Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:cash balance of $10,000 will be maintained throughout the cash budget period. Prepare

a monthly cash budget for January and February and answer the following:

How much surplus (or loan) is expected at the end of February?

A $1,900

B. $200

C. $1,400

D. $3,100

E. none of the other choices is correct

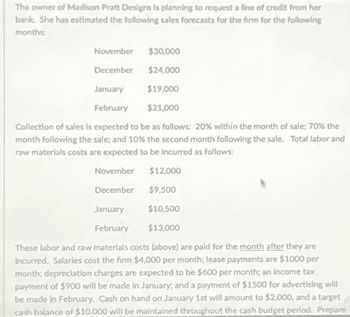

Transcribed Image Text:The owner of Madison Pratt Designs is planning to request a line of credit from her

bank She has estimated the following sales forecasts for the firm for the following

months:

November

$30,000

December $24,000

January $19,000

February

$21,000

Collection of sales is expected to be as follows: 20% within the month of sale; 70% the

month following the sale; and 10% the second month following the sale. Total labor and

raw materials costs are expected to be incurred as follows:

November

$12,000

December $9,500

January $10,500

February $13,000

These labor and raw materials costs (above) are paid for the month after they are

incurred. Salaries cost the firm $4,000 per month; lease payments are $1000 per

month; depreciation charges are expected to be $600 per month; an income tax

payment of $900 will be made in January; and a payment of $1500 for advertising will

be made in February. Cash on hand on January 1st will amount to $2,000, and a target

cash balance of $10.000 will be maintained throughout the cash budget period. Prepare

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- A cash budget. Show the budget by month and in total. Determine any borrowing that would be needed to maintain the minimum cash balance of $57,000.arrow_forwardHow do I solve the chart?arrow_forwardJayden's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: November December Actual $ 240,000 January 260,000 February March Forecast Additional Information $ 320,000 April forecast $360,000 360,000 370,000 Of the firm's sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 30 percent are paid in the month after sale and 70 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense…arrow_forward

- Mecca 4 Company, a retailer of specialty wall-papers, prepares a monthly master budget. Data for the September master budget are given below: a. The August 31st balance sheet (Actual): cash accounts receivable inventory building and equipment (net) $25,000 133,000 32,813 203,500 e. accounts payable August-Actual September-Projected October-Projected November-Projected capital stock retained earnings b. Actual sales for August and budgeted sales for September, October, and November are given below: $62,016 $190,000 375,000 405,000 310,000 295,372 36,925 C. Sales are 30% for cash and 70% on credit. All credit sales are collected in the month following the sale. There are no bad debts. d. The gross margin percentage is 65% of sales. The desired ending inventory is equal to 25% of the following month's COGS. One fourth of the purchases are paid for in the month of the purchase and the remaining 75% are purchased on account and paid in full the following month. The monthly operating…arrow_forwardCoronado, Inc. prepared the following cash budget for the fourth quarter. Fill in the missing amounts, assuming that Coronado desires to maintain a $15,000 minimum monthly cash balance and all equipment was purchased during December. Any required borrowings and repayments must be made in even increments of $1,000. (Enter answers in necessary fields only. Leave other fields blank. Do not enter 0.) Please help me fill in the blanks with work so I can follow along.arrow_forwardThe company provides the following information regarding the cash budget for next year: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Beginning cash balance $5,000 $5,000 $5,000 $5,000 Excess (Deficiency) ($3,000) $2,000 ($2,500) $1,000 The company's policy is to start each quarter with a cash balance of $5,000.The company has access to a line of credit in the amount of $50,000 for any short term borrowing needs and pays the loans off as quickly as possible.The company assumes the cash budget for the year will begins with no loans.What is the expected loan balance at the end of Quarter 2 (ignore interest)?arrow_forward

- Please help with question 1 and 2. Both the images are of the same continuing questionarrow_forwardYour Company is working on its cash budget for July. The budgeted beginning cash balance is $46,000. Budgeted cash receipts total $174,000 and budgeted cash disbursements total $175,000. The desired ending cash balance is $50,000. What is the excess (deficiency) of cash available over disbursements for July? Group of answer choices $ 45,000 $221,000 $ 50,000 $ 1,000 $ 47,000arrow_forwardGiving questions, Prepare a cash budget for the January and February for the year 2020arrow_forward

- c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0. Leave no cells blank be certain to enter O wherever required. Total cash receipts Total cash payments Net cash flow Beginning cash balance Cumulative cash balance Monthly loan (or repayment) Ending cash balance Cumulative loan balance Jayden's Carryout Stores. Cash Budget January 0 0 0 February 0 0 0 March 0 0arrow_forwardDevelop a cash budget for the next three months using the information provided below. Monthly sales forecasts are $150,000, $180,000, and $60,000 (June, July, August) The current month's sales are $120,000 (May) Cost of goods sold equals 65% of sales Lease payment= 22,000 per month The company is required to pay an installment of $120,000 for a note (debt) The cash position at the end of the current month is $80,000 The target cash balance is $50,000 Assume that 60% of sales are collected in the month sold and the remaining collected in the following month.arrow_forwardCarmen is a retailer of scrapbooking products. The sales forecast for the coming months is: Revenues April May $ 253,000 $ 272,000 $ 299,000 $ 346,000 $ 355,000 June July August Carmen's sales are 60% cash and 40% store credit. The credit sales are collected 60% in the month of sale, the remainder the following month. Accounts receivable on April 1 are $34,000. Carmen's cost of sales averages 65% of revenues. The inventory policy is to carry 30% of next month's sales needs. April 1 inventory will be as expected under the policy. Carmen pays for purchases 40% in the month of purchase and 60% the following month. Accounts payable on April 1 is $133,000. a. Prepare a purchases budget for as many months as is possible. April May June July August Sales Cost of Sales Percentage % % Cost of Sales Ending Inv Beginning Inv Purchasesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education