Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

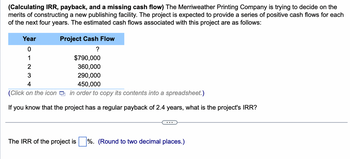

Transcribed Image Text:(Calculating IRR, payback, and a missing cash flow) The Merriweather Printing Company is trying to decide on the

merits of constructing a new publishing facility. The project is expected to provide a series of positive cash flows for each

of the next four years. The estimated cash flows associated with this project are as follows:

Project Cash Flow

?

Year

0

1

2

3

4

(Click on the icon in order to copy its contents into a spreadsheet.)

If you know that the project has a regular payback of 2.4 years, what is the project's IRR?

$790,000

360,000

290,000

450,000

The IRR of the project is%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Findell Corporation is considering two projects, A and B, and it has gathered the following estimates for the projects Project A 5 years $84,480 $64,000 Project B 5 years $57,300 $50,000 Useful life Present value of cash inflows Present value of cash outflows What is the present value index for Project A?arrow_forwardClick here to read the eBook: Analysis of an Expansion Project PROJECT CASH FLOW Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The financial staff has collected the following information on the project: Sales revenues $5 million Operating costs (excluding depreciation) 3.5 million Depreciation 1 million Interest expense 1 million The company has a 40% tax rate, and its WACC is 11%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. What is the project's cash flow for the first year (t = 1)? Round your answer to the nearest dollar.$????? If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's project's cash flow would now be $ .??? Ignore part b. If the tax rate dropped to 35%, how would that change your answer to part a? Round…arrow_forwardPlease provide correct solution for correct answerarrow_forward

- Suzanne's Cleaners is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4 5 Cash flows -$1,100 $300 $310 $320 $330 $340 2.85 years 3.16 years 3.52 years 2.31 years 2.56 yearsarrow_forwardmine. Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $825 million today, and it will have a cash outflow of $75 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the following table. Bullock Mining has a 12 percent required return on all of its gold mines. Year 0 1 2 3 4 5 6 7 8 9 Cash Flow -$825,000,000 160,000,000 185,000,000 215,000,000 245,000,000 210,000,000 205,000,000 190,000,000 160,000,000 75,000,000arrow_forward(Related to Checkpoint 11.6) (MIRR calculation) Emily's Soccer Mania is considering building a new plant. This project would require an initial cash outlay of $11 million and would generate annual cash inflows of $3.5 million per year for years one through four. In year five the project will require an investment outlay of $4.2 million. During years 6 through 10 the project will provide cash inflows of $4.2 million per year. Calculate the project's MIRR, given a discount rate of 12 percent. REIZE The MIRR of the project with a discount rate of 12% is%. (Round to two decimal places.)arrow_forward

- Herky Foods is considering acquisition of a new wrapping machine. By purchasing the machine, Herky will save money on packaging in each of the next 5 years, producing the series of cash inflows shown in the following table: The initial investment is estimated at $1.46 million. Using a 9% discount rate, determine the net present value (NPV) of the machine given its expected operating cash inflows. Based on the project's NPV, should Herky make this investment? The net present value (NPV) of the new wrapping machine is $. (Round to the nearest cent.)arrow_forwardDogwood Company is considering a capital investment in machinery: (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dogwood invest in the machinery? 8. Calculate the payback. Amount invested Expected annual net cash inflow Payback 1,500,000 24 500,000 3 years 9. Calculate the ARR. Round the percentage to two decimal places. Average annual operating income Average amount invested ARR Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 15%arrow_forwardNEED HELP ASAP! Imagine you are going to have a project to sell a Massive Machinary you owned. You have invested THB 15,500,000 for the Machine. This machine is expected ot have a life of 7 years. The expected cash flow for the next seven years are as follow; Year 1 - THB 900,000 Year 2 - THB 950,000 Year 3 - THB 1,200,000 Year 4 - THB 2,500,000 Year 5 - THB 2,500,000 Year 6 - THB 3,640,000 Year 7 - THB 5,560,000 Discount Rate is at 7% per year. Please find the Present Value for each year and also the Net Present Value. Then, see if you should accept this project or not? Give me a solid support for your answerarrow_forward

- Hi. I need an understanding of how to calculate a projects net investments and cash flows. The image is attached.arrow_forwardJack Sprat Inc. wants to know if they invest 11,548 in new exercise equipment, plus $2.000 for installation. how long before they will receive their initial invest back from future cash flows? What is the payback period for the initial costs? Projected Cash flows Year 1: 5,000 Year 2: 7,000 Year 3: 4,000 Year 4: 1,000 Post your answer as number of years with 2 decimal places, for example 5.55arrow_forwardAfter analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below. To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education