Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

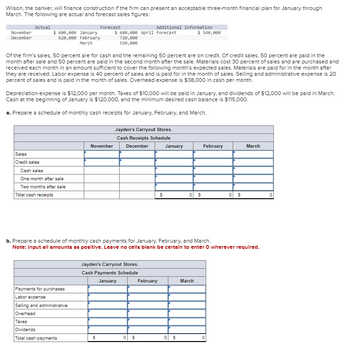

Transcribed Image Text:Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through

March. The following are actual and forecast sales figures:

Actual

November

December

Sales

Credit sales

$ 600,000 January

620,000 February

March

Cash sales

One month after sale

Two months after sale

Total cash receipts

Of the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit. Of credit sales, 50 percent are paid in the

month after sale and 50 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and

received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after

they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense is 20

percent of sales and is paid in the month of sales. Overhead expense is $38,000 in cash per month.

Forecast

Depreciation expense is $12,000 per month. Taxes of $10,000 will be paid in January, and dividends of $12,000 will be paid in March.

Cash at the beginning of January is $120,000, and the minimum desired cash balance is $115,000.

a. Prepare a schedule of monthly cash receipts for January, February, and March.

Payments for purchases

Labor expense

Selling and administrative

Overhead

Taxes

Dividends

Total cash payments

November

$ 680,000 April forecast

720,000

550,000

Additional Information

$

Jayden's Carryout Stores.

Cash Receipts Schedule

December

Jayden's Carryout Stores.

Cash Payments Schedule

January

0 $

$

February

January

b. Prepare a schedule of monthly cash payments for January, February, and March.

Note: Input all amounts as positive. Leave no cells blank be certain to enter O wherever required.

$ 540,000

$

0 $

March

February

0 $

March

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

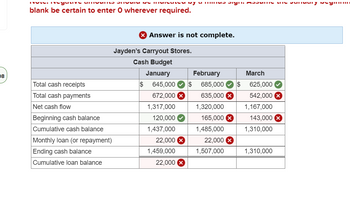

I put them in as negatives and it was still wrong.

Transcribed Image Text:08

meyouve amount STEM DE INMIGO my a mində sığnı. Assume ane yanuary wym

blank be certain to enter O wherever required.

Total cash receipts

Total cash payments

Net cash flow

Beginning cash balance

Cumulative cash balance

Monthly loan (or repayment)

Ending cash balance

Cumulative loan balance

X Answer is not complete.

Jayden's Carryout Stores.

Cash Budget

January

$ 645,000 $

672,000 X

1,317,000

120,000

1,437,000

22,000 X

1,459,000

22,000 x

February

685,000 $

635,000 x

1,320,000

165,000 X

1,485,000

22,000 x

1,507,000

March

625,000

542,000 X

1,167,000

143,000

1,310,000

1,310,000

Solution

by Bartleby Expert

Follow-up Question

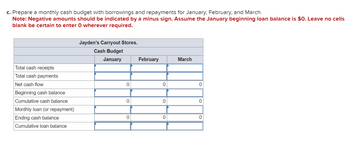

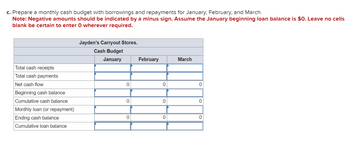

Transcribed Image Text:c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March.

Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0. Leave no cells

blank be certain to enter O wherever required.

Total cash receipts

Total cash payments

Net cash flow

Beginning cash balance

Cumulative cash balance

Monthly loan (or repayment)

Ending cash balance

Cumulative loan balance

Jayden's Carryout Stores.

Cash Budget

January

0

0

0

February

0

0

0

March

0

0

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

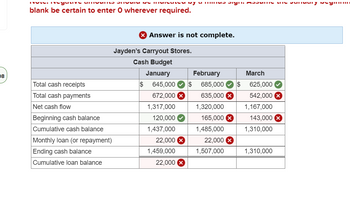

I put them in as negatives and it was still wrong.

Transcribed Image Text:08

meyouve amount STEM DE INMIGO my a mində sığnı. Assume ane yanuary wym

blank be certain to enter O wherever required.

Total cash receipts

Total cash payments

Net cash flow

Beginning cash balance

Cumulative cash balance

Monthly loan (or repayment)

Ending cash balance

Cumulative loan balance

X Answer is not complete.

Jayden's Carryout Stores.

Cash Budget

January

$ 645,000 $

672,000 X

1,317,000

120,000

1,437,000

22,000 X

1,459,000

22,000 x

February

685,000 $

635,000 x

1,320,000

165,000 X

1,485,000

22,000 x

1,507,000

March

625,000

542,000 X

1,167,000

143,000

1,310,000

1,310,000

Solution

by Bartleby Expert

Follow-up Question

Transcribed Image Text:c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March.

Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0. Leave no cells

blank be certain to enter O wherever required.

Total cash receipts

Total cash payments

Net cash flow

Beginning cash balance

Cumulative cash balance

Monthly loan (or repayment)

Ending cash balance

Cumulative loan balance

Jayden's Carryout Stores.

Cash Budget

January

0

0

0

February

0

0

0

March

0

0

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Bramble Enterprises had a tough month in May, but June's sales and cash activity are looking strong. Bramble had to borrow $3,000 in May in order to maintain the company's required minimum balance of $5,000. The loan carries an annual interest rate of 6%, with monthly interest payments required. Loan withdrawals, in $1,000 increments, are assumed to be taken out on the first of the month. Loan payments, also in $1,000 increments, reduce the principal on the last day of the month. The June 1 cash balance is $5,780. With budgeted cash receipts of $105,000 and cash disbursements of $102,800 in June, how much of the prior month's loan would Bramble be able to pay off in June, if any? What is Bramble's projected ending cash balance in June? Loan paid off $ 1000 Projected ending cash balance $ 6980arrow_forwardEnticement Co currently expects sales of $50,000 a month. Variable costs of sales are $40,000 a month (all payable in the month of sale). It is estimated that if the credit period allowed to accounts receivable were to be increased from 30 days to 60 days, sales volume would increase by 20%. All customers would be expected to take advantage of the extended credit. The cost of capital is 12 1/2% a year. What is the increase in accounts receivable? What is the financing cost (cost of capital) based on additional sales? What is the annual contribution margin on additional sales? What is the annual net benefit from extending credit period?arrow_forwardThe financial managers at Henderson Corporation are arranging the financing for working capital requirements for the upcoming year. Henderson's local bank offers a discount interest loan at a quoted (simple) interest rate of 12.00%. With a discount interest loan, interest is payable up front, and the actual amount received is less than the face amount of the loan. Suppose Henderson applies for a $300,000 loan with a nine-month term. Calculate the interest payment, the amount of cash received, the annual percentage rate (APR), and the effective annual rate (EAR) of this loan. Interest payment Amount of cash received Annual percentage rate (APR) Effective annual rate (EAR) What is the nine-month rate if the bank charges a $100 processing fee? O 9.93% O 9.03% O 8.94% Value O 13.19%arrow_forward

- It is December 31. Last year, Galaxy Corporation had sales of $80,000,000, and it forecasts that next year's sales will be $86,400,000. Its fixed costs have been-and are expected to continue to be-$44,000,000, and its variable cost ratio is 10.00 %. Galaxy's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 12%, and 5,000,000 shares of outstanding common equity. The company's profits are taxed at a marginal rate of 35%. The following are the two principal equations that can be used to calculate a firm's DFL value: DFL (at EBIT = $X) = Given this information, complete the following sentences: Percentage Change in EPS Percentage Change in EBIT Consider the following statement about DFL, and indicate whether or not it is correct. 0 0 DFL (at EBITSX) = • The company's percentage change in EBIT is . The percentage change in Galaxy's earnings per share (EPS) is • The degree of financial leverage (DFL) at $86,400,000 is. (Hint: Use the changes in EPS…arrow_forwardSuppose that Ken-Z Art Gallery has annual sales of $870,000, cost of goods sold of $560,000, average inventories of $244,500, average accounts receivable of $265,000, and an average accounts payable balance of $79,000. Assuming that all of Ken-Z's sales are on credit, what will be the firm's cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forwardThe Bandon Pine Corporation's purchases from suppliers in a quarter are equal to 60 percent of the next quarter's forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 25 percent of sales and interest and dividends are $95 per quarter. No capital expenditures are planned. Here are the projected quarterly sales: Q1 az 03 Q4 Sales $1,860 $2,160 $1,860 $1,560 Sales for the first quarter of the following year are projected at $2,190. Calculate the company's cash outleys by completing the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Payment of accounts Wages, taxes, other expenses Long-term financing expenses (interest and dividends) Q1 Q2 Q3 Q4arrow_forward

- To meet any shortfall in the previous question, NewBank will borrow the cash in the fed funds market. Management decides to borrow the needed funds for the remainder of the month (now 29 days). The required yield on a discount basis is 2.9%. What does the balance sheet look like after this transaction?arrow_forwardThe management of XYZ Co has annual credit sales of $20 million and accounts receivable of $4 million. Working capital is financed by an overdraft at 12% interest per year. Assume 365 days in a year. What is the annual finance cost saving if the management reduces the collection period to 60 days?arrow_forwardBiochemical Corporation requires $650,000 in financing over the next three years. The firm can borrow the funds for three years at 12.60 percent interest per year. The CEO decides to do a forecast and predicts that if she utilizes short-term financing instead, she will pay 9.25 percent interest in the first year, 13.50 percent interest in the second year, and 10.50 percent interest in the third year. Assume interest is paid in full at the end of each year. Determine the total interest cost under each plan. Long-term fixed-rate Short-term variable-rate Which plan is less costly? multiple choice Short-term variable-rate plan Long-term fixed-rate plan interest costarrow_forward

- (Cost of factoring) MDM Inc. is considering factoring its receivables. The firm has credit sales of $300,000 per month and has an average receivables balance of $600,000 with 60-day credit terms. The factor has offered to extend credit equal to 89 percent of the receivables factored less interest on the loan at a rate of 1.3 percent per month. The 11 percent difference in the advance and the face value of all receivables factored consists of a 2 percent factoring fee plus a 9 percent reserve, which the factor maintains. In addition, if MDM Inc. decides to factor its receivables, it will sell them all, so that it can reduce its credit department costs by $1,200 a month. a. What is the cost of borrowing the maximum amount of credit available to MDM Inc. through the factoring agreement? Note: Assume a 30-day month and 360-day year. b. What considerations other than cost should MDM Inc. account for in determining whether to enter the factoring agreement? The cost of borrowing the maximum…arrow_forwardcO X HAS cASH BALANCE OF $33 AND SHORT TERM LOAN BALANCE OF $200 AT THE BEGINNING OF QTR 1. THE NET CASH INFLOW FOR THE 1ST QTR IS $89 AND THE FOR THE SECOND QTR THERE IS A NET CAHS OUTFLOW OF $44. aLL CASH SHORTFALLS ARE FUNDED WITH SHORT TERM DEBT. THE FIRM PAYS 2% OF ITS PRIOR QUARTERS ENDING LOAN BALANCE AS INTERST EACH QUARTER. THE MINIMUM CASH BALANCE IS $25. wHAT IS THE SHORT TERM LOAN BALANCE AT THE END OF THE YEAR? available anwsers are 107 111 121 128 133arrow_forwardA firm has the following monthly pattern of sales: January $ 200 February 300 March 600 April 1,200 May 600 June 300 Sixty percent of the sales are on credit and are collected after a month. The company pays wages each month that are 60 percent of sales and has fixed disbursements (for example, rent) of $150 a month. In March it receives $250 from a bond that matures; in April and June it makes a tax payment of $150. Management maintains a cash balance of $200 at all times. Construct a cash budget that indicates the firm’s monthly needs for short-term financing. Its beginning cash position is $200. Round your answers to the nearest dollar. Enter the disbursements values in Part 2 and desired level of cash in Part 3 as positive values. Use a minus sign to enter cash outflows, shortage of cash values, negative initial and ending cash positions in Part 3, if any. Do not leave any cells blank. If the answer is zero, enter "0". Part 1 January February…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education