Concept explainers

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system.

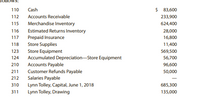

The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows:

During May, the last month of the fiscal year, the following transactions were completed:

May 1. Paid rent for May, $5,000.

3. Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000.

4. Paid freight on purchase of May 3, $600.

6. Sold merchandise on account to Korman Co., terms 2/10, n/30, FOB shipping point, $68,500. The cost of the merchandise sold was $41,000.

7. Received $22,300 cash from Halstad Co. on account.

10. Sold merchandise for cash, $54,000. The cost of the merchandise sold was $32,000.

13. Paid for merchandise purchased on May 3.

15. Paid advertising expense for last half of May, $11,000.

16. Received cash from sale of May 6.

19. Purchased merchandise for cash, $18,700.

19. Paid $33,450 to Buttons Co. on account.

20. Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 6. The invoice amount of the returned merchandise was $13,500, and the cost of the returned merchandise was $8,000.

Record the following transactions on Page 21 of the journal:

20. Sold merchandise on account to Crescent Co., terms 1/10, n/30, FOB shipping point, $110,000. The cost of the merchandise sold was $70,000.

21. For the convenience of Crescent Co., paid freight on sale of May 20, $2,300.

21. Received $42,900 cash from Gee Co. on account.

21. Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000.

24. Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000.

26. Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800.

28. Paid sales salaries of $56,000 and office salaries of $29,000.

29. Purchased store supplies for cash, $2,400.

30. Sold merchandise on account to Turner Co., terms 2/10, n/30, FOB shipping

point, $78,750. The cost of the merchandise sold was $47,000.

30. Received cash from sale of May 20 plus freight paid on May 21.

31. Paid for purchase of May 21, less return of May 24.

nstructions

1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section and place a check mark (¸) in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal.

2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required

to update or post to the

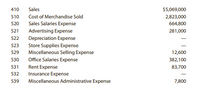

3. Prepare an unadjusted

4. At the end of May, the following adjustment data were assembled. Analyze and use

these data to complete (5) and (6).

a. Merchandise inventory on May 31 $570,000

b. Insurance expired during the year 12,000

c. Store supplies on hand on May 31 4,000

d.

e. Accrued salaries on May 31:

Sales salaries $7,000

Office salaries 6,600 13,600

f. The adjustment for customer returns and allowances is $60,000 for sales and $35,000 for cost of merchandise sold.

5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet.

6. Journalize and post the

7. Prepare an adjusted trial balance.

8. Prepare an income statement, a statement of owner’s equity, and a

9. Prepare and

10. Prepare a post-closing trial balance.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Rescue Sequences LLC purchased inventory by issuing a $30,000, 60-day, non-interest bearing note on October 1. Assume that the note is discounted at a 15% rate. Required: Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a perpetual inventory system and a 360-day calendar fiscal year.arrow_forwardCheese Factory uses a perpetual inventory system. The following activities occurred during May: • May 2 - Cheese Factory purchased $45,000 worth of inventory, on credit terms 3/10 n/30. . May 5 - Cheese Factory returned $5,000 worth of that inventory to the supplier. • May 9 - Cheese Factory paid for the inventory, taking advantage of all available discounts. Required: Prepare the journal entries to record the transactions above using the gross method. Use the MSWord link for the table to write your journal entries. After you have written the journal entries on the table in the MSWord document provided, put your name below the table on the document, save the document and then upload it to this problem in the upload space provided at the bottom of this box.arrow_forwardRecording Inventory Purchases and Sales on Account Record the entries for the following transactions for Shoppers Inc. Shoppers uses a perpetual inventory system and records sales taxes payable at the point of sale. a. On January 1, 2020, Shoppers Inc. purchased merchandise for resale for $56,000 on credit terms 1/15, n/30. Shoppers Inc. incurred a shipping charge of $288 on the purchase, which was immediately paid. Shoppers Inc. uses the gross method to record purchases. b. Shoppers Inc. sells $22,400 of inventory during the first week of January 2020, to customers for $40,000, with a sales tax rate of 5%. Of the total sales for the week, 30% are cash sales, and 70% are credit sales (n/30). c. On January 14, 2020, Shoppers Inc. pays the balance for purchases on account. d. Assume instead that Shoppers Inc. sells $24,000 of inventory during the first week of January 2020 to customers for $44,800, which includes a 5% sales tax. Of the total sales for the week, 30% are cash sales, and…arrow_forward

- The following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a perpetual inventory system. July 1 Purchased merchandise from Sabol Imports Co., $13,322, terms FOB destination, n/30. 3 Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. 5 Purchased merchandise from Schnee Co., $13,700, terms FOB destination, 2/10, n/30. 6 Issued debit memo to Schnee Co. for merchandise with an invoice amount of $4,850 returned from purchase on July 5. 13 Paid Saxon Co. for invoice of July 3. 14 Paid Schnee Co. for invoice of July 5, less debit memo of July 6. 19 Purchased merchandise from Southmont Co., $29,840, terms FOB shipping point, n/eom. 19 Paid freight of $410 on July 19 purchase from Southmont Co. 20 Purchased merchandise from Stevens Co., $22,200, terms FOB destination, 1/10, n/30. 30 Paid…arrow_forwardSant Summa is a retailer that purchases merchandise inventory from Lee Co. Sant Summa record inventory purchases using the gross method and the perpetual inventory system. Sant Summa started the month of July with $2,000 in inventory. Required: Record the journal entries for the following transactions Calculate Sant Summa's Cost of Goods Available for Sale based on the above information. Calculate Sant Summa's Ending Inventory based on the above information. 2-Jul Purchased $5,200 of merchandise inventory from Lee Co. with credit terms 2/15, n60 and FOB shipping point. (Inventory cost Lee $4,000) 3-Jul Paid $350 for shipping charges for the May 2 purchase. 4-Jul Sant Summa returned $200 of damaged merchandise inventory to Lee Co. (inventory cost to Lee of $170) 13-Jul Paid the appropriate amount for the Lee Co. purchases of July 2, taking all discounts. (Lee…arrow_forwardMorton Company uses a perpetual inventory system. On December 1, 2019, the company purchased inventory on account for $9,000. The credit terms are 2/10, n/30. If Morton pays the bill on Decermber 29, 2019, what amount of discount will be taken?arrow_forward

- Crosby Company owns a chain of hardware stores throughout the state. The company uses a periodic inventory system and the retail Inventory method to estimate ending inventory and cost of goods sold. The following data are available for the three months ending March 31, 2021: Beginning inventory. Net purchases Net markups Net markdowns Net sales Beginning inventory Net purchases Net markups Required: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold for the three months ending March 31, 2021, using the information provided. Assume stable retail prices during the period (Round ratio calculation to 2 decimal places (i.e.. 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign.) Cost $180,000 630,000 Net markdowns Goods available for sale (excluding beg. inventory) Goods available for sale (including beg inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) sales Estimated ending…arrow_forwardSatoor, Inc.Satoor, Inc., which uses a periodic inventory system, purchased merchandise from Taye Company on July 7 for $15,000. The credit terms were 1/10, n/30. The goods were shipped FOB shipping point on July 7. Satoor, Inc. received the merchandise on July 10 and paid the amount due on July 15.Refer to the information provided for Satoor, Inc. Who is responsible for payment of the transportation costs on the merchandise sold? a. seller b. split equally between the two companies c. buyer d. Cannot be determined from the information provided.arrow_forwardOn March 1, 2021 Lane Tech Merchandising (LTM) purchased the following inventory in the amount of $12,500 paying $4,500 cash and the rest on account. On March 5, 2021 LTM paid the balance of the transaction of March 1, 2021. On March 10, LTM sold merchandise for $10,000 cash. The cost of merchandise sold was $7,590. Record the journal entries to record the ongoing transactions under perpetual inventory systemarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education