FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

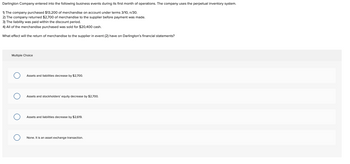

Transcribed Image Text:Darlington Company entered into the following business events during its first month of operations. The company uses the perpetual inventory system.

1) The company purchased $13,200 of merchandise on account under terms 3/10, n/30.

2) The company returned $2,700 of merchandise to the supplier before payment was made.

3) The liability was paid within the discount period.

4) All of the merchandise purchased was sold for $20,400 cash.

What effect will the return of merchandise to the supplier in event (2) have on Darlington's financial statements?

Multiple Choice

O

Assets and liabilities decrease by $2,700.

Assets and stockholders' equity decrease by $2,700.

Assets and liabilities decrease by $2,619.

None. It is an asset exchange transaction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company that uses the perpetual inventory system purchased inventory for $1,130,000 on account with terms of 5/7, n/20. Which of the following correctly records the payment made 15 days after the date of invoice? A. Accounts Payable 1,130,000 Merchandise Inventory 1,130,000 B. Accounts Payable 1,130,000 Merchandise Inventory 56,500 Cash 1,073,500 C. Accounts Payable 1,130,000 Cash 1,130,000 D. Cash 1,130,000 Accounts Payable 1,130,000arrow_forwardVaughn Limited, which uses a perpetual inventory system, purchased inventory costing $22,000 on February 1 by issuing a 3-month note payable bearing interest at 6%, with interest and principal due on May 1. The company's year end is on March 31 and the company records adjusting entries only at that time. (a) Your answer is correct. Prepare the journal entry to record the purchase of inventory on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) (b) Date Account Titles Feb. 1 Inventory Notes Payable eTextbook and Media List of Accounts Mar. 31 Date Account Titles Debit 22000 Debit Credit Prepare the journal entry to record the accrual of interest expense on March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required,…arrow_forwardRiley Kilgo Inc. purchased inventory costing $100,000 and sold 80% of the goods for $240,000. All purchases and sales were on account. Kilgo later collected 20% of the accounts receivable. Journalize these transactions for Kilgo, which uses the perpetual inventory system. For these transactions, show what Kilgo will report for inventory, revenues, and expenses on its financial statements. Report gross profit on the appropriate statement.arrow_forward

- Two different companies, Quick Cleaners and JunkTrader entered into the following inventory transactions during December. Both companies use a perpetual inventory system. • December 3 - Quick Cleaners sold inventory on account to JunkTrader for $550,000, terms 3/10, n/30. This inventory originally cost Quick Cleaners $330,000. . December 8 - JunkTrader returned inventory to Quick Cleaners for a credit of $20,000. Quick Cleaners returned this inventory to inventory at its original cost of $12,000. December 23 - JunkTrader paid Quick Cleaners for the amount owed. Required: Prepare the journal entries to record these transactions on the books of Quick Cleaners using the gross method. Use the MSWord link for the table to write your journal entries. After you have written the journal entries on the table in the MSWord document provided, type in your name below the table on the document, save the document and then upload it to this problem in the upload space provided at the bottom of this…arrow_forwardOn June 10, Sheffield Corp. purchased $8,700 of merchandise on account from Concord Company, FOB shipping point, terms 3/10, n/30. Sheffield Corp. pays the freight costs of $600 on June 11. Goods totaling $700 are returned to Concord for credit on June 12. On June 19, Sheffield Corp. pays Concord Company in full, less the purchase discount. Both companies use a perpetual inventory system. Prepare separate entries for each transaction on the books of Sheffield Corp.. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Rate Account Titles and Explanation ما Debit Creditarrow_forwardOn June 10, Sunland Company purchased $7,800 of merchandise from Blossom Company, terms 4/10, n/30. Sunland Company pays the freight costs of $370 on June 11. Goods totaling $800 are returned to Blossom Company for credit on June 12. On June 19, Sunland Company pays Blossom Company in full, less the purchase discount. Both companies use a perpetual inventory system (b) Prepare separate entries for each transaction for Blossom Company. The merchandise purchased by Blossom Company on June 10 cost McGiver $3,180, and the goods returned cost Blossom Company $210. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction date…arrow_forward

- Vaughn Limited, which uses a perpetual inventory system, purchased inventory costing $22,000 on February 1 by issuing a 3-month note payable bearing interest at 6%, with interest and principal due on May 1. The company's year end is on March 31 and the company records adjusting entries only at that time. (a) Prepare the journal entry to record the purchase of inventory on February 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles Feb. 1 Debit Creditarrow_forwardCraig Ferguson Company had the following account balances at year-end: cost of goods sold $70,000; inventory $17,300: operating expenses $33,000; sales revenue $121,000; sales discounts $1,400; and sales returns and allowances $1,950. A physical count of inventory determines that merchandise inventory on hand is $16,250. (a) Prepare the adjusting entry necessary as a result of the physical count. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Debit Creditarrow_forwardOn October 23, Johnson Company purchased $100,000 of inventory on credit with payment terms of 1/15, net 45. Using the net price method, prepare journal entries to record Johnson Company's purchases if it pays on October 31.View Solution:arrow_forward

- Shankar Company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 2 for $48,000, with terms 4/10, n/30. On February 10, the company pays on account for the inventory. Required: (a) Determine the financial statement effects for the inventory purchase on account on February 2. (b) Determine the financial statement effects for the payment on February 10. Complete this question by entering your answers in the tabs below. Required a Required b Determine the financial statement effects for the inventory purchase on account on February 2. (Amounts to be deducted should minus sign.) Revenues Income Statement Expenses Net Incomearrow_forwardConcord Ltd. had beginning inventory of 53 units that cost $101 each. During September, the company purchased 208 units on account at $101 each, returned 9 units for credit, and sold 154 units at $201 each on account. Journalize the September transactions, assuming that Concord Ltd. uses a perpetual inventory system. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record purchase on account enter a debit amount enter a credit amount enter an account title to record purchase on account enter a debit amount enter a credit amount (To record purchase on account) enter an account title to record purchase return enter a debit amount enter a credit amount enter an account title to record purchase return enter a debit…arrow_forwardOn October 5, Cullumber Company sells merchandise to Bramble Company for $4,790, terms 1/10, n/30. The cost of the merchandise sold is $2,740. Cullumber paid the freight charges of $105.Record the transactions on the books of Cullumber Company using the perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record credit sales) (To record cost of goods sold on account) (To record payment of freight on goods sold)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education