FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

The following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a perpetual inventory system.

| July | 1 | Purchased merchandise from Sabol Imports Co., $13,322, terms FOB destination, n/30. |

| 3 | Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $240 was added to the invoice. | |

| 5 | Purchased merchandise from Schnee Co., $13,700, terms FOB destination, 2/10, n/30. | |

| 6 | Issued debit memo to Schnee Co. for merchandise with an invoice amount of $4,850 returned from purchase on July 5. | |

| 13 | Paid Saxon Co. for invoice of July 3. | |

| 14 | Paid Schnee Co. for invoice of July 5, less debit memo of July 6. | |

| 19 | Purchased merchandise from Southmont Co., $29,840, terms FOB shipping point, n/eom. | |

| 19 | Paid freight of $410 on July 19 purchase from Southmont Co. | |

| 20 | Purchased merchandise from Stevens Co., $22,200, terms FOB destination, 1/10, n/30. | |

| 30 | Paid Stevens Co. for invoice of July 20. | |

| 31 | Paid Sabol Imports Co. for invoice of July 1. | |

| 31 | Paid Southmont Co. for invoice of July 19. |

CHART OF ACCOUNTSBetz CompanyGeneral Ledger

| ASSETS | |

| 110 | Cash |

| 120 | |

| 125 | Notes Receivable |

| 130 | Inventory |

| 131 | Estimated Returns Inventory |

| 140 | Office Supplies |

| 141 | Store Supplies |

| 142 | Prepaid Insurance |

| 180 | Land |

| 192 | Store Equipment |

| 193 | |

| 194 | Office Equipment |

| 195 | Accumulated Depreciation-Office Equipment |

| LIABILITIES | |

| 211 | Accounts Payable-Sabol Imports Co. |

| 212 | Accounts Payable-Saxon Co. |

| 213 | Accounts Payable-Schnee Co. |

| 214 | Accounts Payable-Southmont Co. |

| 215 | Accounts Payable-Stevens Co. |

| 216 | Salaries Payable |

| 218 | Sales Tax Payable |

| 219 | Customer Refunds Payable |

| 221 | Notes Payable |

| EQUITY | |

| 310 | Common Stock |

| 311 | |

| 312 | Dividends |

| REVENUE | |

| 410 | Sales |

| 610 | Interest Revenue |

| EXPENSES | |

| 510 | Cost of Goods Sold |

| 521 | Delivery Expense |

| 522 | Advertising Expense |

| 524 | Depreciation Expense-Store Equipment |

| 525 | Depreciation Expense-Office Equipment |

| 526 | Salaries Expense |

| 531 | Rent Expense |

| 533 | Insurance Expense |

| 534 | Store Supplies Expense |

| 535 | Office Supplies Expense |

| 536 | Credit Card Expense |

| 539 | Miscellaneous Expense |

| 710 | Interest Expense |

Journalize the entries to record the transactions of Betz Company for July. Refer to the Chart of Accounts for exact wording of account titles.

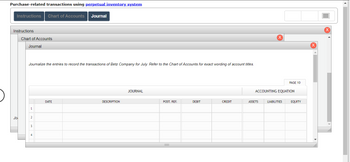

Transcribed Image Text:Purchase-related transactions using perpetual inventory system

Instructions Chart of Accounts Journal

Instructions

Jol

Chart of Accounts

Journal

Journalize the entries to record the transactions of Betz Company for July. Refer to the Chart of Accounts for exact wording of account titles.

1

2

3

DATE

DESCRIPTION

JOURNAL

POST. REF.

DEBIT

CREDIT

X

ASSETS

ACCOUNTING EQUATION

PAGE 10

LIABILITIES

EQUITY

▸

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected transactions were completed by Capers Company during October of the current year:Oct. 1. Purchased merchandise from UK Imports Co., $14,448, terms FOB destination, n/30.3. Purchased merchandise from Hoagie Co., $9,950, terms FOB shipping point, 2/10, n/eom. Prepaid freight of $220 was added to the invoice.4. Purchased merchandise from Taco Co., $13,650, terms FOB destination, 2/10, n/30.6. Issued debit memo to Taco Co. for $4,550 of merchandise returned frompurchase on October 4.Oct. 13. Paid Hoagie Co. for invoice of October 3.14. Paid Taco Co. for invoice of October 4 less debit memo of October 6.19. Purchased merchandise from Veggie Co., $27,300, terms FOB shipping point, n/eom.19. Paid freight of $400 on October 19 purchase from Veggie Co.20. Purchased merchandise from Caesar Salad Co., $22,000, terms FOB destination, 1/10, n/30.30. Paid Caesar Salad Co. for invoice of October 20.31. Paid UK Imports Co. for invoice of October 1.31. Paid Veggie Co. for invoice…arrow_forwardAt the end of January of the current year, the records of Donner Company showed the following for a particular item that sold at $15.20 per unit: Transactions Units Inventory, January 1 Purchase, January 12. 560 Amount $1,792 540 Purchase, January 26 140 2,808 1,008 Sale Sale (420) (200) Required: 1a. Assuming the use of a periodic inventory system, compute Cost of Goods Sold under each method of inventory: average cost, FIFO, LIFO, and specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 1b. Assuming the use of a periodic inventory system, prepare a partial income statement under each method of inventory: (a) average cost, (b) FIFO, (c) LIFO, and (d) specific identification. For specific identification, assume that the first sale was selected from the beginning inventory and the second sale was selected from the January 12 purchase. 2a. Between FIFO and…arrow_forwardWhat did you guys get on this one?arrow_forward

- Presented below are selected transactions for Flounder Company during September and October of the current year. Flounder uses a periodic inventory system. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $49,000, FOB destination, terms 1/15, n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $2,240 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $116,900, terms 2/10, n/30, FOB destination. 16 The correct company paid $2,500 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,600 for returned goods. These goods had cost Flounder Company $3,000 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the balance…arrow_forwardTransactions for Buyer and Seller Shore Co. sold merchandise to Blue Star Co. on account, $111,500, terms FOB shipping point, 2/10, n/30. The cost of the goods sold is $66,900. Shore paid freight of $2,000. Journalize Shore Co.'s entry for the sale, purchase, and payment of amount due, using the net method under a perpetual inventory system. If an amount box does not require an entry, leave it blank. Accounts Receivable-Blue Star Co. 109,270 Sales 109,270 Cost of Goods Sold 66,900 Inventory 66,900 Accounts Receivable-Blue Star Co. 2,000 Cash 2,000 Cash Accounts Receivable-Blue Star Co. Journalize Blue Star Co.'s entry for the sale, purchase, and payment of amount due. If an amount box does not require an entry, leave it blank. Inventory Accounts Payable-Shore Co.arrow_forwardThe following purchase transactions occurred during the last few days of Whilczel Company's business year, which ends October 31, or in the first few days after that date. A periodic inventory system is used. · An invoice for P6,000, terms FOB shipping point, was received and entered November 1. The invoice shows that the material was shipped October 29, but the receiving report indicates receipt of goods on November 3. · An invoice for P2,700, terms FOB destination, was received and entered November 2. The receiving report indicates that the goods were received October 29. · An invoice for P3,150, terms, FOB shipping point, was received October 15, but never entered. Attached to it is a receiving report indicating that the goods were received October 18. Across the face of the receiving report is the following notation: "Merchandise not of the same quality as ordered - returned for credit October 19". · An invoice for P3,600 terms FOB shipping…arrow_forward

- Journalize the following transactions for Armour Inc. Oct. 7 Sold merchandise on credit to Rondo Distributors, for $1,200, terms n/30. The cost of the merchandise was $720. Purchased merchandise, $10,000, terms FOB shipping point, 2/15, n/30, with prepaid freight charges of $525 added to the invoice. Journalize the transactions above using the periodic inventory system. If an amount box does not require an entry, leave it blank. Oct. 7 Oct. 8 Journalize the transactions above using the perpetual inventory system. Oct. 7- Sale Cost Oct. 8arrow_forwardSales and Purchase-Related Transactions for Seller and Buyer Using Perpetual Inventory System The following selected transactions were completed during April between Swan Company and Bird Company. Both companies use the net method under a perpetual inventory system. Ap 2. Swan Company sold merchandise on account to Bird Company, $54,800, terms FOB shipping point, 2/10, n/30. Swan paid freight of $1,620, which was added to the invoice. The cost ef the goods sold was $33,180. 8. Swan Company sold merchandise on account to Bird Company, $48,300, terms FOB destination, 1/15, n/eom. The cost of the goods sold was $25,920. 8. Swan Company paid freight of $1,205 for delivery of merchandise sold to Bird Company on April 8. 12. Bird Company paid Swan Company for purchase of April 2. 23. Bird Company paid Swan Company for purchase of April 24. Swan Company sold merchandise on account to Bird Company, $66,060, terms FOB shipping point, n/eom. The cost of the goods sold was $37,140. 25. Swan…arrow_forwardSeiz Company used perpetual inventory system to record inventory transactions for 2021. Inventory P 1,900,000 Sales 6,500,000 Sales returns 150,000 Cost of goods sold 4,600,000 Inventory losses 120,000 On December 24, the entity recorded a P 150,000 credit sales of goods costing P 100,000. These goods were sold on FOB destination point terms and were in transit on December 31. The goods were included in the physical count. The inventory on December 31 determined by physical count has a cost of P 2,000,000 and a net realizable value of P 1,700,000. Any inventory writedown is not yet recorded. What amount should be reported as Cost of Goods Sold for 2020? a. 5,020,000 b. 4,500,000 c. 4,720,000 d. 4,920,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education