FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 3 - Proctoring Enable X +

C

getproctorio.com/secured #lockdown

Proctoring Enabled: Chapter 4 Required Homework (G... i

Mc

Graw

Hill

3

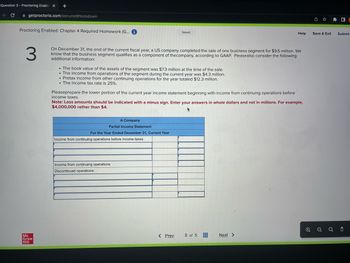

On December 31, the end of the current fiscal year, a US company completed the sale of one business segment for $9.6 million. We

know that the business segment qualifies as a component of the company, according to GAAP. Pleasealso consider the following

additional information:

. The book value of the assets of the segment was $7.3 million at the time of the sale.

The income from operations of the segment during the current year was $4.3 million.

Pretax income from other continuing operations for the year totaled $12.3 million.

. The income tax rate is 25%.

A Company

Partial Income Statement

For the Year Ended December 31, Current Year

Saved

Pleaseprepare the lower portion of the current year income statement beginning with income from continuing operations before

income taxes.

Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example,

$4,000,000 rather than $4.

Income from continuing operations before income taxes

Income from continuing operations

Discontinued operations:

< Prev

Help

3 of 5

Next >

Save & Exit

e

Ⓡ

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 20X1, Prime Company purchased all the outstanding stock of Spring Company, located in Canada, for $137,700. On January 1, 20X1, the direct exchange rate for the Canadian dollar (C$) was C$1 = $0.81. Spring's book value on January 1, 20X1, was C$96,000. On January 1, 20X1, the book value of the Spring's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment. The remaining useful life of Spring's property, plant and equipment at January 1, 20X1, was 10 years. During 20X1, Spring earned C$24,000 in income and declared and paid C$7,400 in dividends. The dividends were declared and paid in Canadian dollars when the exchange rate was C$1 = $0.75. On December 31, 20X1, Prime continues to hold the Canadian currency received from the dividend. On December 31, 20X1, the direct exchange rate is C$1 = $0.64. The average exchange rate during 20X1 was C$1 = $0.76. Management has determined that the Canadian dollar is Spring's…arrow_forwardOn 12/20/20x1, Banana Company, a U.S.-based entity, acquired all of the outstanding common stock of Pooma Industries, which is located in Switzerland. The cost of acquiring Watermellon was 8.2 million Swiss francs. On the acquisition date, the U.S. dollar/Swiss franc exchange rate was $0.52 = SF1. The assets and liabilities acquired at 12/20/20x1 were: Assets Swiss Franc Liabilities and Equity Swiss Franc Cash 500,000 Notes Payable 1,270,500 Inventory 770,500 Shareholders' Equity 3,500,000 Property, plant and equipment 3,500,000 Total Assets $4,770,500 Total Liabilities and Shareholders’ Equity $4,770,500 At 12/31/20x1, Banana Company prepares its year-end financial statements. By 12/31/20x1, the U.S. dollar/Swiss franc exchange rate was $0.535 = SF1. For purposes of this problem, assume that after the 12/20/20x1, Watermellon Industries had no additional transactions that changed their financial position. Required…arrow_forwardOn January 1, 20X8, Pace Company acquired all of the outstanding stock of Spin PLC, a British Company, for $350,000. Spin's net assets on the date of acquisition were 250,000 pounds (£). On January 1, 20X8, the book and fair values of the Spin's identifiable assets and liabilitie approximated their fair values except for equipment. The remaining useful life of Spin's equipment at January 1, 20X8, was 10 years. During 20X8, Spin earned 60,000 pounds in income and declared and paid 10,000 pounds in dividends. The dividends were declared and paid in pounds on November 1, 20X8. Pace's income from its own operations was $150,000 for 20X8. Pace's total stockholders' equity on January 1, 20X8 was $1,000,000. It declared $50,000 of dividends during 20X8. Assume Pace uses the fully adjusted equity method to account for its investment in Spin. Management has determined that the pound is Spin's appropriate functional currency. Relevant exchange rates were as follows: January 1, 20X8 November 1,…arrow_forward

- Par Corporation, a Canadian company, purchased 80% of the outstanding shares of Sub Company of Germany on December 31, Year 5 for €3,000,000 Euros. At that date, the carrying values of Sub’s assets and liabilities were equal to fair values. There was a goodwill impairment loss in Year 6 of €10,000. The fiscal Year 5 financial statements of Sub were as follows: Sub Company Balance Sheet December 31, Year 5 Cash € 500,000 Accounts receivable 900,000 Inventory 1,200,000 Capital assets (net) 3,250,000 € 5,850,000 Accounts payable € 650,000 Bonds payable 1,700,000 Common shares 2,000,000 Retained earnings 1,500,000 € 5,850,000 Par anticipated that there would be a high volume of intercompany transactions with Sub, because Par provides the raw materials to Sub and sales are global. Also Sub obtained most of its financing thru banks in Canada. Par uses the cost method to account for its investment in Sub. The fiscal Year 6 financial statements of Par and Sub were as follows: Balance Sheets…arrow_forwardNorthern purchased the entire business of Southern including all its assets and liabilities for $658,000. Below is information related to the two companies: Northern Southern Fair value of assets $1,044,000 $798,000 Fair value of liabilities 585,000 315,000 Reported assets 813,000 634,000 Reported liabilities 483,000 258,000 Net Income for the year 59,000 58,000 How much goodwill did Northern pay for acquiring Southern?arrow_forwardSFFN Corp. purchased the entire business of AZC, Inc. including all its assets and liabilities for $1,800,000. Below is information related to the two companies: SFFN AZC Fair value of assets $ 3,050,000 $ 1,600,000 Fair value of liabilities 2,575,000 800,000 Reported assets 2,800,000 1,400,000 Reported liabilities 2,500,000 750,000 Net Income for the year 460,000 250,000 How much goodwill will SFFN recognize as a result of its acquisition of AZC? Select one: a. $-0- b. $1,225,000 c. $1,150,000 d. $200,000 e. $1,000,000arrow_forward

- The owners of a company are planning to sell the business to new interests. The cumulative net earnings for the past 4 years were P6,000,000 including casualty loss of P200,000. The current value of net assets of the company was P16,000,000. Goodwill is determined by capitalizing average earnings at 8%. What is the amount of goodwill? a. P1.450.000 b. P1.550.000 c. P2,215.000 d. P3.375.000arrow_forwardThe following previously unreported intangible assets were acquired by a U.S. company in a business combination. Their beginning-of- current-year book values and allocation to reporting units are listed below. Trade names Distribution network Goodwill Trade names Distribution network Reporting Unit #1 Reporting Unit #2 $14,000 Both identifiable intangibles have a 5-year remaining life. Information for year-end impairment testing is as follows: Sum of Expected Sum of Expected Future Undiscounted Future Discounted Cash Flows Cash Flows 70,000 Select one: O a. $7,700 O b. $5,040 C. $9,240 d. $7,000 $11,200 56,000 $12,600 8,400 O Information for year-end goodwill impairment testing is as follows: Reporting Reporting Unit #1 Unit #2 Fair value Book value before year-end adjustments for identifiable intangible amortization and impairment charges $10,500 7,000 $47,600 49,000 $36,400 For consolidation eliminating entry (O), what amount will be reported as expense for identifiable intangibles…arrow_forwardChristina Company (a U.S.-based company) has a subsidiary in Canada that began operations at the start of 2020 with assets of 142,000 Canadian dollars (CAD) and liabilities of CAD 74,000. During this initial year of operation, the subsidiary reported a profit of CAD 36,000. It distributed two dividends, each for CAD 6,000 with one dividend declared on March 1 and the other on October 1. Applicable U.S. dollar ($) exchange rates for 1 Canadian dollar follow: January 1, 2020 (start of business) $0.79 March 1, 2020 0.77 Weighted average rate for 2020 0.76 October 1, 2020 0.75 December 31, 2020 0.74 Compute the net translation adjustment the company will report in accumulated other comprehensive income for the year 2020 under this second set of circumstances. Assume that the Canadian dollar is this subsidiary’s functional currency. What translation adjustment would the company report for the year 2020?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education