FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

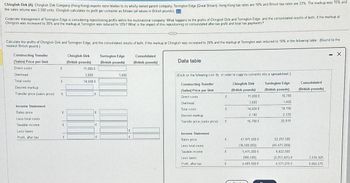

Transcribed Image Text:Chinglish Dirk (A), Chinglish Dirk Company (Hong Kong) exports razor blades to its wholly owned parent company, Torrington Edge (Great Britain). Hong Kong tax rates are 18% and British tax rates are 33%. The markup was 15% and

the sales volume was 2,500 units Chinglish calculates its profit per container as follows (all values in British pounds)

Corporate management of Torrington Edge is considering repositioning profits within the multinational company What happens to the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at

Chinglish was increased to 20% and the markup at Torrington was reduced to 10%? What is the impact of this repositioning on consolidated after-tax profit and total tax payments?

Calculate the profits of Chinglish Dirk and Torrington Edge, and the consolidated results of both, if the markup at Chinglish was increased to 20% and the markup at Torrington was reduced to 10% in the following table: (Round to the

nearest British pound)

Constructing Transfer

(Sales) Price per Unit

Direct costs

Chinglish Dirk

X

Torrington Edge

Consolidated

(British pounds)

(British pounds)

(British pounds)

Data table

£

11,000 £

Overhead

Total costs

Desired markup

Transfer price (sales price)

£

3,600

1,400

(Click on the following icon in order to copy its contents into a spreadsheet.)

£

14,600 £

Constructing Transfer

(Sales) Price per Unit

Chinglish Dirk

(British pounds)

Torrington Edge

Consolidated

(British pounds)

(British pounds)

Direct costs

£

11,000 £

16,790

Income Statement

Overhead

Total costs

3,600

1,400

E

14,600 £

18,190

Sales price

£

£

Desired markup

2,190

2,729

Less total costs

Transfer price (sales price)

£

16,790 £

20,919

Taxable income

£

£

Less taxes

E

Income Statement

Profit, after-tax

£

£

£

Sales price

£

Less total costs

Taxable income

Less taxes

Profit, after-tax

£

41,975,000 £

(36,500,000)

5,475,000 £

(985,500)

4,489,500 £

52,297,500

(45,475,000)

6,822,500

(2,251,425) £

3,236,925

4,571,075 £

9,060,575

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show stepwise and correct. Thanks.arrow_forwardAce Industries has current assets equal to $10 million. The company's current ratio is 2.0, and its quick ratio is 1.5. What is the firm's level of current liabilities? What is the firm's level of inventories? Do not round intermediate calculations. Round your answers to the nearest dollar. Current liabilities: $ Inventories: $arrow_forward1.Compute the price to net income ratio for both Kohl's and Wal-Mart. Round your answers to two decimal places. 2.Use Kohl's and Wal-Mart as comparables, along with the equity to net income ratios from part (c), and then estimate for Target its equity intrinsic value and its equity intrinsic value per share. Round the equity intrinsic value to the nearest million and the value per share to the nearest cent.arrow_forward

- One item is omitted from each of the following computations of the return on investment: Rate of Return on Investment = Profit Margin x Investment Turnover 17 % = 10 % x (a) (b) = 28 % x 0.75 18 % = (c) x 1.5 10 % = 20 % x (d) (e) = 15 % x 1.2 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank (b) fill in the blank % (c) fill in the blank % (d) fill in the blank (e) fill in the blank %arrow_forwardYou are given the following information for Troiano Pizza Company: sales = $84,700; costs = $58,900; addition to retained earnings = $8,100; dividends paid = $3,500; interest expense = $3,210; tax rate = 23 percent. Calculate the depreciation expense for the company. Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardAlgo Plc reported total revenue for 2019 of £1.3 million. Algo's 2019 shares outstanding were 1.4 million. The price/sales (P/S) ratio for Micro Plc, a close competitor of Algo, is 9.5. What could Algo's price per share be based on the data given (round it to two decimal points)?arrow_forward

- The Lancaster Corporation's income statement is given below. Sales Cost of goods sold Gross profit Fixed charges (other than interest) Income before interest and taxes Interest Income before taxes Taxes (35%) Income after taxes LANCASTER CORPORATION a. What is the times-interest-earned ratio? Note: Round your answer to 2 decimal places. Times interest earned Fixed charge coverage times b. What would be the fixed-charge-coverage ratio? Note: Round your answer to 2 decimal places. times $ 223,000 155,000 $ 68,000 33,100 $ 34,900 13,400 $ 21,500 7,525 $ 13,975arrow_forwardThomson Trucking has $15 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 18%, and its return on assets (ROA) is 6.25%. What is its times-interest-earned (TIE) ratio? Round your answer to two decimal places. Xarrow_forwardAssume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and its working capital is $360,000. Answer each of the following questions independently, always referring to the original information. Required: If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? Note: Do not round intermediate calculations. Round "Current ratio" to 1 decimal place. If the firm sells inventory that was purchased for $50,000 at a cash price of $64,000, what will its new acid-test ratio be? Note: Do not round intermediate calculations. Round your answer to 1 decimal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education