FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Under the following four independent assumptions, prepare the journal entries for the sale of the land and buildings, allocation of any loss or gain,any deficits, the payment of the liability, and the distributions to the partners if:

A) the land and buildings were sold for 180,000, and any partners with a resulting deficits can and do pay the amount of their deficits

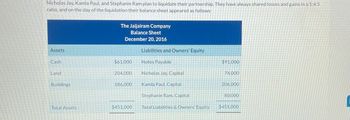

Transcribed Image Text:Nicholas Jay, Kamla Paul, and Stephanie Ram plan to liquidate their partnership. They have always shared losses and gains in a 1:4:5

ratio, and on the day of the liquidation their balance sheet appeared as follows:

The Jaijairam Company

Balance Sheet

December 20, 2016

Assets

Liabilities and Owners' Equity

Cash

$61,000

Notes Payable

$91,000

Land

204,000

Nicholas Jay, Capital

74,000

Buildings

186,000

Kamla Paul, Capital

206,000

Stephanie Ram, Capital

80,000

Total Assets

$451,000

Total Liabilities & Owners' Equity

$451,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- As part of the initial investment, Jackson contributes accounts receivable that had a balance of $40,480 in the accounts of a sole proprietorship. Of this amount, $1,308 is deemed completely worthless. For the remaining accounts, the partnership will establish a provision for possible future uncollectible accounts of $655. The amount debited to Accounts Receivable for the new partnership isarrow_forwardEntry of a new partner under the goodwill method.Pearsonand Murphy have partner capital balances, at book value, of $45,000 and $65,000 as of Decem-ber 31. Pearson is allocated 60% of profits or losses, and Murphy is allocated the balance. Thepartners believe that tangible net assets have a market value in excess of book value in theamount of $30,000 net. The $30,000 is allocated as follows:Book ValueMarket ValueAccounts receivable . . . . . . . . .$120,000$102,000Inventory . . . . . . . . . . . . . . . . . .200,000258,000Warranty obligations . . . . . . . .20,00030,000They are considering admitting Warner to the partnership in exchange for total considera-tion of $84,000 cash. In exchange for the consideration, Warner will receive a 30% interest incapital and a 35% interest in profits.1. Prepare the entries associated with the admission of Warner to the partnership under thegoodwill method.2. If the goodwill suggested by the admission of Warner proved to be…arrow_forwardHi, can someone help me with this question please?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education