FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a,b, and c please

Transcribed Image Text:The following is the adjusted trial balance data for Emma's Alterations as of December 31, 2019.

Emma's Alterations

Adjusted Trial Balance

Year Ended December 31, 2019

Debit

Credit

Cash

$600,538

Accounts Receivable

51,689

Equipment

199,430

Merchandise Inventory

171,744

Accounts Payable

$236,893

Common Stock

502,200

Sales

396,893

Interest Revenue

100,976

Rent Revenue

65,100

Sales Salaries Expense

27,250

Office Supplies Expense

6,103

Sales Discounts

61,347

Interest Expense

3,570

Sales Returns and Allowances

55,632

Cost of Goods Sold

90,300

Rent Expense

10,600

Depreciation Expense-Office Equipment

8,560

Insurance Expense

3,421

Advertising Expense

11,878

Totals

$1,302,062 $1,302,062

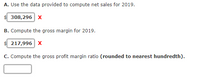

Transcribed Image Text:A. Use the data provided to compute net sales for 2019.

308,296 x

B. Compute the gross margin for 2019.

217,996 x

C. Compute the gross profit margin ratio (rounded to nearest hundredth).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Problem 9-25 Fudge factors An oil company executive is considering investing $10.1 million in one or both of two wells: well 1 is expected to produce oil worth $3.01 million a year for 10 years; well 2 is expected to produce $2.01 million for 15 years. These are real (inflation-adjusted) cash flows. The beta for producing wells is 0.91. The market risk premium is 9%, the nominal risk-free interest rate is 7%, and expected inflation is 3%. The two wells are intended to develop a previously discovered oil field. Unfortunately there is still a 21% chance of a dry hole in each case. A dry hole means zero cash flows and a complete loss of the $10.1 million investment. Ignore taxes and make further assumptions as necessary. a. What is the correct real discount rate for cash flows from developed wells? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Real discount rate b. The oil company executive proposes to add 20 percentage points to the…arrow_forwardChoose the letter of the correct answer.arrow_forwardplease explain the answer B ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education