FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

perpare a statment of

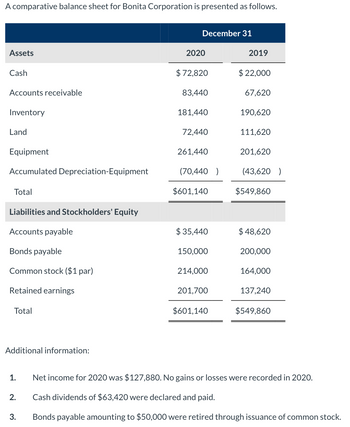

Transcribed Image Text:A comparative balance sheet for Bonita Corporation is presented as follows.

Assets

Cash

Accounts receivable

Inventory

Land

Equipment

Accumulated Depreciation-Equipment

Total

Liabilities and Stockholders' Equity

Accounts payable

Bonds payable

Common stock ($1 par)

Retained earnings

Total

Additional information:

1.

2.

3.

December 31

2020

$72,820

83,440

181,440

72,440

261,440

(70,440 )

$601,140

$ 35,440

150,000

214,000

201,700

$601,140

2019

$ 22,000

67,620

190,620

111,620

201,620

(43,620

$549,860

$ 48,620

200,000

164,000

137,240

$549,860

Net income for 2020 was $127,880. No gains or losses were recorded in 2020.

Cash dividends of $63,420 were declared and paid.

Bonds payable amounting to $50,000 were retired through issuance of common stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Do we add in notes payable due 2024 into our statement of cashflows when the balance sheet has dates 2021 and 2022?arrow_forwardUsing PROBLEM 1, how much is the projected net cash flows from operating activities for 2026 must be? Using PROBLEM 1, how much is the INTRINSIC Value of ABC Corporation? Using PROBLEM 1, how much is the total present value of Free Cash Flows to ordinary shareholders of ABC Corporation?arrow_forward1. Prepare a forccast cash flow stateaent for 2020. The beginning and ending balances in each of the balance sheet accounts Dec. 31, 2019 Dec. 31, 2020 Pi00,000 360,000 460,000 30,000 P950,000 P1,500,000 Cash P260,000 Accounts receivable Inventory Prepaid insurance Total current assets 180,000 400,000 50,000 P890,000 P1,200,000 Land Plant & equipment Accumulated depreciation Total non-current assets 1,000,000 (400,000) P1,800,000 1,400,000 (500,000) P2,400,000 Total assets P2,690,000 P3,350,000 Accounts payable Accrued operating expenses Interest payable Income taxes payable Р 300,000 200,000 20,000 122,000 P 260,000 132,000 30,000 150.000 P 572,000 700,000 1,100,000 978,000 P 642,000 600,000 Total current liabilities Bonds payable Common stock 800,000 Retained earnings 648,000 Total liabilities & equity P2,690,000 P3,350,000 The forecast income statement for the Mexico Company for 2020 is presented below: Sales Cost of sales Gross profit Operating expenses Income before interest & tax…arrow_forward

- As part of your analysis, you are required to investigate Insignia Corporation Limited’s cash flows. Required: Using the financial statement provided: Prepare Insignia’s Cash Flow Statement for 2020.arrow_forwardSubject: acountingarrow_forwardHow does Long-Term Bank Loan impact Avett Inc.'s 2020 Statement of Cash Flows? Question 10 options: The periodic change in Long-Term Bank Loan is added in Cash Flows from Operations The periodic change in Long-Term Bank Loan is added in Cash Flows from Financing The periodic change in Long-Term Bank Loan is subtracted in Cash Flows from Financing The periodic change in Long-Term Bank Loan is added in Cash Flows from Investing The periodic change in Long-Term Bank Loan is not included on the Statement of Cash Flows The periodic change in Long-Term Bank Loan is subtracted in Cash Flows from Operations The periodic change in Long-Term Bank Loan is subtracted in Cash Flows from Investingarrow_forward

- Here are cash flows for a project under consideration. C(0)= -$8160, C(1)=6180, and C(2)=20280. What is the IRR of the project?arrow_forwardAs part of your analysis, you are required to investigate Insignia Corporation Limited’s cash flows. Required: Using the financial statement provided: Calculate the following for 2020: Operating Cash Flow Net Capital Spending Change in Net Working Capitalarrow_forwardHow do Other Payables impact Avett Inc.'s 2020 Statement of Cash Flows? Question 17 options: The periodic change in Other Payables is subtracted in Cash Flows from Investing The periodic change in Other Payables is added in Cash Flows from Operations The periodic change in Other Payables is subtracted in Cash Flows from Financing The periodic change in Other Payables is added in Cash Flows from Financing The periodic change in Other Payables is added in Cash Flows from Investing The periodic change in Other Payables is not included on the Statement of Cash Flows The periodic change in Other Payables is subtracted in Cash Flows from Operationsarrow_forward

- Determine External Funds Needed (EFN) and how it may be financed.arrow_forwardWhich of the following is an appropriate method of computing free cash fl ow to the fi rm? A . Add operating cash fl ows to capital expenditures and deduct after-tax interest payments.arrow_forwardsuppose that the following information is related to X company for 2020 net cash flows from operating activities 12000 net cash flows from financing activities 18000 beginning cash balance 5000 Ending cash balance 10000 The net cash flows from investing activities is O a. (25000) O b. 10000 O c. 30000 O d. 8000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education