FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

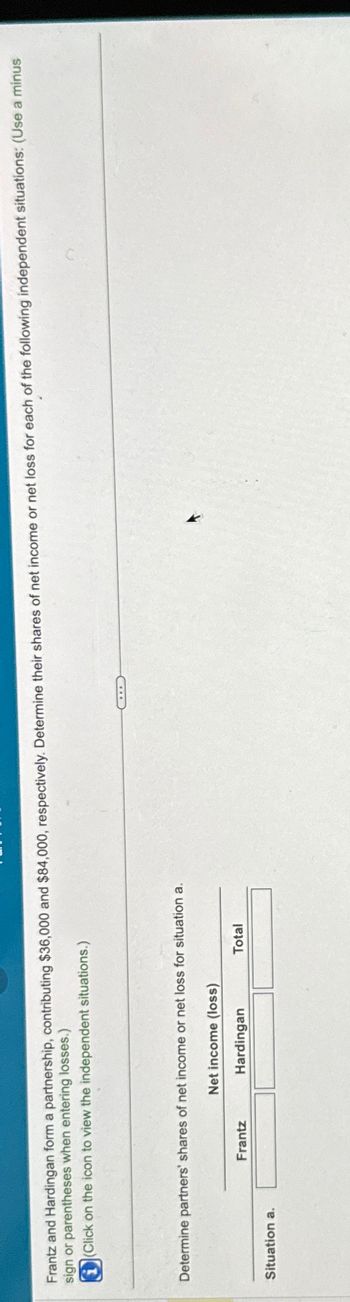

Transcribed Image Text:Frantz and Hardingan form a partnership,

sign or parentheses when entering losses.)

(Click on the icon to view the independent

contributing $36,000 and $84,000, respectively. Determine their shares of net income or net loss for each of the following independent situations: (Use a minus

situations.)

Determine partners' shares of net income or net loss for situation a.

Net income (loss)

Hardingan

Situation a.

Frantz

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- 1. What is KW Partnership’s ordinary business income (loss)? 2. Which of the following items are separately stated?arrow_forwardThe condensed balance sheet and profit – sharing ratio of the partnership of Wenda, Wendy, and Wilma are presented below: Cash P 22,500.00 Liabilities P52,500.00 Due from Wanda 7,500.00 Due to Wilma 10,000.00 Other assets 205,000.00 Wanda, cap’l (4) 75,000.00 Wendy, cap’l (3) 50,000.00 Wilma, cap’l (3) 47,500.00 Total assets P235,000.00 Total equities P235,000.00 21. The partners agreed to liquidate and they sold all the Other assets for P150,000.00. How much of the available cash should go to Wanda? a. P45,500.00 b. P75,000.00 c. P42,500.00 d. P53,000.00 22. Refer to No. 21 above, how much will be received by Wendy in the partnership liquidation a. P41,000.00 b. P74,000.00 c. P33,500.00 d. P66,600.00arrow_forwardThe following condensed balance sheet is for the partnership of Gulian, Singh, and Zahiri, who share profits and losses in the ratio of 4:3:3, respectively: Cash Other assets Gulian, loan Total assets $ 80,000 750,000 31,000 Beginning balances Sold assets $ 861,000 Accounts payable Zahiri, loan Gulian, capital Singh, capital Zahiri, capital Total liabilities and capital Required: The partners decide to liquidate the partnership. Fifty percent of the other assets are sold for $260,000. Prepare a proposed schedule of liquidation at this point in time. Note: Amounts to be deducted should be entered with a minus sign. Adjusted balances Max loss on remaining noncash assets Paid liabilities Safe payments GULIAN, SINGH, AND ZAHIRI Proposed Schedule of Liquidation Cash Other Assets Accounts Payable $ 280,000 41,000 250,000 150,000 140,000 $ 861,000 Gulian, Loan and Capital Singh, Capital Zahiri, Loan & Capitalarrow_forward

- Dividing Partnership Income. Tyler Hawes and Piper Albright formed a partnership, investing $210,000 and $70,000, respectively. Determine their participation in the year's net income of $110,000 under each of the following independent assumptions: a. No agreement concerning division of net income. b. Divided in the ratio of original capital investment. c. Interest at the rate of 5% allowed on original investments and the remainder divided in the ratio of 2:2. d. Salary allowances of $40,000 and $48,000, respectively, and the balance divided equally. e. Allowance of interest at the rate of 5% on original investments, salary allowances of $40,000 and $48,000, respectively, and the remainder divided equally. Hawes Albright (a) (b) (c) (d) (e) 00000 00000arrow_forwardplease answer do not image formatarrow_forwardThe following condensed balance sheet is for the partnership of Hardwick, Saunders, and Ferris, who share profits and losses in the ratio of 4:3:3, respectively: Cash Other assets Hardwick, loan Total assets $ 93,000 815,000 44,000 Beginning balances Sold assets $952,000 Accounts payable Ferris, loan Hardwick, capital Saunders, capital Ferris, capital Adjusted balances Max loss on remaining noncash assets Paid liabilities Safe payments Total liabilities and capital The partners decide to liquidate the partnership. Forty percent of the other assets are sold for $125,000. Prepare a proposed schedule of liquidation at this point in time. (Amounts to be deducted should be entered with a minus sign.) HARDWICK, SAUNDERS, AND FERRIS Proposed Schedule of Liquidation Cash Other Assets $ 48,000 54,000 380,000 240,000 230,000 $952,000 Accounts Payable Hardwick, Loan and Capital Saunders, Capital Ferris, Loan & Capitalarrow_forward

- SEE ATTACHEDarrow_forwardFor Industry H, determine each partner's share of income assuming the partners agree to share income by giving a $67,700 per year salary allowance to Price, a $126,100 per year salary allowance to Waterhouse, a $113,700 per year salary allowance to Coopers, a 15% interest on their initial capital investments, and the remaining balance shared equally. (Enter all allowances as positive values. Enter losses as negative values.) Important! Be sure to click the correct Industry at the top of the dashboard. Net income (loss) Salary allowances Balance of income (loss) Interest allowances Balance of income (loss) Balance allocated equally Balance of income (loss) Shares of each partner Initial partnership investments Net income Allocation of Partnership Income Price Total net income Total 0 Waterhouse $ $ PRICE, WATERHOUSE, AND COOPERS Statement of Partners' Equity For Year Ended December 31 Price Coopers 0 0 Waterhouse 0 0 0 $ For Industry H, prepare a statement of partners' equity for the…arrow_forwardThe Pen, Evan, and Torves Partnership has asked you to assist in winding-up its business affairs. You compile the following information: 1. The partnership's trial balance on June 30, 20X1, Is Cash Accounts Receivable (net) Inventory Plant and Equipment (net) Accounts Payable Pen, Capital Evan, Capital Torves, Capital Total Profit and loss percentages Preliquidation capital balances Loss absorption potential (capital balances / loss percent) Decrease highest LAP to next highest: Debit $ 6,800 30,000 22,000 99,700 Decrease LAPS to next highest: $ 158,500 2. The partners share profits and losses as follows: Pen, 50 percent; Evan, 30 percent; and Torves, 20 percent. 3. The partners are considering an offer of $108,000 for the firm's accounts receivable, Inventory, and plant and equipment as of June 30. The $108,000 will be paid to creditors and the partners in Installments, the number and amounts of which are to be negotiated. Required: Prepare a cash distribution plan as of June 30,…arrow_forward

- The following condensed balance sheet is for the partnership of Miller, Tyson, and Watson, who share profits and losses in the ratio of 6:2:2, respectively: Cash $ 50,000 Liabilities $ 42,000 Other assets 150,000 Miller, capital 69,000 Tyson, capital 69,000 Watson, capital 20,000 Total assets $ 200,000 Total liabilities and capital $ 200,000 a. Assuming no liquidation expenses, calculate the safe payments that can be made to partners at this point in time.arrow_forwardAfter the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forwardPlease show work 1. Nan and Lew formed an equal partnership. Nan contributes property with an adjusted basis of $75,000 to a partnership. The property has a fair market value of $120,000 on the date of the contribution. a. What is the partnership’s basis in the property contributed by Nan? $ _________________ b. What is the amount of gain recognized by Nan in this transaction? $ __________________ c. Lew performs services valued at $105,000 for the partnership for his one-third interest in the partnership. Income or gain recognized $____________ His basis in the Partnership interest $____________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education