FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 7

View Policies

Current Attempt in Progress

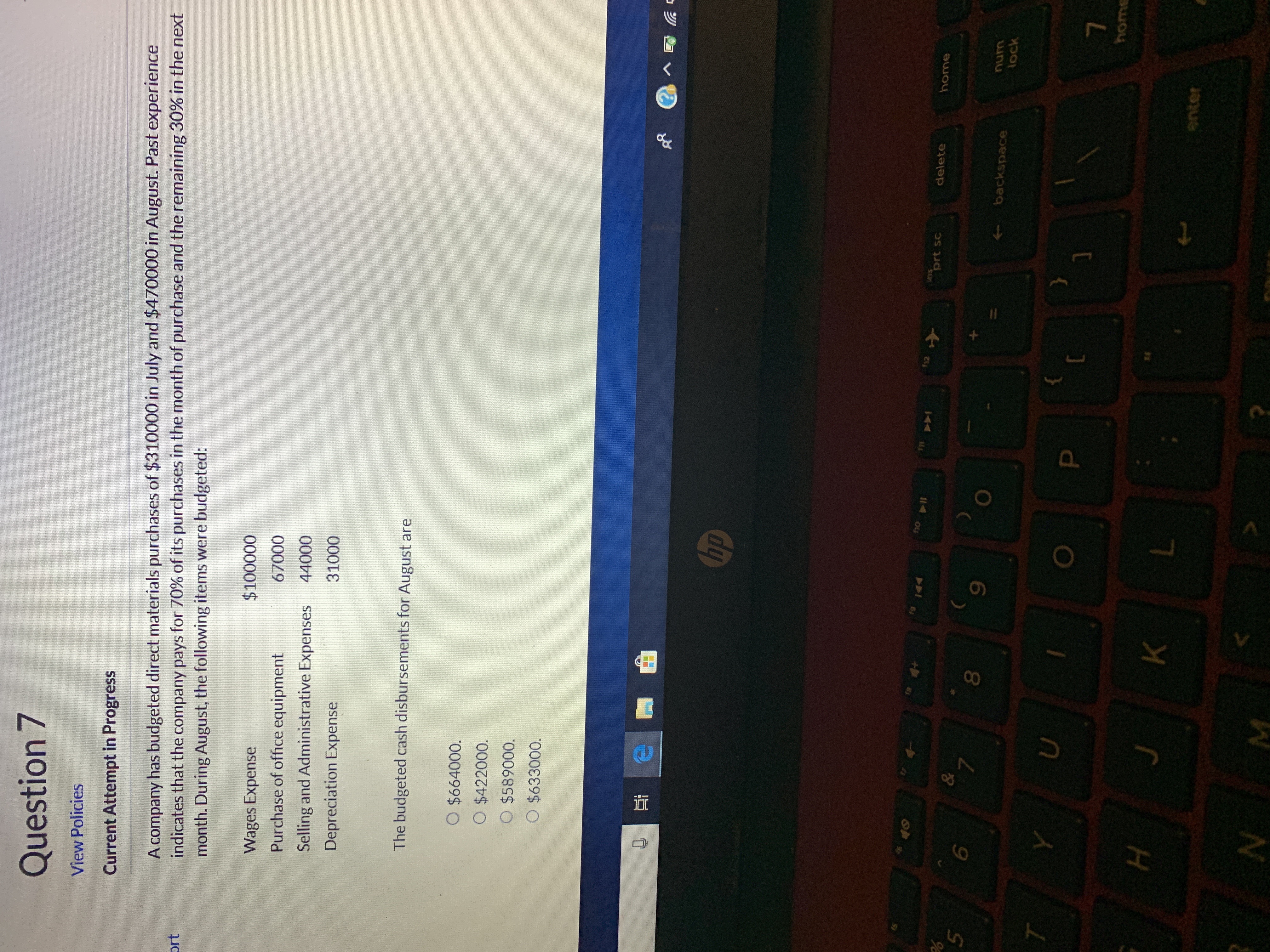

A company has budgeted direct materials purchases of $310000 in July and $470000 in August. Past experience

indicates that the company pays for 70 % of its purchases in the month of purchase and the remaining 30% in the next

month. During August, the following items were budgeted:

$100000

Wages Expense

67000

Purchase of office equipment

44000

Selling and Administrative Expenses

31000

Depreciation Expense

The budgeted cash disbursements for August are

O $664000.

O $422000.

O $589000.

O $633000.

hp

44

ns

prt sc

delete

home

&

7

5

num

backspace

lock

U

home

K

enter

N M

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Production and Purchases Budgets Drainage Solutions Culverts produces small culverts for water drainage under two-lane dirt roads. Budgeted unit sales for the next several months are: Month Sales September 2,100 October 1,600 November 900 December 600 At the beginning of September, 525 units of finished goods were in inventory. During the final third of the year, as road construction declines, plans are to have an inventory of finished goods equal to 25 percent of the following month's sales. Each unit of finished goods requires 600 pounds of raw materials at a cost of $5 per pound. Management wishes to maintain month-end inventories of raw materials equal to 50 percent of the following month's needs. Five hundred thousand pounds of raw materials were on hand at the start of September. Required a. Prepare a production budget for September, October, and November. Do not use a negative sign with your answers. Drainage Solutions Culverts Production Budget For the Months of September,…arrow_forwardProvide solution for this questionarrow_forwardiiiiarrow_forward

- Nonearrow_forwardCash Budget The controller of Stanley Yelnats Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales Manufacturing costs 42,000 $101,000 $121,000 $171,000 52,000 62,000 Selling and administrative expenses Capital expenditures 29,000 33,000 38,000 41,000 The company expects to sell about 15% of its merchandise for cash. Of sales on account, 65% are expected to be collected in full in the month following the sale and the remainder in the following month. Depreciation, Insurance, and property tax expense represent $8,000 of the estimated monthly manufacturing costs. The annual Insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following month. All selling and administrative expenses are paid in the month incurred.…arrow_forwardCash Receipts Budget and Accounts Receivable Aging Schedule Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the following sales: Quarter 1 $4,690,000 Quarter 2 5,410,000 Quarter 3 4,890,000 Quarter 4 7,920,000 In Shalimar's experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are $5,160,000 and for the fourth quarter of the current year are $7,430,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. Quarter Cash Sales Credit Sales 3, current year $_______ $______ 4, current year ________ _______ 1, next year _______ _______ 2,…arrow_forward

- Current Attempt in Progress Sunland Company's budgeted sales and direct materials purchases are as follows. Budgeted Sales Budgeted D.M. Purchases January $188,000 $28,200 February 206,800 33,840 March 235,000 35,720 A Sunland's sales are 30% cash and 70% credit. Credit sales are collected 10% in the month of sale, 50% in the month following sale, and 36% in the second month following sale; 4% are uncollectible. Sunland's purchases are 50% cash and 50% on account. Purchases on account are paid 40% in the month of purchase, and 60% in the month following purchase. (a) Prepare a schedule of expected collections from customers for March. SUNLAND COMPANY Schedule of Expected Collections from Customersarrow_forwardS ABC Company's raw materials purchases for June, July, and August are budgeted at $39,000, $29,000, and $54,000, respectively. Based on past experience, ABC expects that 70% of a month's raw material purchases will be paid in the month of purchase and 30% in the month following the purchase. Required: Prepare an analysis of cash disbursements from raw materials purchases for ABC Company for August. Budgeted raw material purchases August cash payments: Current month's purchases Prior month's purchases Total cash payments June July August $ 0arrow_forwardQuestion 10 Cash Budget Daybook Inc. collects 30% of its sales on account in the month of the sale and 70% in the month following the sale. If sales on account are budgeted to be $105,000 for September and $116,000 for October, what are the budgeted cash receipts from sales on account for October?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education