Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Financial Account Query

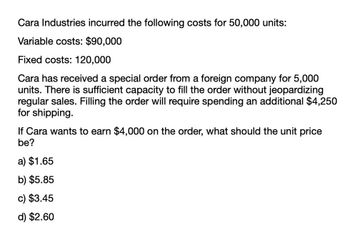

Transcribed Image Text:Cara Industries incurred the following costs for 50,000 units:

Variable costs: $90,000

Fixed costs: 120,000

Cara has received a special order from a foreign company for 5,000

units. There is sufficient capacity to fill the order without jeopardizing

regular sales. Filling the order will require spending an additional $4,250

for shipping.

If Cara wants to earn $4,000 on the order, what should the unit price

be?

a) $1.65

b) $5.85

c) $3.45

d) $2.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Emerald Island Company is considering building a manufacturing plant in County Kerry. Predicting sales of 100,000 units, Emerald Isle estimates the following expenses: An Irish firm that specializes in marketing will be engaged to sell the manufactured product and will receive a commission of 10% of the sales price. None of the U.S. home office expense will be allocated to the Irish facility. Required: 1. If the unit sales price is 2, how many units must be sold to break even? (Hint: First compute the variable cost per unit.) 2. Calculate the margin of safety ratio. 3. Calculate the contribution margin ratio.arrow_forwardRequired:(a) GEM has an opportunity to sell 10 000 units to an overseas customer. Import duties and other special costs associated with this order would total $42 000. The only selling costs that would be associated with the order would be a shipping cost of $9.00 per unit. What would be the minimum acceptable unit price for GEM to consider this order? (hint: GEM would not accept the order if it would reduce the company’s profit) (b) The company has 200 units of Flicks on hand that were produced two months ago. Due to blemishes on the units, it will be impossible to sell these units at the normal price. If the company wishes to sell them through regular sales channels, what would be the relevant cost for setting the minimum price? Explain. (c) “All future costs are relevant in decision making.” Do you agree? Explain.arrow_forwardIt costs Sheridan Company $12 of variable and $$ of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 3900 scales at $15 each. Garner would incur special shipping costs of $1 per $ cale if the order were accepted. Sheridan has sufficient unused capacity to produce the 3900 scales. If the special order is accepted, what will be the effect on net income?arrow_forward

- Martin Company incurred the following costs for 70,000 units:Variable costs $420,000Fixed costs $392,000Martin has received a special order from a foreign company for 3,000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $6,300 for shipping. If Martin wants to earn $6,000 on the order, what should the unit price be? Group of answer choices $9.70 $15.70 $8.00 $10.10arrow_forwardMartin Company incurred the following costs for 70,000 units: Variable costs $420,000 Fixed costs $392,000 Martin has received a special order from a foreign company for 3,000 units. There is sufficient capacity to fill the order without jeopardizing regular sales. Filling the order will require spending an additional $6,300 for shipping. If Martin wants to earn $6,000 on the order, what should the unit price be? Group of answer choices $9.70 $15.70 $8.00 $10.10arrow_forwardIt costs Garner Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 3,000 scales at $15 each. Garner would incur special shipping costs of $1 per scale if the order were accepted. Garner has sufficient unused capacity to produce the 3,000 scales. If the special order is accepted, what will be the effect on net income?arrow_forward

- It costs Bramble Company $13 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $32. A foreign wholesaler offers to purchase 980 scales at $17 each. Bramble would incur special shipping costs of $3 per scale if the order were accepted. Bramble has sufficient unused capacity to produce the 980 scales. If the special order is accepted, what will be the effect on net income?arrow_forwardIt costs Crane Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 1500 scales at $15 each. Garner would incur special shipping costs of $1 per scale if the order were accepted. Crane has sufficient unused capacity to produce the 1500 scales. If the special order is accepted, what will be the effect on net income? $4500 decrease $3000 increase $22500 increase $3000 decreasearrow_forwardIt costs Sheridan Company $12 of variable and $5 of fixed costs to produce one bathroom scale which normally sells for $35. A foreign wholesaler offers to purchase 1700 scales at $15 each. Garner would incur special shipping costs of $1 per scale if the order were accepted. Sheridan has sufficient unused capacity to produce the 1700 scales. If the special order is accepted, what will be the effect on net income? $5100 decrease $3400 decrease $3400 increase $25500 increasearrow_forward

- It costs Ghala Company OMR 13 of variable and OMR 6 of fixed costs to produce one unit which normally sells for OMR 35. AlI Hadid Co. offers to purchase 3,000 units at OMR 15 each. Ghala Co. would incur shipping costs of OMR 1 per unit if the order were accepted. Ghala Co. has sufficient unused capacity to produce the 3,000 units. If the special order is accepted, what will be the effect on net income? Select one: O a. None of the answers are correct Ob. OMR 45,000 increase O c. OMR 6,000 increase O d. OMR 9,000 decrease e. OMR 3,000 increasearrow_forwardIt costs Ghala Company OMR 13 of variable and OMR 6 of fixed costs to produce one unit which normally sells for OMR 35. Al Hadid Co. offers to purchase 3,000 units at OMR 15 each. Ghala Co. would incur shipping costs of OMR 1 per unit if the order were accepted. Ghala Co. has sufficient unused capacity to produce the 3,000 units. If the special order is accepted, what will be the effect on net income? Select one: O a. OMR 6,000 increase Ob. OMR 3,000 increase O c. OMR 9,000 decrease O d. None of the answers are correct Oe. OMR 45,000 increasearrow_forwardIt costs Ghala Company OMR 13 of variable and OMR 6 of fixed costs to produce one unit which normally sells for OMR 35. Al Hadid Co. offers to purchase 3,000 units at OMR 15 each. Ghala Co. would incur shipping costs of OMR 1 per unit if the order were accepted. Ghala Co. has sufficient unused capacity to produce the 3,000 units. If the special order is accepted, what will be the effect on net income? Select one: a. OMR 6,000 increase O b. OMR 3,000 increase C. OMR 45,000 increase d. None of the answers are correct e. OMR 9,000 decreasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning