FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Required

1. Prepare a cash receipts budget schedule for each of the first three months (July – September), including the total receipts per month

2. Prepare a material purchases budget schedule for each of the first three months (July – September), including the total purchases per month

3. Prepare a cash budget for the month of July. Include the owners’ cash contributions

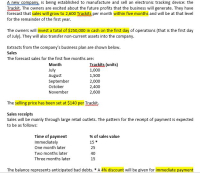

Transcribed Image Text:A new company, is being established to manufacture and sell an electronic tracking device: the

Trackit. The owners are excited about the future profits that the business will generate. They have

forecast that sales will grow to 2,600 Trackits per month within five months and will be at that level

for the remainder of the first year.

The owners will invest a total of $250,000 in cash on the first day of operations (that is the first day

of July). They will also transfer non-current assets into the company.

Extracts from the company's business plan are shown below.

Sales

The forecast sales for the first five months are:

Irackits (units)

1,000

Month

July

August

September

October

1,500

2,000

2,400

November

2,600

The selling price has been set at $140 per Trackit.

Sales receipts

Sales will be mainly through large retail outlets. The pattern for the receipt of payment is expected

to be as follows:

Time of payment

Immediately

One month later

% of sales value

15*

25

Two months later

40

Three months later

15

The balance represents anticipated bad debts. * A 4% discount will be given for immediate payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ll. Subject Accountingarrow_forwardRequired: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. Budgeted Gross Margin SHADEE CORPORATION Budgeted Income Statement Budgeted Net Operating Income May Junearrow_forwardPrepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget.3. Direct materials budget. The management of Zigby Manufacturing prepared the following balance sheet for March 31. ZIGBY MANUFACTURING Balance Sheet March 31 Assets Liabilities and Equity Cash $ 65,000 Liabilities Accounts receivable 399,000 Accounts payable $ 204,500 Raw materials inventory 90,200 Loan payable 27,000 Finished goods inventory 308,028 Long-term note payable 500,000 $ 731,500 Equipment $ 630,000 Equity Less: Accumulated depreciation 165,000 465,000 Common stock 350,000 Retained earnings 245,728 595,728 Total assets $ 1,327,228 Total liabilities and equity $ 1,327,228 To prepare a master budget for April, May, and June, management gathers the following information. Sales for March total 22,800 units. Budgeted sales in units follow: April, 22,800; May, 16,000; June, 23,000; and July, 22,800.…arrow_forward

- Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February. Prepare a cash budget for January and February in columnar form. please dont provide answer in an image format thnkuarrow_forwardPerez Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Perez expects sales in January year 1 to total $210,000 and to increase 20 percent per month in February and March. All sales are on account. Perez expects to collect 68 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 8 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of year 1. Determine the amount of sales revenue Perez will report on the year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of year 1. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Prepare a sales budget for the first quarter of year 1.arrow_forwardSchedule of Cash Payments for a Service Company EastGate Physical Therapy Inc. is planning its cash payments for operations for the first quarter (January-March). The Accrued Expenses Payable balance on January 1 is $25,600. The budgeted expenses for the next three months are as follows: January February $58,900 $71,700 $79,400 4,900 5,400 6,400 45,400 49,500 54,500 $109,200 $126,600 $140,300 Other operating expenses include $3,200 of monthly depreciation expense and $700 of monthly insurance expense that was prepaid for the year on May 1 of the previous year. Of the remaining expenses, 80% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on January 1 relates to the expenses incurred in December. Salaries Utilities Other operating expenses Total Prepare a schedule of cash payments for operations for January, February, and March. EastGate Physical Therapy Inc. Schedule of Cash Payments for Operations…arrow_forward

- 3. The Uthred Company, a merchandising firm, has planned the following sales for the next four months: March $50,000 Аpril $70,000 Мay $90,000 June July $90,000 Total budgeted Sales $60,000 Sales are made 60% on account and 40% cash. From experience, the company has learned that a month's sales on account are collected according to the following pattern: Month of sale 60% • First month following month of sale . • Second month following month of sale • Uncollectible 28% 10% 2% Uthred has a building that is not used in the business operation; they rented it out and receive $10,080 rent every month. The company requires a minimum cash balance of $14,000 to start a month.arrow_forwardThe budget director for Rundle Cleaning Services prepared the following list of expected selling and administrative expenses. All expenses requiring cash payments are paid for in the month incurred except salary expense and insurance. Salary is paid in the month following the month in which it is incurred. The insurance premium for six months is paid on October 1. October is the first month of operations, accordingly, there are no beginning account balances. Required a. Complete the schedule of cash payments for S&A expenses by filling in the missing amounts. b. Determine the amount of salaries payable the company will report on its pro forma balance sheet at the end of the fourth quarter. c. Determine the amount of prepaid insurance the company will report on its pro forma balance sheet at the end of the fourth quarter. Complete this question by entering your answers in the tabs below. Req A Complete the schedule of cash payments for S&A expenses by filling in the missing amounts.…arrow_forwardCan you show how you got the numbers for question 6? Can you show me how to prepare the following: Prepare a selling and administrative expenses budget for January Prepare a budgeted income statement for Januaryarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education