FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

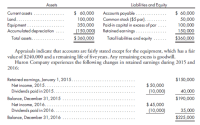

Cardinal Company acquires an 80% interest in Huron Company common stock for $420,000 cash on January 1, 2015. At that time, Huron Company has the following

Prepare a determination and distribution of excess schedule for the investment in Huron Company (a value analysis is not needed). Prepare

Transcribed Image Text:Assets

Liabilities and Equity

$ 60,000

100,000

350,000

Accounts payable ...

Common stock ($5 par)...

Paid-in capital in excess of par

Retained earnings ..

Totalliabilities and equity .....

$ 60,000

50,000

100,000

150,000

Current assets

Land......

Equipment

Accumulated depreciation

Total assets....

(150,000)

$ 360,000

$360,000

Appraisals indicate that accounts are fairly stated except for the equipment, which has a fair

value of $240,000 and a remaining life of five years. Any remaining excess is goodwill.

Huron Company experiences the following changes in retained earnings during 2015 and

2016:

Retained earnings, January 1,2015.

Net income, 2015.....

Dividends paid in 2015....

$150,000

$ 50,000

(10,000)

40,000

Balance, December 31,2015

$190,000

Net income, 2016......

Dividends paid in 2016.

$ 45,000

(10,000)

35,000

$225,000

Balance, December 31,2016

....

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ruiz Company puchased 30 per cent of Sim Company’s outstanding common stock for $3,000,000 and uses the equity method of accounting. Sim Company reported net income of $ 640,000 for 2018. On 2018 December 31, Sim Company paid a cash dividend of $200,000. In 2019, Sim Company incurred a net loss of $ 65,000. Prepare entries to reflect these events on Ruiz Company’s books.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardPlease include each step of calculations for my reference. Thanks!arrow_forward

- On January 1, 2023, Payne Company bought a 15 percent interest in Scout Company. The acquisition price of $225,500 reflected an assessment that all of Scout’s accounts were fairly valued within the company’s accounting records. During 2023, Scout reported net income of $121,900 and declared cash dividends of $36,200. Payne possessed the ability to significantly influence Scout’s operations and, therefore, accounted for this investment using the equity method. On January 1, 2024, Payne acquired an additional 80 percent interest in Scout and provided the following fair-value assessments of Scout’s ownership components: Consideration transferred by Payne for 80% interest $ 1,454,400 Fair value of Payne's 15% previous ownership 272,700 Noncontrolling interest's 5% fair value 90,900 Total acquisition-date fair value for Scout Company $ 1,818,000 Also, as of January 1, 2024, Payne assessed a $435,000 value to an unrecorded database internally developed by Scout. The database is…arrow_forwardPorter Corporation purchased 80% of the common stock of Salem Company for $850,000 on January 1, 2013. During the next three years, Salem had the following income and Dividends paid: Year Income Dividends 2013 $100,000 $25,000 2014 $110,000 $35,000 2015 $170,000 $60,000 Prepare the journal entries made under both methods and then compute the ending balance in the "investment" account under both methods.arrow_forwardThe following information relates to Crip Crippy Investment of HIJ Corporation. (1). Purchase investment for $1,000,000 on January 1, 2009 (2) HIJ Corporation had earnings of $600,00 at December 31, 2009 and declared dividends of $400,000. (3) The dividends were paid on January 2, 2010. (4) On July 1, 2010 Crip Crippy sold fifty percent of its interest for $ 400,000 (5) At June 30, 2010, HIJ had earnings of $600,000 for the year and paid dividends of $200,000 for shares outstanding as at November 30, 2010. Requiement: Using the cost and equity method, record all entries from January 1, 2009 to December 31, 2010 using the following scenarios (a) Crip Crippy purchased 40% of HIJ Corporation (b) Crip Crippy purchased 18% of HIJ Corporationarrow_forward

- Juniper Inc. acquired a 25% interest in Saturn Co. on January 1, 2021, for $260,000. During 2021, Saturn reported net income of $86,000, and paid a total cash dividend to shareholders in the amount of $16,000. Juniper uses the equity method to account for this investment. At the end of 2021, Juniper will report the following debit balance in the investment account: Question 6 options: $285,500 $260,000 $277,500 $281,500arrow_forwardDuring 2021 Blossom Company purchased 8700 shares of Nash Inc. for $17 per share. During the year Blossom Company sold 1850 shares of Nash, Inc. for $22 per share. At December 31, 2021 the market price of Nash, Inc.’s stock was $15 per share. What is the total amount of gain/(loss) that Blossom Company will report in its income statement for the year ended December 31, 2021 related to its investment in Nash, Inc. stock? $-8150 $-17400 $-4450 $9250arrow_forwardConcord Corporation purchased for $285,000 a 25% interest in Murphy, Inc. This investment enables Concord to exert significant influence over Murphy. During the year, Murphy earned net income of $185,000 and paid dividends of $54,000.Prepare Concord’s journal entries related to this investment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record the purchase enter a debit amount enter a credit amount enter an account title to record the purchase enter a debit amount enter a credit amount (To record the purchase.) enter an account title to record the net income enter a debit amount enter a credit amount enter an account title to record the net income enter a debit amount enter a credit amount (To record the net income.)…arrow_forward

- BuyCo, Inc. holds 25 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2017, Marqueen reported earnings of $100,000 and declares cash dividends of $30,000. During that year, Marqueen acquired inventory for $50,000, which it then sold to BuyCo for $80,000. At the end of 2017, BuyCo continued to hold merchandise with a transfer price of $32,000.a. What Equity in Investee Income should BuyCo report for 2017?b. How will the intra-entity transfer affect BuyCo’s reporting in 2018?c. If BuyCo had sold the inventory to Marqueen, how would the answers to (a) and (b) have changed?arrow_forwardConcord Corporation purchased for $288,000 a 25% interest in Murphy, Inc. This investment enables Concord to exert significant influence over Murphy. During the year, Murphy earned net income of $173,000 and paid dividends of $54,000. Prepare Concord's journal entries related to this investment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the purchase.) (To record the net income.) (To record the dividend.)arrow_forwardOn January 1, 2020, Windsor Company purchased 6,100 shares of Kusher Company stock for $439,200. Windsor's investment represents 30 percent of the total outstanding shares of Kusher. During 2020, Kusher paid total dividends of $152,000 and reported net income of $456,000. What revenue does Windsor report related to this investment and what is the amount to be reported as an investment in Kusher stock at December 31? Revenue $ Investment in Kusher stock at December 31 $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education