Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting question

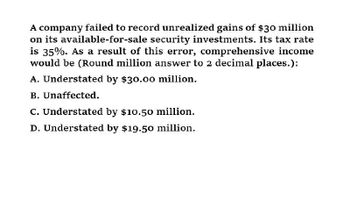

Transcribed Image Text:A company failed to record unrealized gains of $30 million

on its available-for-sale security investments. Its tax rate

is 35%. As a result of this error, comprehensive income

would be (Round million answer to 2 decimal places.):

A. Understated by $30.00 million.

B. Unaffected.

C. Understated by $10.50 million.

D. Understated by $19.50 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Branch Corp.'s total assets at the end of last year were $310,000 and its net income after taxes was $22,750. What was its return on total assets? Select the correct answer. a. 8.34% b. 7.34% c. 6.84% d. 7.84% e. 6.34%arrow_forwardSuppose a company has the following financials (in £millions) and no other non-operating income or expense: Net financial expense after tax = 8 Net interest expense = 12.6 Reported tax (on standard income statement) = 1220.4 Operating profit = 4,741 What is the company's net operating profit after tax (NOPAT)? (in £millions) Select one: a. 1,635 b. 3,516 c. None of the others d. 5,163arrow_forwardHedepeth fne net income for the most recent year was S15,185, The tax rate was 34 percent The mm paid $3,806 in total interest expense and deducted $2,485 in depreciation expense. a) What is the company's Earnings Before Taxes (EBT) b) What is the company's Earnings Before Interest and Taxes (EBIT) c) What is the company's Earnings Before Interest, Taxes, and Depreciation (EBITD) d) What was the cash coverage ratio for the year and how do you interpret your answer?arrow_forward

- Frezia Corp.'s total assets at the end of last year were P315,000 and its net income after taxes was P22,750. What was Frezia’s return on total assets? * Choices: 7.58% 8.78% 7.22% 7.96% 8.36%arrow_forwardA company failed to record unrealized gains of $38 million on its debt investments classified as trading securities. Its tax rate is 25%. As a result of this error, total shareholders' equity would be:arrow_forwardB1.arrow_forward

- Bramble Inc. has an investment in available-for-sale securities of $ 68000. This investment experienced an unrealized loss of $ 5800 during the current year. Assuming a 30% tax rate, the effect of this loss on comprehensive income will be a.no effect. b. $ 20400 decrease. c. $ 68000 increase. d. $ 4060 decrease.arrow_forwardIf a company has a discontinued operations gain of $40,000 and a 20% tax rate, what is the effect on net income? O Increase of $32,000. O Increase of $21,000. Increase of $9,600. No effect. C A D W P D sarrow_forwardLEKTOL LTD. reported income tax expense for the year of $4 million. Interest payable decreased by $1 million. How much cash did the company pay income tax during the year? a. None of the above. b. $4 million. c. $3 million. d. $5 million. Clear my choice Non-current assets (long-term, long-lived assets): assets not expected to be sold or used up within one year or one operating cycle of the business, whichever is shorter. a. True O b. Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning