After analysing the financial data of Q-Constructions, you notice that they are trending in the right direction. A new 12-month construction proposal has come to the company worth $1,000,000 and an important question is whether it will be financially viable. They want you to analyse the proposal, in particular, the recommended cash flow schedule and to understand the key financial points during the construction project. The following cash flow schedule is summarised below.

To ensure that all upfront and on-going outlay costs are covered in advance, Q-Constructions incur an initial start-up cost of $200,000. The proposal states that they will receive a deposit from the client of 10% of the total project price at the beginning. They then receive four equal instalment payments of 20% of the total project price associated to project milestones from the client at the end of the 2nd, 6th, 8th and 10th month. Finally, they receive the last 10% project milestone on lock-up which occurs at the end of the 12th month. Q-Constructions has ongoing project costs of $20,000 to pay salaries and services at the end of each month. In additional, there are material costs of $100,000 associated for each of the project milestones at the end of the 2nd, 6th, 8th and 10th month. The current cost of capital for company is 8% per annum compounded monthly. You have been tasked with the important objective to determine whether this future project is financially viable. In addition, they want you to determine which milestone is needed to be completed in the project proposal such that it will be financially viable. It’s time to show your Quants knowledge and expertise with Excel to determine the financial viability of this project.

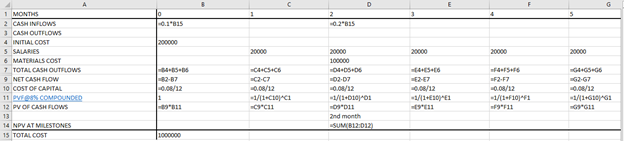

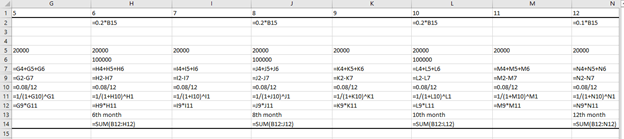

A. Set up a

- The full spreadsheet with all completed entries. Show how you entered cash inflow and

cash outflow amounts at the beginning, 1st, 2nd, 3rd You can type this in Word. - The NPV calculation (showing the calculation via the Excel function NPV and Excel cell references is OK). You can show this either in the spreadsheet or type it in Word.

B. The company wants to know at which milestone in the project proposal would be financially viable if the contract has terminated was early. Determine the milestone in the construction proposal for which the project would be financially viable.

C. Q-Constructions would like you to create a visualisation of the completed NPV spreadsheet from part (A). Include the graph here and in the infographic as indicated.

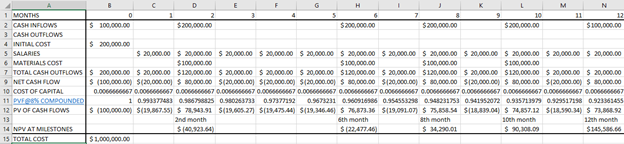

(A) Calculate the Cash flows and NPV as shown below

Resultant Table:

Hence, the NPV of the project when completed will be $145,586.66

(B) The milestone at which project can be dropped at 10th month when NPV will be $90,308.09 as shown in Step 1.

Step by stepSolved in 3 steps with 4 images

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardIf the appropriate interest rate to use when evaluating potential project for the firm is 10%, what is the present value of these cash flows?arrow_forwardI think the payback periods are correct, I just need the different cash flows of each year + the final question at the bottom. Thank you.arrow_forward

- Greater Findlay Development Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay a fixed amount of rent plus a percentage of the gross sales generated each year. The cash flows from each of the businesses has approximately the same amount of risk. The business names, annual expected cash flows, and initial capital outflow for each of the businesses that would like to lease space in the strip mall are provided below. Greater Findlay Development Consortium uses a 12% hurdle rate which is its cost of capital. All business will be evaluated based on 4-year term because the contract will expire in four years. Video Now Apple Garden Croger Mart Horizon Wireless Initial Capital Outlay ($200,000) ($298,000) ($248,000) ($272,000) Annual Net Cash Flows Year 1 65,000 100,000 80,000…arrow_forwardHook Industries is considering the replacement of one of its old metal stamping machines. Three alternative replacement machines are under consideration. The cash flows associated with each are shown in the following table attached: . The firm's cost of capital is 10%. d. Calculate the profitability index (PI) for each press. e. Rank the presses from best to worst using PI.arrow_forwardA company manager asked you to evaluate an investment opportunity. Select and explain two (2) investment criteria you will use to make a decision as to whether to accept or reject the opportunity. You are the CFO of Midas Mining Ltd and the company is looking to expand its mining operations. Your staff have narrowed it down to two (2) projects, with the cash flows presented in the table below. However, given the substantial cash outlay, your company can only choose one of the projects (A or B). Information Project A Project B Cost $5 550 000 $6 640 000 Required: a) Perform a project evaluation, using the Net Present Value (NPV) The prevailing discount rate is 12%. b) Identify which project (if any) should be accepted by Midas Mining Ltd.arrow_forward

- suppose that you have started a manufacturing/Service Organization in Abu Dhabi UAE with a capital of $250000 1-you need to assume cash flows with assumed discounted rate for five years and calculate the NPV of the project. 2- Find out the BEP (Break Even Point) of your business and take necessary actions on the basis of your results.arrow_forwardmine. Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $825 million today, and it will have a cash outflow of $75 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the following table. Bullock Mining has a 12 percent required return on all of its gold mines. Year 0 1 2 3 4 5 6 7 8 9 Cash Flow -$825,000,000 160,000,000 185,000,000 215,000,000 245,000,000 210,000,000 205,000,000 190,000,000 160,000,000 75,000,000arrow_forwardThe Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $92,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4 percent per year forever. The project requires an initial investment of $1,450,000. a-1 What is the NPV for the project if the company requires a return of 11 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV $ a-2 Should the company accept or reject the project? Reject Accept b. The company is somewhat unsure about the assumption of a growth rate of 4 percent in its cash flows. At what constant growth rate would the company just break even if it still required a return of 11 percent on investment? (Do not round intermediate calculations. Enter your…arrow_forward

- Dogwood Company is considering a capital investment in machinery: (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dogwood invest in the machinery? 8. Calculate the payback. Amount invested Expected annual net cash inflow Payback 1,500,000 24 500,000 3 years 9. Calculate the ARR. Round the percentage to two decimal places. Average annual operating income Average amount invested ARR Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 15%arrow_forwardHi. I need an understanding of how to calculate a projects net investments and cash flows. The image is attached.arrow_forwardPlease give answer for A and Barrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education