FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

| January - June | |||||||

| Month | January | February | March | April | May | June | |

| Beginning Cash Balance | $ - | $ - | $ - | $ - | $ - | ||

| Add Receipts | |||||||

| Collections from customers | $ - | $ - | $ - | $ - | $ - | $ - | |

| Total Increases To Cash | $ - | $ - | $ - | $ - | $ - | $ - | |

| Direct Material Purchases | $ - | $ - | $ - | $ - | $ - | $ - | |

| Direct Labor | $0 | $0 | $0 | $0 | $0 | $0 | |

| Manufacturing |

$ - | $ - | $ - | $ - | $ - | $ - | |

| Selling and Administrative Expenses | $ - | $ - | $ - | $ - | $ - | $ - | |

| Interest Expense | $ - | $ - | $ - | $ - | $ - | ||

| Total Decreases To Cash | $ - | $ - | $ - | $ - | $ - | $ - | |

| Excess(deficiency) of cash | $ - | $ - | $ - | $ - | $ - | $ - | |

| Financing (line of credit): | |||||||

| Borrowings (enter as positive value) | |||||||

| Repayments (enter as negative value) | |||||||

| Ending cash Balance | $ - | $ - | $ - | $ - | $ - | $ - | |

| Balance of line of credit | $ - | $ - | $ - | $ - | $ - | $ - | |

| Schedule of Expected Collections from customers | |||||||

| January - June | |||||||

| January | February | March | April | May | June | Totals | |

| Cash Collected From This Month's Sales (10%) | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

| Cash collected from sale 1 month ago (70%) | $ - | $ - | $ - | $ - | $ - | $ - | |

| Cash collected from sale 2 months ago (20%) | $ - | $ - | $ - | $ - | $ - | ||

| Cash collected from sale 3 months ago (10%) | $ - | $ - | $ - | $ - | |||

| Total collections | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

| Schedule of Expected Payments for Direct materials | |||||||

| January - June | |||||||

| January | February | March | April | May | June | Totals | |

| Accounts Payable January 1 | $ - | ||||||

| Accounts Payable prior month | $ - | $ - | $ - | $ - | $ - | $ - | |

| Total Payments | $ - | $ - | $ - | $ - | $ - | $ - | $ - |

Transcribed Image Text:Toodle Train Company makes toy trains for children. The trains are made of painted

wood with rubber wheels that really turn. The budget for unit sales for the first half of

2010:

January

500

February 800

March

700

April

May

June

1500

1600

1550

Toodle expects July sales to be 1,750 units. Each train sells for $30. There were 25

trains in Inventory on December 31, 2010. It is the company's policy to maintain a

finished goods inventory at the end of each month equal to 5% of next month's

anticipated sales.

Each train requires two types of direct materials: wood and wheels. At December 31,

2010 there was 23 board feet of wood and 206 wheels on hand.

Material

Desired Ending

Inventory

Wood

.3 board feet

15% * next month's use

Wheels

4 wheels

10%* next month's use

Each train requires .25 direct labor hours to produce. The average hourly wage including

benefits is $20 per hour.

Units used per

train

Manufacturing Overhead costs for Toodle Train Company are as follows:

$1.00 per direct labor hour

$1.40 per direct labor hour

Indirect Materials

Indirect Labor

Utilities

Maintenance

Supervisory Salaries

Depreciation

Property Taxes

Cost per unit

$3 per board

foot

$ 0.10 per

wheel

Depreciation

Property Taxes

.10 per direct labor hour and $800 per month

.03 per direct labor hour and $400 per month

$2,500 per month

$1500 per month

$80 per month

Selling and Administrative Expenses are as follows:

Advertising

$2,500 per month

Office Salaries

$1,800 per month

$75 per month

$50 per month

(continued)

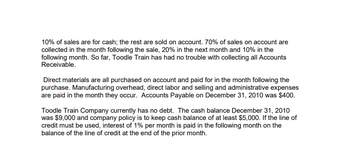

Transcribed Image Text:10% of sales are for cash; the rest are sold on account. 70% of sales on account are

collected in the month following the sale, 20% in the next month and 10% in the

following month. So far, Toodle Train has had no trouble with collecting all Accounts

Receivable.

Direct materials are all purchased on account and paid for in the month following the

purchase. Manufacturing overhead, direct labor and selling and administrative expenses

are paid in the month they occur. Accounts Payable on December 31, 2010 was $400.

Toodle Train Company currently has no debt. The cash balance December 31, 2010

was $9,000 and company policy is to keep cash balance of at least $5,000. If the line of

credit must be used, interest of 1% per month is paid in the following month on the

balance of the line of credit at the end of the prior month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardDo not give solution in imagrarrow_forwardMinden Company Balance Sheet April 30 Assets Cash Accounts receivable Inventory Buildings and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Note payable Common stock Retained earnings Total liabilities and stockholders' equity $ 12,700 66,500 48,500 229,000 $ 356,700 $ 67,500 19,100 180,000 90,100 $ 356,700 The company is in the process of preparing a budget for May and has assembled the following data: a. Sales are budgeted at $262,000 for May. Of these sales, $78,600 will be for cash; the remainder will be credit sales. One-half of a month's credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30 accounts receivable will be collected in May. b. Purchases of inventory are expected to total $196,000 during May. These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the…arrow_forward

- Need 1-3arrow_forwardGraded HW i Fixed Budget For Year Ended December 31 $ Sales 3,171,000 Costs Direct materials 996,600 Direct labor 226,500 Sales staff commissions 60,400 Depreciation-Machinery 295,000 Supervisory salaries 203,000 Shipping 226,500 Sales staff salaries (fixed annual 250,000 amount) Administrative salaries 556,450 Depreciation-Office equipment 198,000 Income $ 158,550 Saved Required: 1&2. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. 3. The company's business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a simple budgeted income statement if 18,100 units are sold. Complete this question by entering your answers in the tabs below. Req 1 Req 3 and 2 Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. Sales Variable costs Direct materials Direct labor Sales staff commissions Shipping Total variable costs Contribution margin Fixed costs PHOENIX COMPANY Flexible Budgets For Year Ended December 31 Flexible…arrow_forwardHow do I solve the chart?arrow_forward

- Budgeted Selling and Administrative Expenses Salary Expense Sales Commissions 5% of Sales Insurance Expense Rent Depreciation on equipment Utilities Total Operating Expenses Schedule of Cash Payments for Selling and Administrative Expenses Salary Expense 100% of Prior Month Sales Commissions Insurance Expense October November December Multiple Choice 30,000 30,500 15,000 15,500 12,000 12,000 14,400 14,400 16,500 16,500 2,100 2,300 90,000 91, 200 ? 15,100 12,000 ? 2,200 ? 30,500 ? 12,000 ? ? ? Rent 100% of Prior Months Utilities Expense Total Payments for Selling and Administrative Expenses The amount of cash paid for Selling and Administrative expenses during the month of November is: 31,000 15,300 12,000 14,400 16,500 2,500 91,700 ? ? 12,000 14,400 ?arrow_forwardDO NOT GIVE SOLUTION IN IMAGE FORMATarrow_forwardProduction Budgetarrow_forward

- October November December Budgeted S&A Expenses Salary Expense 10,000 10,500 11,000 Sales Commissions 5% of Sales. 5,300 5,000 5,500 2,000 Insurance Expense 2,000 2,000 Rent 2,400 2,400 2,400 1,500 1,500 1,500 Depreciation on equipment Utilities 1,100 1,300 1,500 Total Operating Expenses 22,000 23, 200 23,700 Schedule of Cash Payments for S&A Expenses Salary Expense ? 10,500 ? 100% of Prior Month Sales 5,100 ? ? Commissions Insurance Expense 2,000 2,000 ? 2,000 2,400 Rent ? 100% of Prior Months Utilities 1,200 ? ? Expense Total Payments for S&A Expenses ? ? ? What is the total amount of S&A expenses for the fourth quarter that the company will report on its pro forma income statement? Multiple Choice $64,400 $68,900 $23,700 $63,900arrow_forwardPlease do not give solution in image format thankuarrow_forwardDd.1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education