site.) 4. Why is depreciation added back in the statement of cashlfow?arrow_forwardUse the following company information to calculate net cash provided or used by investing activities. (a) Long-term investments were sold for $51,000 cash, yielding a gain of $22,150. (b) Paid $72,000 cash for new machinery. (c) Sold land costing $34,000 for $40,000 cash, yielding a $6,000 gain. (d) Equipment with a book value of $195,000 and an original cost of $320,000 was sold at a loss of $27,000. Statement of Cash Flows (partial) Cash flows from investing activitiesarrow_forward

- 8arrow_forwardQuestion 30: Match each form to its purpose. SS-4 Used to obtain a Social Security number DROP HERE W-4 Provides information to calculate income tax withholding DROP HERE SS-5 Used to obtain an Employer Identification Number DROP HERE 1-9 Verifies employment eligibility DROP HERE Question 12: Which of these is a credit reduction state/territory? Question 15: Union dues are considered a deduction. Answer: Answer: A. O Connecticut A. O cafeteria B. O Ohio B. O insurance C. O Virginia C. O mandatory D. O U.S. Virgin Islands D. O voluntary Question 14: Alejandra owns and operates an appliance store where employees clock in and out for each shift. Per the FLSA, Alejandra rounds employee time worked to the nearest 15-minute increment. On Tuesday this week, Stanley works 4 hours and 9 minutes in the morning and 3 hours and 11 minutes in the afternoon. How does Alejandra record Stanley's time? Answer: A. O 7 hours B. O 7 hours and 15 minutes C. O 7 hours and 20 minutes D. O 7 hours and 30…arrow_forwardRenew Life Industries has an EBIT of $28 million, depreciation of $3 million and a tax rate of 38%. Renew Life invests $8 million in fixed assets and $13 million to increase current assets. Accounts payable is expected to increase by $3 million, accruals total $2 million, and liabilities increase to $6 million. Determine the available cash flow.arrow_forward

- Make sure you provide complete answers, and show your work with calculation problems Given the following information, calculate the Net Free Cash Flow. Net income = $25,000; Capital expenditures = $4,000; Cash dividends paid to shareholders = $2,500; Repayment of Long-term debt = $1,500; Depreciation, Depletion & Amortization = $5,000; Increase in current assets = $250; Increase in current liabilities = $750;arrow_forwardPlease see below. I really need help with this asap. Please include relevant terms and dates as needed.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education