FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

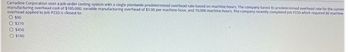

Transcribed Image Text:Carradine Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine hours. The company based as predetermined overhead rate for the curren

manufacturing overhead cost of $105,000. variable manufacturing overhead of $3.00 per machine hour, and 70,000 machine hours. The company recently completed job P223 which required 60 machine

overhead applied to Job P233 is closest to

O $90

O $270

Ⓒ$450

O$180

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $ 400 $ 270 34 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. 156,000 $ 651,000 4.70 S Required 1 Required 2 If Job 400…arrow_forwardMickley Company’s plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials $ 290 Direct labor $ 180 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 50 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)arrow_forwardPlease give me answer immediately.arrow_forward

- Mickley Company's plantwide predetermined overhead rate is $21.00 per direct labor-hour and its direct labor wage rate is $14.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 290 $ 210 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 70 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forwardGadubhaiarrow_forwardMoody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates: Machine-hours required to support estimated production Fixed manufacturing overhead cost Variable manufacturing overhead cost per machine-hour Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job 400 was started and completed. The following information was available with respect to this job: Direct materials Direct labor cost Machine-hours used $380 $ 270 39 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 50 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 130% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 152,000 $ 657,000…arrow_forward

- Mickley Company's plantwide predetermined overhead rate is $19.00 per direct labor-hour and its direct labor wage rate is $16.00 per hour. The following information pertains to Job A-500: Direct materials Direct labor $ 240 $ 160 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 60 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.) 1. Total manufacturing cost 2. Unit product cost per unitarrow_forwardMickley Company's plantwide predetermined overhead rate is $19.00 per direct labor - hour and its direct labor wage rate is $12.00 per hour. The following information pertains to Job A-500: Direct materials $ 240 Direct labor $ 120 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 60 units, what is the unit product cost for this job?arrow_forwardBeans Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $162,000, variable manufacturing overhead of $2.80 per direct labor-hour, and 60,000 direct labor-hours. Recently, Job K818 was completed with the following characteristics: Number of units in the job Total direct labor-hours Direct materials Direct labor cost 10 50 $ 920 $ 1,400 The total job cost for Job K818 is closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1,675 $2,320 $2,595arrow_forward

- Prather Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company ba predetermined overhead rate for the current year on the following data: Total direct labor-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per direct labor-hour Recently, Job P513 was completed with the following characteristics: Number of units in the job i Total direct labor-hours Direct materials Direct labor cost The total job cost for Job P513 is closest to: $1,400 O $690 $900 O $1,210 10 20 50,000 $ 285,000 $ 3.80 $710 $ 500arrow_forwardMickley Company’s plantwide predetermined overhead rate is $20.00 per direct labor-hour and its direct labor wage rate is $11.00 per hour. The following information pertains to Job A-500: Direct materials $ 210 Direct labor $ 165 Required: 1. What is the total manufacturing cost assigned to Job A-500? 2. If Job A-500 consists of 80 units, what is the unit product cost for this job? (Round your answer to 2 decimal places.)arrow_forwardMcewan Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor- hours. The company based its predetermined overhead rate for the current year on 46,000 direct labor-hours, total fixed manufacturing overhead cost of $322,000, and a variable manufacturing overhead rate of $4.80 per direct labor-hour. Job X941, which was for 50 units of a custom product, was recently completed. The job cost sheet for the job contained the following data: Total direct labor-hours Direct materials Direct labor cost 400 $ 800 $ 6,300 Required: Calculate the selling price for Job X941 if the company marks up its unit product costs by 20%. (Round intermediate calculations and final answer to 2 decimal places.) Selling price per unitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education