FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Book

Print

erences

Divide

Impairment loss.

Investment, end of year

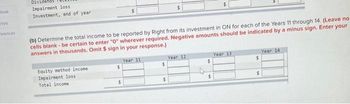

(b) Determine the total income to be reported by Right from its investment in ON for each of the Years 11 through 14. (Leave no

cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Enter your

answers in thousands. Omit $ sign in your response.).

Year 11

Equity method income

Impairment loss

Total income

$

Year 12

S

$

to

$

$

Year 13

$

Year 14

Transcribed Image Text:ces

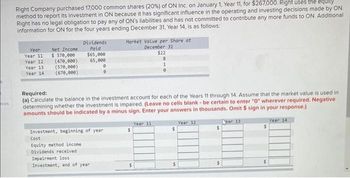

Right Company purchased 17,000 common shares (20%) of ON Inc. on January 1, Year 11, for $267,000. Right uses the equity

method to report its investment in ON because it has significant influence in the operating and investing decisions made by ON.

Right has no legal obligation to pay any of ON's liabilities and has not committed to contribute any more funds to ON. Additional

information for ON for the four years ending December 31, Year 14, is as follows:

Year

Year 11

Year 12

Year 13

Year 14

Net Income

$ 370,000

(470,000)

(570,000)

(670,000)

Dividends

Paid

$65,000

65,000

0

Market Value per Share at

December 311

Investment, beginning of year

Cost

Equity method income

Dividends received

Impairment loss

Investment, end of year

$22

8

1

Required:

(a) Calculate the balance in the investment account for each of the Years 11 through 14. Assume that the market value is used in

determining whether the investment is impaired. (Leave no cells blank - be certain to enter "0" wherever required. Negative

amounts should be indicated by a minus sign. Enter your answers in thousands. Omit $ sign in your response.)

Year 11

Year 12

ar 13

Year 14

$

$

0

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 5, 2020, Splish Brothers Company purchased the following stock securities: 282 shares Bonter Corporation common stock for $4,230. 470 shares Wane Corporation common stock for $9,400. 752 shares Strauss Corporation common stock for $21,432. Assume that Splish Brothers Company cannot exercise significant influence over the activities of the investee companies and that the cost method is used to account for the investments.On June 30, 2020, Splish Brothers Company received the following cash dividends: Bonter Corporation$2.00 per share Wane Corporation$1.00 per share Strauss Corporation$1.50 per share On November 15, 2020, Splish Brothers Company sold 156 shares of Strauss Corporation common stock for $7,020.On December 31, 2020, the fair value of the securities held by Splish Brothers Company is as follows: Bonter Corporation common stock $10 Wane Corporation common stock 16 Strauss Corporation common stock 28arrow_forward26. On January 1, B company paid $2,295,000 to acquire 90,000 shares of O company's voting common stock, which represents a 30 percent investment. No allocations to goodwill or other specific accounts were made. Significant influence over O company is achieved by this acquisition, and so B company applies the equity method. O company declared a $1 per share dividend during the year and reported net income of $750,000. What is the balance in the Investment in O company account found in B company's financial records as of December 31?arrow_forwardSubject: acountingarrow_forward

- Indigo Corporation purchased 370 shares of Sherman Inc. common stock for $13,100 (Indigo does not have significant influence). During the year, Sherman paid a cash dividend of $3.00 per share. At year-end, Sherman stock was selling for $37.50 per share. Assume the stock is nonmarketable. Prepare Indigo's journal entries to record (a) the purchase of the investment, (b) the dividends received, and (c) the fair value adjustment. (Assume a zero balance in the Fair Value Adjustment account.) (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.)arrow_forwardRohan Limited is a privately owned company and has 31 December year-end. The company elected to apply ASPE for its financial reporting. On January 1, 2017, Rohan Limited purchased 30 shares of the 100 outstanding common shares of another privately held company, Bassett Company, for $165,000 cash. Rohan Limited has significant influence as a result of this acquisition. At that date, the statement of financial position of Bassett Company reflected the following: Non-depreciable assets $155,400 (fair value, $199,000); Depreciable assets (net), $178,000 (fair value, $250,000); and Total liabilities, $101,900 (book value equaled fair value); The depreciable assets had remaining useful life of 5 years and had been depreciated using straight-line method. On December 31, 2017, Bassett Company reported net income of $88,400. Bassett Company also declared and paid cash dividend in the amount of $20,000 on December 31, 2017. Goodwill was not impaired over the time period in question. Required:…arrow_forwardConcord Corporation purchased for $285,000 a 25% interest in Murphy, Inc. This investment enables Concord to exert significant influence over Murphy. During the year, Murphy earned net income of $185,000 and paid dividends of $54,000.Prepare Concord’s journal entries related to this investment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record the purchase enter a debit amount enter a credit amount enter an account title to record the purchase enter a debit amount enter a credit amount (To record the purchase.) enter an account title to record the net income enter a debit amount enter a credit amount enter an account title to record the net income enter a debit amount enter a credit amount (To record the net income.)…arrow_forward

- Marigold Corporation purchased 630 common shares of Ditch Inc. for $12,900 on February 21. Marigold paid a 1% commission on the share purchase and, because the shares were not publicly traded, decided to account for them following the cost model. On June 30, Ditch declared and paid a cash dividend of $1.90 per share. (a) Prepare Marigold Corporation's journal entry to record the purchase of the investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Date Account Titles and Explanation Feb. 21 Debit Creditarrow_forwardOn May 1, Year 3, the board of directors of Boxer Industries declared a property dividend of 4,500 shares of King Corporation common stock that Boxer had purchased as an investment (book value: $58,500). The market value of the 4,500 King shares was $121,500 (or $27 per share) on the date of declaration and $180,000 (or $40 per share) on the date of distribution. What amount will be debited to Retained earnings in the journal entry recorded on the declaration date? amount debited to retained earnings on the date of declaration?arrow_forwardOn January 1, Tasty Foods purchased 10,000 shares (100%) of Eco-Safe Packaging’s voting stock for $12 per share. Throughout the year, both companies continue to operate as separate legal entities. By December 31, Eco-Safe Packaging’s cash balance is $2,000, and Tasty Foods’ cash balance is $5,000. In preparing its year-end financial statements, for how much would Tasty Foods report its cash balance? a. $7,000.b. $5,000.c. $3,000.d. $2,000.arrow_forward

- Cheyenne Corporation purchased for $327,000 a 25% interest in Murphy, Inc. This investment enables Cheyenne to exert significant influence over Murphy. During the year, Murphy earned net income of $185,000 and paid dividends of $62,000. Prepare Cheyenne's journal entries related to this investment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the purchase.) (To record the net income.) (To record the dividend.) Larrow_forwardHansabenarrow_forwardSandhill Corporation purchased for $288,000 a 25% interest in Murphy, Inc. This investment enables Sandhill to exert significant influence over Murphy. During the year, Murphy earned net income of $173,000 and paid dividends of $54,000. Prepare Sandhill's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education