FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

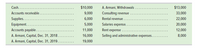

As of December 31, 2019, Armani Company’s financial records show the following items and amounts. Prepare the 2019 year-end income statement for Armani Company.

Transcribed Image Text:Cash.......

$10,000

A. Armani, Withdrawals

$13,000

Accounts receivable.

9,000

Consulting revenue

Rental revenue..

33,000

Supplies...

6,000

22,000

Equipment..

5,000

Salaries expense.

20,000

Accounts payable .

11,000

Rent expense

12,000

A. Armani, Capital, Dec. 31, 2018.

16,000

Selling and administrative expenses.

8,000

A. Armani, Capital, Dec. 31, 2019.

19,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The financial statements of Dandy Distributors Ltd. are shown on the "Fcl. Stmts." page. 1 Based on Dandy's financial statements, calculate ratios for the year ended December 31, 2020. Assume all sales are on credit. Show your work. 2 From these ratios, analyze the financial performance of Dandy.arrow_forwardUse the following selected data from Business Solutions's income statement for the three months ended March 31, 2022, and from its March 31, 2022, balance sheet to complete the requirements. Computer services revenue $ 25, 364 Net sales (of goods) 18, 138 Total sales and revenue 43, 502 Cost of goods sold 15, 644 Net income 19, 551 Quick assets 90, 356 Current assets 97, 288 Total assets 121, 816 Current liabilities 820 Total liabilities 820 Total equity 120, 996 Required: Compute the gross margin ratio (both with and without services revenue) and net profit margin ratio. Compute the current ratio and acid - test ratio. Compute the debt ratio and equity ratio. What percent of its assets are current? What percent are long term?arrow_forwardThe following is a partial trial balance for the Green Star Corporation as of December 31, 2021: Account Title Sales revenue Debits Credits 2,050,000 48,000 68,000 Interest revenue Gain on sale of investments Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense 870,000 250, 000 93,000 58,000 148,000 There were 150,000 shares of common stock outstanding throughout 2021. Required: 1. Prepare a single-step income statement for 2021, including EPS disclosures. 2. Prepare a multiple-step income statement for 2021, including EPS disclosures. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a multiple-step Income statement for 2021, including EPS disclosures. (Amounts to be deducted should be Indicated with a minus sign. Round EPS answer to 2 decimal places.) GREEN STAR CORPORATION Income Statement For the Year Ended December 31, 2021arrow_forward

- F. Based on Baker’s account balances, the amount of Net Income that would be shown on Baker’s Income Statement for December 2017 would be:arrow_forwarda,b, and c pleasearrow_forwardGranite, Incorporated is the largest uniform supplier in North America. Selected information from its annual report follows. For the 2019 fiscal year, the company reported sales revenue of $6.1 billion and Cost of Goods Sold of $4.3 billion. Fiscal Year Balance Sheet (amounts in millions) Cash and Cash Equivalents Accounts Receivable, Net Inventory Prepaid Rent and Other Current Assets Accounts Payable Salaries and Wages Payable Notes Payable (short-term) Other Current Liabilities 2019 Current Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio $ 540 860 330 795 210 520 116 28 2018 $430 810 340 660 190 520 28 320 Required: Assuming that all sales are on credit, compute the following ratios for 2019. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places.arrow_forward

- Selected information from Bigg Company's financial statements follows: Fiscal Year Ended December 31 2019 2018(in thousands) 2017 Gross sales $2,004,719 $1,937,021 $1,835,987 Less: Sales discounts 4,811 4,649 4,406 Less: Sales returns and allowances 2,406 2,324 2,203 Net sales $1,997,502 $1,930,048 $1,829,378 Cost of goods sold 621,463 619,847 660,955 Gross profit $1,376,039 $1,310,201 $1,168,423 Operating expenses 577,369 595,226 583,555 Operating income $798,670 $714,975 $584,868 Other income (expenses) 15,973 (6,140) (8,773) Net income $814,643 $708,835 $576,095 At December 31 2019 2018(in thousands) 2017 Accounts receivable $201,290 $195,427 $182,642 Less: Allowance for doubtful accounts 2,516 2,736 2,192 Net accounts receivable $198,774 $192,691 $180,450 Required: 1. Calculate the following ratios for 2018 and 2019. Round your answers…arrow_forwardFollowing are selected accounts for Best Buy, Inc., for the fiscal year ended February 2, 2019. (a) Indicate whether each account appears on the balance sheet (B) or income statement (I). Best Buy, Inc. ($ millions)Amount Classification Sales $42,879 Answer B I Accumulated depreciation 6,690 Answer B I Depreciation expense 770 Answer B I Retained earnings 2,985 Answer B I Net income 1,464 Answer B I Property, plant & equipment, net 2,510 Answer B I Selling, general and admin expense 8,015 Answer B I Accounts receivable 1,015 AnswerB I Total liabilities 9,595 Answer B I Stockholders' equity 3,306 Answer B I (b) Using the data, compute total assets and total expenses. Total Assets Answer Total Expenses Answer answer complete and correct and in detail with all workarrow_forwardOn the attached page prepare a well-formatted multi-section income statement for the Fiona Company for the fiscal year ending December 31, 2020 from the data below. Use the entire figures as shown on your income statement.Note: For items in section 2 (Other Items) and section 4 (Below-the-line Items) use brackets if an item will have a negative impact on earnings. In section 1 individual items are not generally shown in brackets except for calculated margins or totals if negative. Cost of Goods Sold amounted to $20,000. Sale of equipment that had a historical cost of $1,400 had accumulated depreciation of $910 and was sold for $890. The tax rate related to such a transaction is 25%. Non-taxable interest income on municipal bonds of $300 Sales revenue totaled $35,000. Interest expense totaled $500 for the period. Selling and Administrative Expenses amounted to $6,000 The company discontinued operations during the year that will result in total losses before taxes of $2,000. This…arrow_forward

- Lansing Company’s 2018 income statement and selected balance sheet data (for current assets and current liabilities) at December 31, 2017 and 2018, follow. LANSING COMPANYIncome StatementFor Year Ended December 31, 2018 Sales revenue $ 100,200 Expenses Cost of goods sold 43,000 Depreciation expense 12,500 Salaries expense 19,000 Rent expense 9,100 Insurance expense 3,900 Interest expense 3,700 Utilities expense 2,900 Net income $ 6,100 LANSING COMPANYSelected Balance Sheet Accounts At December 31 2018 2017 Accounts receivable $ 5,700 $ 6,000 Inventory 2,080 1,590 Accounts payable 4,500 4,800 Salaries payable 900 710 Utilities payable 240 170 Prepaid insurance 270 300 Prepaid rent 240 190 Required:Prepare the cash flows from operating activities section only of the company’s 2018 statement of cash flows using the direct method. (Amounts to be…arrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education