FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

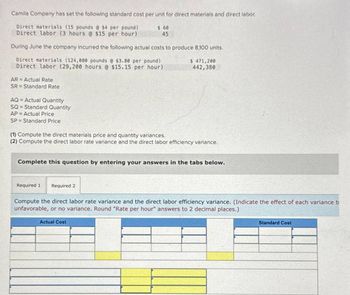

Transcribed Image Text:Camila Company has set the following standard cost per unit for direct materials and direct labor.

Direct materials (15 pounds @ $4 per pound)

Direct labor (3 hours @ $15 per hour)

During June the company incurred the following actual costs to produce 8,100 units.

Direct materials (124,000 pounds @ $3.80 per pound)

Direct labor (29,200 hours @ $15.15 per hour)

AR = Actual Rate

SR=Standard Rate

AQ=Actual Quantity

SQ=Standard Quantity

AP = Actual Price

SP=Standard Price

$ 60

45

(1) Compute the direct materials price and quantity variances.

(2) Compute the direct labor rate variance and the direct labor efficiency variance.

Required 1 Required 2

$ 471,200

442,380

Complete this question by entering your answers in the tabs below.

Actual Cost

Compute the direct labor rate variance and the direct labor efficiency variance. (Indicate the effect of each variance b

unfavorable, or no variance. Round "Rate per hour" answers to 2 decimal places.)

Standard Cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the following information appears in the standard cost card for a company that makes only one product: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 5 pounds $ 11.00 per pound $ 55.00 Direct labor 2 hours $ 17.00 per hour $ 34.00 Variable manufacturing overhead 2 hours $ 3.00 per hour $ 6.00 During the most recent period, the following additional information was available: 20,000 pounds of material was purchased at a cost of $10.50 per pound. All of the material that was purchased was used to produce 3,900 units. 8,000 direct labor-hours were recorded at a total cost of $132,000. The actual variable overhead cost incurred during the period was $25,050. Assuming the company uses direct labor-hours to compute its predetermined overhead rate, what is the variable overhead rate variance? Multiple Choice $1,650 F $1,650 U $1,050 U $1,050 Farrow_forwardGodoarrow_forward6arrow_forward

- Assume a company reported the following results: Sales $400,000 Variable expenses 260,000 Contribution margin Fixed expenses 140,000 60,000 Net operating income $ 80,000 Average operating assets $575,000 The margin is closest to: Multiple Choice 35.0%. 20.0%. 69.6%. 14.5%.arrow_forwardLucia Company has set the following standard cost per unit for direct materials and direct labor. Direct materials (14 pounds @ $3 per pound) Direct labor (2 hours @ $14 per hour) $ 42 28 During May the company incurred the following actual costs to produce 8.100 units. Direct materials (115,780 pounds @ $2.80 per pound) Direct labor (19,700 hours @ $14.10 per hour) $ 323,968 277,770 AR = Actual Rate SR = Standard Rate AQ = Actual Quantity SQ AP Standard Quantity Actual Price SP=Standard Price AH = Actual Hours SH Standard Hours (1) Compute the direct materials price and quantity variances. (2) Compute the direct labor rate variance and the direct labor efficiency variance. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the direct materials price and quantity variances. Note: Indicate the effect of each variance by selecting favorable, unfavorable, or no variance.arrow_forwardAntuan Company set the following standard costs per unit for its product. Direct materials (6 pounds @ $5 per pound) $ 30 Direct labor (2 hours @ $17 per hour) 34 Overhead (2 hours @ $18.50 per hour). 37 Standard cost per unit $ 101 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials. $ 45,000 Indirect labor 180,000 Power 45,000 Maintenance 90,000 360,000 Total variable overhead costs Fixed overhead costs 24,000 Depreciation-Building Depreciation-Machinery 80,000 Taxes and insurance 12,000 Supervisory salaries. 79,000 Total fixed overhead costs 195,000 Total overhead costs $ 555,000 The company incurred the following actual costs when it operated at 75% of capacity in October. Direct materials (91,000 pounds @ $5.10 per…arrow_forward

- Bulluck Corporation makes a product with the following standard costs: Direct materials Direct labor Variable overhead Standard Quantity or Hours 3.5 grams 0.7 hours 0.7 hours The company reported the following results concerning this product in July. Actual output Raw materials used in production Actual direct labor-hours Purchases of raw materials Actual price of raw materials purchased Actual direct labor rate Actual variable overhead rate Standard Price or Rate $ 1.00 per gram $ 11.00 per hour $ 2.00 per hour The variable overhead rate variance for July is: 3,000 units 11,370 grams 1,910 hours 12,100 grams $ 1.20 per gram $11.40 per hour $ 2.10 per hour The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.arrow_forwardRRarrow_forwardThe following information relates to production activities of Mercer Manufacturing for the year. Actual direct materials used 17,300 pounds at $4.70 per pound Actual direct labor used 17,935 hours at $32 per hour Actual units produced 32,600 Standard quantity and price per unit for direct materials 0.50 pound at $4.65 per pound Standard quantity and rate per unit for direct labor 0.50 hour at $33 per hour AR = Actual RateSR = Standard RateAQ = Actual QuantitySQ = Standard QuantityAP = Actual PriceSP = Standard Price (1) Compute the direct materials price and quantity variances.(2) Compute the direct labor rate and efficiency variances.arrow_forward

- Amber Company produces iron table and chair sets. During October, Amber's costs were as follows: Actual purchase price Actual direct labor rate $2.70 per pound $7.90 per hour $ 2.50 per pound 1,010,000 pounds 21,000 1,215,000 pounds 14,000 1,040,000 pounds $5,880 F Standard purchase price Standard quantity for sets produced Standard direct labor hours allowed Actual quantity purchased in October Actual direct labor hours Actual quantity used in October Direct labor rate variance Required: 1. Calculate the total cost of purchases for October. 2. Compute the direct materials price variance based on the actual quantity purchased. 3. Calculate the direct materials quantity variance based on the actual quantity used. 4. Compute the standard direct labor rate for October. 5. Compute the direct labor efficiency variance for October. Complete this question by entering your answers in the tabs below.arrow_forwardMilar Corporation makes a product with the following standard costs Standard Quantity Standard Price on or Hours 6.5 pounds Direct materials Direct labor Nariable overhead Rate. $ 6.00 per pound $25.00 per hour $11.50 per hour 0.8 hours 0.8 hours In January the company produced 3,360 units using 13.440 pounds of the direct material and 2.808 direct labor-hours, During the month, the company purchased 16,900 pounds of the direct material at a cost of $14,200. The actual direct labor cost was S69,795 and the actual Varlable overhead cost Was $30,940. The company applies variable overhead on the basis of direct iabor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for January is Multiple Choice $405 F $405 U Windows Update S2.595U Countdown to goodnes... We're all set to do the restart you scheduled. Mc Graw Hill Prev 24 of 36 Nexflm Type here to search |耳 59 F Mostly cloudy 8:34 AM 10/21/2021 DELL F1 F2 F3 F4 F5 F6 F7…arrow_forwardDoogan Corporation makes a product with the following standard costs: Standard Quantity or Standard Price or Hours Rate Direct materials Direct labor Variable overhead 9.0 grams e.4 hours $ 3.60 per gram $36.00 per hour $ 8.60 per hour e.4 hours The company produced 6,800 units in January using 40.910 grams of direct material and 2.540 direct labor-hours. During the month, the company purchased 46,000 grams of the direct material at $3.30 per gram. The actual direct labor rate was $35.30 per hour and the actual varlable overhead rate was $8.40 per hour. The company applies varlable overhead on the basis of direct labor-hours. The direct materials purchases varlance is computed when the materials are purchased. The varlable overhead rate varlance for January is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education