FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

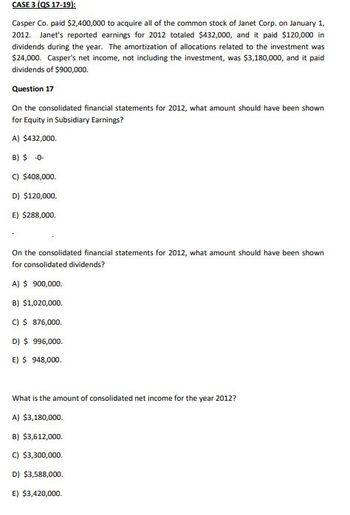

Transcribed Image Text:CASE 3 (QS 17-19);

Casper Co. paid $2,400,000 to acquire all of the common stock of Janet Corp. on January 1,

2012. Janet's reported earnings for 2012 totaled $432,000, and it paid $120,000 in

dividends during the year. The amortization of allocations related to the investment was

$24,000. Casper's net income, not including the investment, was $3,180,000, and it paid

dividends of $900,000.

Question 17

On the consolidated financial statements for 2012, what amount should have been shown

for Equity in Subsidiary Earnings?

A) $432,000.

B) $ -0-

C) $408,000.

D) $120,000.

E) $288,000.

On the consolidated financial statements for 2012, what amount should have been shown

for consolidated dividends?

A) $ 900,000.

B) $1,020,000.

C) $ 876,000.

D) $ 996,000.

E) $ 948,000.

What is the amount of consolidated net income for the year 2012?

A) $3,180,000.

B) $3,612,000.

C) $3,300,000.

D) $3,588,000.

E) $3,420,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 24 At the beginning of the year, Fairbridge, Inc. purchased an investment in Miller Milling Mills for $500,000, representing 10% of the book value of Miller. During the year, Miller reported net income of $800,000 and pays cash dividends of $92,000. At the end of the year, the fair value of Fairbridge’s investment is $525,000. Required At what amount is the investment reported on Fairbridge’s balance sheet at year-end? What amount of income from investments does Fairbridge report? Prepare journal entries to record the transactions for Fairbridge Company.arrow_forwardThe investments of Harlon Enterprises included the following cost and fair value amounts: ($ in millions) Fair Value, Dec. 31 Securities Available-for-Sale 2016 Cost 2017 A Corporation shares B Corporation bonds C Corporation shares $ 20 $14 na $ 37 35 35 15 14 na D Industries shares 50 46 45 Totals $115 $95 $101 Harlon Enterprises sold its holdings of A Corporation shares on June 1, 2017, for $15 million. On September 12, 2017, it purchased the C Corporation shares. Required: 1. What is the effect of the sale of the A Corporation shares and the purchase of the C Corporation shares on Harlon's 2017 pretax earnings? 2. At what amount should Harlon's securities available-for-sale portfolio be reported in its 2017 balance sheet? What adjusting entry is needed to accomplish this? What is the effect of the adjustment on Harlon's 2017 pre- tax earnings?arrow_forward(TCO A) Bend Inc. holds 25% of the outstanding voting shares of Calico Co. and appropriately applies the equity method of accounting. Amortization associated with this investment equals $9,000 per year. For 20X3, Calico reported earnings of $80,000 and paid cash dividends of $30,000. During 20X3, Calico acquired inventory for $57,600, which was then sold to Bend for $90,000. At the end of 20X3, Bend still held some of this inventory at its transfer price of $40,000.Required:(1) Determine the amount of intra-entity profit at the end of 20X3.(2) Determine the amount of Equity in Investee Income that Bend should have reported for 20X3.arrow_forward

- 26. On January 1, B company paid $2,295,000 to acquire 90,000 shares of O company's voting common stock, which represents a 30 percent investment. No allocations to goodwill or other specific accounts were made. Significant influence over O company is achieved by this acquisition, and so B company applies the equity method. O company declared a $1 per share dividend during the year and reported net income of $750,000. What is the balance in the Investment in O company account found in B company's financial records as of December 31?arrow_forwardPearl Corporation paid $300,000 on January 1, 2010 for a 35% interest in Sandlin Inc. On January 1, 2010, the book value of Sandlin's stockholders' equity consisted of $400,000 of common stock and $400,000 of retained earnings. All the excess purchase cost over book value acquired was attributable to a patent with an estimated life of 5 years. During 2010 and 2011, Sandlin paid $6,000 of dividends each quarter and reported net income of $120,000 for 2010 and S160,000 for 2011. Pearl used the equity method. Required: 1. Calculate Pearl's income from Sandlin for 2010. 2. Determine the balance of Pearl's Investment in Sandlin account on December 31, 2010arrow_forwardCardinal Company acquires an 80% interest in Huron Company common stock for $420,000 cash on January 1, 2015. At that time, Huron Company has the following balance sheet: (attached)Prepare a determination and distribution of excess schedule for the investment in Huron Company (a value analysis is not needed). Prepare journal entries that Cardinal Company would make on its books to record income earned and/or dividends received on its investment in Huron Company during 2015 and 2016 under the following methods: simple equity, sophisticated equity, and cost.arrow_forward

- Porter Corporation purchased 80% of the common stock of Salem Company for $850,000 on January 1, 2013. During the next three years, Salem had the following income and Dividends paid: Year Income Dividends 2013 $100,000 $25,000 2014 $110,000 $35,000 2015 $170,000 $60,000 Prepare the journal entries made under both methods and then compute the ending balance in the "investment" account under both methods.arrow_forward. Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1, 2013, at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings. The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest. Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013. Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows: 2013 2014 Paulee's sales to Sergio $5,000 $6,000 Paulee's cost of sales to Sergio 3,000 3,500 Unrealized profit at year-end 1,000 1,500 At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory…arrow_forwarddevratarrow_forward

- Nonearrow_forwardCrane Company reported net income of $470000 for the year ended 12/31/21. Included in the computation of net income were: depreciation expense, $59000; amortization of a patent, $31000; income from an investment in common stock of Blossom Company, accounted for under the equity method, $47000; and amortization of a bond discount, $11000. Crane also paid an $79000 dividend during the year. The net cash provided by operating activities would be reported at O $445000. $414000. $335000. O $524000.arrow_forwardLuck Corporation , which was formed January 1, 2015, has a net short-term capital gain of $60,000 and a net long-term capital loss of $100,000 during 2020. Luck Corporation had taxable income from other sources of $200,000. Prior years' transactions included the following (note 2019 had no capital gains or losses):2015- net long term capital gain of 150k 2016- net short term capital gain of 24k 2017- net short term capital gain of 12k 2018- net long term capital gain of 8kLuck's carryover to 2021 is: Select one: a. $0 b. $40,000 long-term capital loss c. $20,000 long-term capital loss d. $20,000 short-term capital loss e. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education