FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

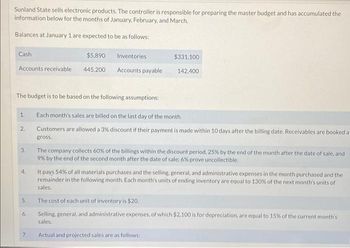

Transcribed Image Text:Sunland State sells electronic products. The controller is responsible for preparing the master budget and has accumulated the

information below for the months of January, February, and March.

Balances at January 1 are expected to be as follows:

Cash

$5,890

Accounts receivable 445,200

The budget is to be based on the following assumptions:

1.

2.

3.

4.

5.

6.

Inventories

Accounts payable

7.

$331,100

142,400

Each month's sales are billed on the last day of the month.

Customers are allowed a 3% discount if their payment is made within 10 days after the billing date. Receivables are booked a

gross.

The company collects 60% of the billings within the discount period, 25% by the end of the month after the date of sale, and

9% by the end of the second month after the date of sale: 6% prove uncollectible.

It pays 54% of all materials purchases and the selling, general, and administrative expenses in the month purchased and the

remainder in the following month. Each month's units of ending inventory are equal to 130% of the next month's units of

sales.

The cost of each unit of inventory is $20.

Selling, general, and administrative expenses, of which $2,100 is for depreciation, are equal to 15% of the current month's

sales.

Actual and projected sales are as follows:

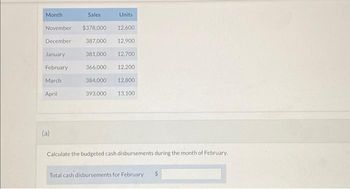

Transcribed Image Text:Month

March

November $378,000

12,600

December 387,000 12,900

January

381,000 12,700

February

366,000 12,200

384,000 12,800

393.000 13,100

April

Sales

(a)

Units

Calculate the budgeted cash disbursements during the month of February.

Total cash disbursements for February

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller of Sonoma Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budgetinformation: May June July Sales $141,000 $169,000 $233,000 Manufacturing costs 59,000 73,000 84,000 Selling and administrative expenses 41,000 46,000 51,000 Capital expenditures _ _ 56,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in September, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of…arrow_forwardThe accountant for Baird's Dress Shop prepared the following cash budget. Baird's desires to maintain a cash balance of $24,000 at the end of each month. Funds are assumed to be borrowed and repaid on the last day of each month. Interest is charged at the rate of 1 percent per month. Required a. Complete the cash budget by filling in the missing amounts. b. Determine the amount of net cash flows from operating activities Baird's will report on the third quarter pro forma statement of cash flows. c. Determine the amount of net cash flows from financing activities Baird's will report on the third quarter pro forma statement of cash flows. Complete this question by entering your answers in the tabs below. Req A Req B and C Complete the cash budget by filling in the missing amounts. Note: Any shortages or repayments should be indicated with a minus sign. Round your answers to the nearest whole dollar amount. Cash Budget July August September Section 1: Cash receipts Beginning cash balance…arrow_forwardDetermine the anticipated total cash receipts for the month of January for Madison Co. in preparing a Cash Budget, given the following info: Accounts Receivable balance as of January 1 $296,000.00 Budgeted Sales for January = $860,000.00 Madison Co. assumes all monthly sales are on account. And that 75% of the sales on account will be collected in the month of the sale, and that the remainder will be collected the following month. $688,000.00 $812,000.00 $941,000.00 O $468,000.00arrow_forward

- Hillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances: Cash $ 43,000 Accounts receivable 202,400 Inventory 58,200 Buildings and equipment (net) 353,000 Accounts payable $ 86,025 Common stock 500,000 Retained earnings 70,575 $ 656,600 $ 656,600 Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 253,000 January $ 388,000 February $ 585,000 March $ 299,000 April $ 196,000 Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales. The company’s gross margin is…arrow_forwardI need the working solution for the cash balance at the beginning month. Cash Budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: September October November Sales $130,000 $156,000 $205,000 Manufacturing costs 55,000 67,000 74,000 Selling and administrative expenses 46,000 47,000 78,000 Capital expenditures _ _ 49,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid…arrow_forwardIn 2021 the company “AROFAH” will prepare a cash budget. The cash receipts and disbursements plan for the first six months (January to June) are as follows: Admission Plan: Sales Receipts: Sales are made in cash as much as 50% and 50% credit of sales. Of credit sales, 60% is received one month after the month of sale and the remaining is received 2 months after the month of sale. The total receipts of receivables in January and February are IDR 200,000 and IDR 300,000, respectively. The acceptance plans are: A. The amount of sales are: B. Other receipts are: January IDR 1,400,000 January IDR 200,000 February IDR 1,500,000 February IDR 300,000 March IDR 1,500,000 March IDR 100,000 April IDR 1,600,000 April IDR 200,000 May IDR 1,700,000 May IDR 400,000 June IDR 1,650,000 June IDR 500,000 2. Expediture Plan : A. Purchase of raw materials: B. Purchase of…arrow_forward

- The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Line Item Description Sales September October November $103,000 $122,000 $166,000 Manufacturing costs 43,000 52,000 60,000 Selling and administrative expenses Capital expenditures 36,000 37,000 63,000 40,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $10,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. Current assets as of…arrow_forwardHillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances: Cash $ 64,000 Accounts receivable 219,200 Inventory 61,350 Buildings and equipment (net) 374,000 Accounts payable $ 92,325 Common stock 500,000 Retained earnings 126,225 $ 718,550 $ 718,550 Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 274,000 January $ 409,000 February $ 606,000 March $ 321,000 April $ 217,000 Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales. The company’s gross margin is…arrow_forwardPrepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget.3. Direct materials budget. The management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Liabilities and Equity Cash $ 65,000 Liabilities Accounts receivable 399,000 Accounts payable $ 204,500 Raw materials inventory 90,200 Loan payable 27,000 Finished goods inventory 308,028 Long-term note payable 500,000 $ 731,500 Equipment $ 630,000 Equity Less: Accumulated depreciation 165,000 465,000 Common stock 350,000 Retained earnings 245,728 595,728 Total assets $ 1,327,228 Total liabilities and equity $ 1,327,228 To prepare a master budget for April, May, and June, management gathers the following information. Sales for March total 22,800 units. Budgeted sales in units follow: April, 22,800; May, 16,000; June, 23,000; and July, 22,800.…arrow_forward

- The following information was taken from Bonita Industries's cash budget for the month of July: Beginning cash balance $440000 Cash receipts 404000 Cash disbursements 558000 If the company's policy is to maintain a minimum end of the month cash balance of $430000, the amount the company would have to borrow in July is $286000. $144000. $10000. $26000.arrow_forwardHillyard Company, an office supplies specialty store, prepares its master budget on a quarterly basis. The following data have been assembled to assist in preparing the master budget for the first quarter: As of December 31 (the end of the prior quarter), the company’s general ledger showed the following account balances: Cash $ 40,000 Accounts receivable 200,000 Inventory 57,750 Buildings and equipment (net) 350,000 Accounts payable $ 85,125 Common stock 500,000 Retained earnings 62,625 $ 647,750 $ 647,750 Actual sales for December and budgeted sales for the next four months are as follows: December(actual) $ 250,000 January $ 385,000 February $ 582,000 March $ 296,000 April $ 193,000 Sales are 20% for cash and 80% on credit. All payments on credit sales are collected in the month following sale. The accounts receivable at December 31 are a result of December credit sales. The company’s gross margin is…arrow_forwardThe budget director of Heathers Florist has prepared the following sales budget. The company had $ 121,600 in accounts receivable on July 1. Heathers Florist normally collects 100 percent of accounts receivable in the month following the month of sale.Required Complete the schedule of cash receipts by filling in the missing amounts.Determine the amount of accounts receivable the company will report on its third quarter pro forma balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education