Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Raghubhai

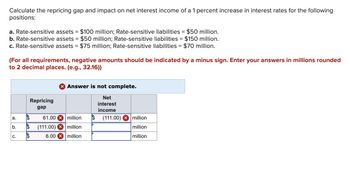

Transcribed Image Text:Calculate the repricing gap and impact on net interest income of a 1 percent increase in interest rates for the following

positions:

a. Rate-sensitive assets = $100 million; Rate-sensitive liabilities = $50 million.

b. Rate-sensitive assets = $50 million; Rate-sensitive liabilities = $150 million.

c. Rate-sensitive assets = $75 million; Rate-sensitive liabilities = $70 million.

(For all requirements, negative amounts should be indicated by a minus sign. Enter your answers in millions rounded

to 2 decimal places. (e.g., 32.16))

Repricing

gap

> Answer is not complete.

Net

interest

income

a. $

b. $

61.00 million

(111.00) million

$ (111.00)

million

million

C. $

6.00 million

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following statements is CORRECT? Question 2 options: a) The proportion of the payment that goes toward interest on a fully amortized loan increases over time. b) An investment that has a nomiral rate of 6% with semiannual payments will have an effective rate that is smaller than 6%. c) If a loan or investment has annual payments, then the effective, periodic, and nominal rates of interest will all be different. d) The present value of a 3-year, $150 ordinary annuity will exceed the present value of a 3-year, $150 annuity due. e) if a loan has a nominal annual rate of 7%, then the effective rate will never be less than 7%.arrow_forwardWhich of the following is the correct mathematical expression of effective annual rate (EAR)? (m denotes the number of times the interest is compounded during the year.) Multiple choice question. EAR = [1 − (Quoted rate/m)]m + 1 EAR = [1 + (Quoted rate/m)]m − 1 EAR = [1 + (Quoted rate/m)]m + 1 EAR = [1 − (Quoted rate/m)]m − 1arrow_forwardPlease answer the question attached in the picture below.arrow_forward

- The present value of a lump sum future amount: O A. increases as the interest rate decreases. OB. decreases as the time period decreases. OC. is inversely related to the future value. O D. is directly related to the interest rate.arrow_forwardVilas Company is considering a capital investment of $190,600 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $12,700 and $49,600, respectively. Vilas has a 12% cost of capital rate, which is the required rate of return on the investment. Click here to view PV table. (a) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 10.50.) Cash payback period 3.83 years Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 10.50.) Annual rate of return 6.66316894 %arrow_forward3. Future value The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation of a future value. The process for converting present values into future values is called four time-value-of-money variables. Which of the following is not one of these variables? O The present value (PV) of the amount invested O The duration of the investment (N) O The interest rate (I) that could be earned by invested funds O The inflation rate indicating the change in average prices This process requires knowledge of the values of three ofarrow_forward

- Q1. (a) What effect does compounding interest more frequently than annually have on: (i) future value and (ii) the effective annual rate (EAR)? Why? Differentiate between a nominal annual rate and an effective annual rate (EAR).arrow_forwardConsider two 1-year loans with a principal of $1 million and a default probability of 2% each. Assume that if one loan defaults, the other does not. Assume that in the event of default, the loan leads to a loss that can take any value between $0 and $1 million with equal probability, i.e., the probability that the loss is higher than $ ? million is 1 − ?. If a loan does not default, it yields a profit equal to $0.02 million. a) Compute the 1-year 99% Value at Risk (VaR) and Expected Shortfall (ES) of a single loan.arrow_forwardwhich of the following statements are true? 1. there is an inverse relationship between interest rates and future vales 2. the effective annual interest rate (EAR) will be higher than the annual percentage rate (APR) for a loan that compounds interest annually 3. there is an inverse relationship between present value and interest rates 4. all else equal, the more frequent interest in compounded on a loan, the more interest you will have to pay.arrow_forward

- Choose the equation below that can be used to determine the value of "P" for a known interest rate, i.arrow_forwardConsider each part below independently. (Ignore income taxes in your calculations.) Use the built-in PV functions for these calculations. Enter PV(n;i) in a value box to calculate the present value of $1 over n compounding periods with a periodic rate of i. Similarly, use PVA(n;i) to calculate the present value of an annuity. E.g., the present value of $1,000 with a periodic rate of 3%, and 2 compounding periods can be entered as 1000*PV(2,3). a) NorthCo's required rate of return is 17% on all investments. The company can purchase a new machine at a cost of $65,000. The new machine would generate cash inflows of $17,000 per year and have an 18-year useful life and no salvage value. Compute the machine's net present value and decide if the machine is an acceptable investment. Round your present values to the nearest dollar. Present Value of Cash Flows Item Net annual cash inflows. Net present value Is the machine an acceptable investment? (Select one) b) East Co is investigating the…arrow_forwardA)What is the amount of RSA, RSL and the income gap amount? B) Calculate the duration gap. C)What is the change in this bank’s net income if the interest rises by 1%, does it go up or does it go down? Show work D) What happens when the interest rises by 1% to this bank’s asset value, liability value and the net worth in dollar amounts? Show work.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education